After two miserable years of confusion, Nintendo finally has a coherent strategy for its mobile games.

New president Shintaro Furukawa stamped his mark on the company even before taking up his new role, telling Nikkei he wants to build mobile games into a ¥100 billion (effectively a $1 billion) annual business.

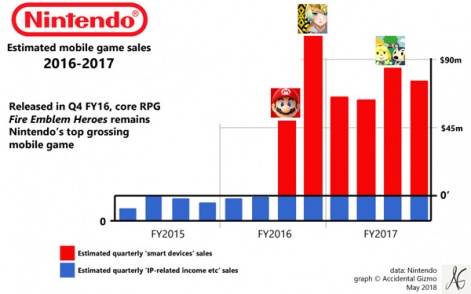

At the moment, for historic reasons, Nintendo combines sales from what it calls “smart devices” into a category alongside “IP related income etcetera”. Hopefully that demarcation will soon be a thing of the past too.

During FY17, the category generated ¥39 billion ($355 million) - or 5 per cent of Nintendo’s overall sales - with a rough estimate suggesting mobile game sales accounted for around $300 million.

Conflict of interest

So how does Furukawa plan to triple Nintendo mobile games business?

He didn’t reveal any more details in the interview but the thrust of what the company has to change is clear.

To date, it’s released three games, all based on existing Nintendo IP.

Super Mario Run was a weird hybrid experience - remember “free-to-start”, in which Nintendo attempted to combine classic Mario console gameplay with paid DLC? Perhaps not a total disaster given the volume of downloads it generated, but it wasn’t a commercial success either.

Fire Emblem Heroes still regularly peaks in the top 10 top grossing game charts in North America and Japan.

And despite using a more standard free-to-play game design and monetisation, third release Animal Crossing: Pocket Camp was even more disappointing.

It didn’t generate much positive reaction or downloads, and outside of everywhere except Japan failed in terms of top grossing status.

Only Fire Emblem Heroes hit the spot.

Slipping easily into the lucrative RPG genre, which relies on autoplay gameplay mechanics with a deep metagame revolving around character collection and levelling to monetise scarce items, over a year since it launched it still regularly peaks in the top 10 top grossing game charts in North America and Japan.

It’s no surprise then that while Nintendo will release another mobile game based on classic IP - Mario Kart Tour - it’s also announced it’s taken a stake in Japanese mobile developer Cygames, which specialises in core RPGs.

Its game Rage of Bahamut was one of the first successful Japanese mobile RPGs in the West and one of the top grossing titles of 2012.

Together, they will release a mobile game based on a brand new IP Dragalia Lost.

A clean slate

The importance of not using an existing Nintendo franchise can’t be overestimated.

Where Super Mario Run and Animal Crossing: Pocket Camp failed was in their attempt to combine the sort of game and economy design a mobile title requires to generate hundreds of millions of dollars with the expectations of a large and vocal historic fanbase.

No matter how Nintendo and its partner DeNA approach Mario Kart Tour, it will suffer from similar issues.

Starting with a brand new IP, however, enables the design of gameplay and metagame using the well-understood mechanics that now generate $40 billion annually in free-to-play mobile games.

If its new president has real ambitions, he will bring out the big guns.

And, more positively, audience reaction switches from a default ‘Don’t mess up the game I love’ to an excited ‘Cool, a brand new mobile game from Nintendo’.

What’s next?

In that context, moving from $300 million of annual mobile game revenues (mainly from Fire Emblem Heroes) to $1 billion suddenly doesn’t look that ambitious.

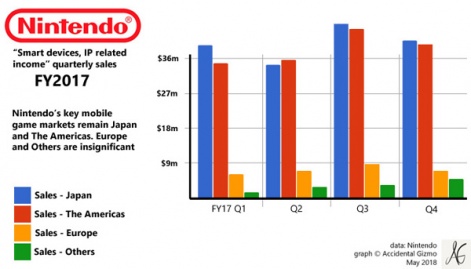

This is particularly the case given Nintendo’s obvious potential in a domestic market in which games such as Monster Strike and Fate/Grand Order have generated $1 billion annually just from the Japanese app stores for consecutive years.

Notably, Nintendo says Dragalia Lost will launch first in Japan and other high value Asian markets such as Hong Kong, Macau and Taiwan.

So, maybe all Nintendo will need to do to hit that $1 billion target is release a couple more Fire Emblem Heroes-style mobile RPGs.

Alternatively, if its new president has real ambitions, he will bring out the big guns.

No doubt, Pokemon Go’s licensing deal contains some sort of timed non-compete clause, but it seems unlikely an IP that’s already demonstrated it can generate $1 billion on mobile will be limited to one location-based/AR experience for ever.

Get the latest news, interviews and in-depth analysis on Twitter, Facebook and our daily newsletter.