Take Activision Blizzard's $5.9 billion all-cash acquisition of King at face value, and it's a fairly straightforward deal.

With a market cap of $25 billion and franchises such as Call of Duty, World of Warcraft, Destiny and Skylanders, Activision Blizzard (NASDAQ:ATVI) is the biggest pureplay games company in the world.

But focused on premium PC and console gaming, it generates very little revenues from the now-large (c. $40 billion) mobile and tablet game sector, or free-to-play gaming.

Hence, buying King, which is effectively a pureplay mobile company that generates all its revenues (and profits) from free-to-play games, fills this important gap in its business.

The right price?

On this basis, the move is complimentary and the only real issue is the price of the all-cash deal.

Looking at King's (NYSE:KING) recent share price, Activision Blizzard's price of $18 per share is a premium of around 20 percent; something unlikely to be viewed in retrospect as excessive.

Of course, using $3.6 billion of its own cash, and borrowing $2.3 billion, could have a future impact.

No deal is straightforward, especially one of this scale.

But both King and Activision Blizzard generate a lot of free cash, so even this is unlikely to be a significant financial drag on future performance.

The right time?

Yet, no deal is straightforward, especially one of this scale. The first thing to consider is timing.

No matter what King's share price has been recently, the fact remains (like Zynga) it IPOed at much too high a price. Its shares have always been significantly under that $22.50 float price. That's not the sign of a healthy company, at least in investors eyes.

And in this sense, the investors are correct.

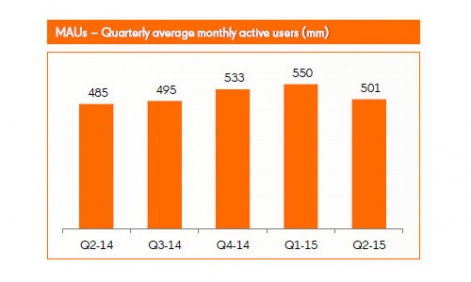

Despite being the industry leader in terms of its reach - King has over 450 million monthly active players of its games - it's now experiencing a decline in sales and profits.

FY15 Q2 revenues were down 14 percent quarter-on-quarter, while profits were down 27 percent.

That's due to the natural decline of its +$1 billion franchise Candy Crush Saga; something King has yet to replicate.

Similarly, the hockey stick growth of the mobile game sector is now over, even in China.

This situation means Activision Blizzard has got a good deal in terms of price, but it's bought an asset in relative decline.

Are other, better-suited, companies Activision Blizzard could have bought for much less cash?

That's something that will have to be turned around, probably by accelerating the process of bringing its big console/PC games to mobile in a more organised manner than has previously occured.

The right company?

The next thing to consider is why King?

One disconnect between the two companies is that while Activision Blizzard is a core gaming company, while King is nothing if not casual.

Depending on your point of view, this could be viewed a complimentary, but reversed, is King the company to help Activision Blizzard bring Call of Duty and Destiny to mobile?

Are other, better-suited, companies Activision Blizzard could have bought for much less cash?

The obvious candidate is Zynga (NASDAQ:ZNGA), which has a market cap of $2 billion. Like King it generates its revenues from free-to-play games, and while having a large casual audience, also has proven reach in the social casino and core sectors.

Yet Zynga remains in trouble; constantly loss-making and CEO Mark Pincus has control of the company's decision making process thanks to his key shareholding.

An alternative acquisition, Glu Mobile (NASDAQ:GLUU), would have been a good fit with Activision Blizzard in terms of its core audience, plus its has a growing female audience through its celebrity games like Kim Kardashian: Hollywood.

Glu Mobile would have been a good fit with Activision Blizzard in terms of its core audience.

It would have also been a sub-$1 billion deal, but Chinese giant Tencent now has a 14.6 percent stake in the company, making any acquisition highly unlikely.

Other options in terms of publicly owned companies such as Gameloft (currently fighting its own corporate war thanks to a takeover bid from Vivendi), were too leftfield; too small, too French etc.

The other player?

Which, excluding Game of War developer Machine Zone (a single title shop that would have been very expensive and has been in the news recently for an infamous late-night spat), leaves one obvious candidate; the privately-owned Kabam.

It's currently believed to be on the path to its own IPO, but given the issues with both Zynga's and King's IPO in the US, investors will no doubt be skeptical about how it prices its float.

Given that uncertainty, it would be a surprise if Activision Blizzard hadn't had talks with Kabam, which would be been a small deal in terms of scale, but obviously more speculative in terms of pricing the business, which is believed to have annual revenues of between $500-$600 million.

Logically considered, buying King was the best deal available to Activision Blizzard.

Again, as with Glu, the spanner in the works could have been Kabam's existing investment from Chinese outfit Alibaba, although it's not a games company and the synergies of that deal now seem unclear.

In this context, and given it could afford it, King was not only the most obvious deal for Activision Blizzard, but also a deal that was the most straightforward and provided the most bang for its buck, even when you're spending 5.9 billion of them.

Of course, that doesn't mean it's will be a good deal. That's something we can only judge in retrospect.

But logically considered, buying King was the best deal available to Activision Blizzard, given it wanted to rapidly increase its scale in mobile games.