New data from GameAnalytics shows just how big an effect the global lockdown is having on our daily mobile gaming habits and adds a unique view of how consumers are spending more time and money on games to keep themselves entertained as the world collectively stays indoors.

In a detailed post on its games industry blog, GameAnalytics has used data from its Benchmarks+ platform covering Q1 to show the impact of Covid19 on mobile gaming behaviour - focusing on traffic changes, playtime, IAP spend and genre trends during the last three-month lockdown across different regions.

"With people looking to stay entertained indoors, we expected them to play more. The interesting part is in understanding where they spend this time and how changes in behaviour affect different types of games, so that publishers and developers are prepared to make the right changes, keep their audience entertained, and keep their businesses growing," said Morten E. Wulff, Founder & Chairman at GameAnalytics.

Over 75,000 developers use GameAnalytics to analyse how gamers are playing, including 40 of the top 100 most downloaded games on the app stores. In total, Benchmarks+ shows how more than a third of the world's mobile players are behaving.

Time spent playing mobile games was 62% higher in March than January as countries entered lockdown

Over the last three months, the number of people playing mobile games connected to GameAnalytics' platform grew from 1.2 billion people per month to 1.75 billion - a rise of nearly half (46%).

But it wasn't just the total number of players that skyrocketed; globally, the total amount of time spent playing games peaked at over 90 million hours in the last ten days of March, 62% higher than the first ten days of January. That's an increase both in the number of game sessions and the per-session playtime.

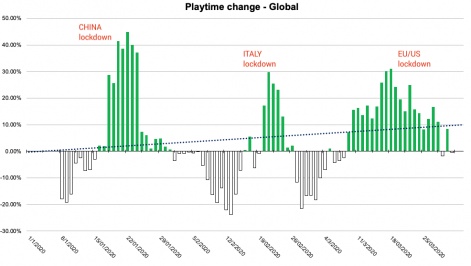

This surge in playtime began in China in the second half of January - the first country to go into lockdown. During this period global playtime soared by 40%, then dipped back 20% – still 20% higher than before. On the 21st of February, there was a second spike when Italy locked down, and on the 10th of March a third surge that coincides with the European and North American lockdowns.

Global spend on In-App Purchases rises - and spikes by 30% once the US and Europe enter lockdown

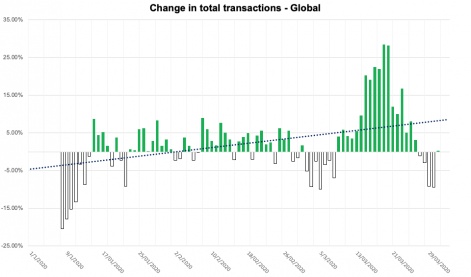

GameAnalytics found that the number of people spending on in-app purchases increased just as the amount of playtime did. That's not unexpected - as the longer people play, the more likely they are to spend. So this suggests that the increase in IAP came from both new and existing players.

The big growth in IAP didn't start until social distancing measures were introduced in Europe and North America - boosting the increase in IAP spend from roughly 5% to a peak of 30% per day around the 16th of March. After a few days at this much higher rate, spending appears to have dropped back to normal levels.

Adventure games get the biggest boost in playtime

The data from Benchmarks+ shows that game genres have been unevenly impacted by our current social environment. Playtime of the top 2% adventure games has grown 25%, to almost 4 hours per user; it would seem that, with a lot of time on their hands, people are opting to play longer, more in-depth games to keep themselves occupied. In contrast, puzzle games saw a 2% decrease.

Arcade-style, hyper-casual games have grown around 8% to 10% since January, with playtime for the top 2% performing games going from 71 minutes at the start of the year to 81 minutes in March.

The full post by the GameAnalytics team includes additional data on conversion and retention between January and March 2020, as the global lockdown took effect. Head over to the GameAnalytics blog to read the full piece.

Benchmarks+ showcases real-world, aggregated performance data for key mobile gaming product metrics like retention, engagement and monetization. Its data is drawn from every game across GameAnalytics' network - currently more than 99,000 mobile games, 1.75 billion monthly active players and 24 billion monthly sessions, making it the largest game intelligence platform of its kind. More information about Benchmarks+ is available at https://gameanalytics.com/benchmarks.

About GameAnalytics

GameAnalytics is a popular free analytics tool for games, used by indie developers, games studios and powerhouse publishers around the world. Their network is approaching 100,000 games, which are played by more than 1.75 billion people for an average of 24 billion sessions each month.

The GameAnalytics platform enables game development teams to rapidly refine gameplay, improve retention and increase revenue with real-time data analysis for all major game engines and operating systems.

Since launching back in 2012, GameAnalytics has received over $8M in funding from high-profile tech investors, including Michael Arrington (Founder of TechCrunch) and Jimmy Maymann (CEO at Huffington Post). In 2016, the company was acquired by the leading mobile advertising company, Mobvista. For more information, visit: gameanalytics.com