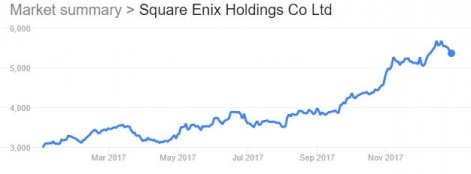

Mirroring the widespread bullish sentiment experienced by global stock markets in 2017, the games sector also had a very positive 12 months.

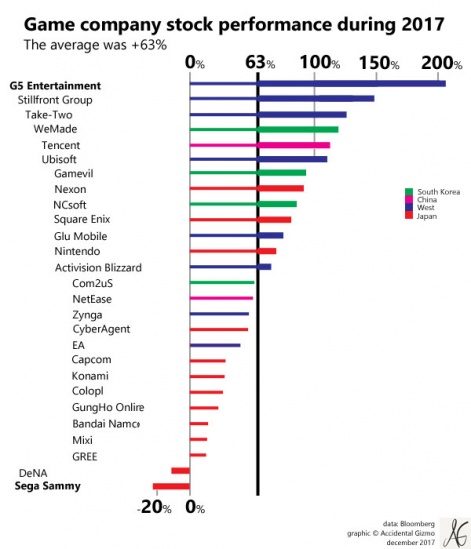

Across the 26 majority games companies which started the year as publicly-owned entities in the US, Europe, China, Japan and South Korea, the average return for investors was 63 per cent.

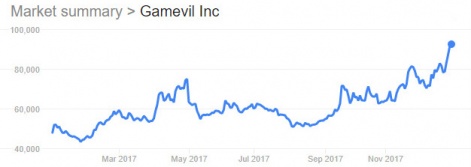

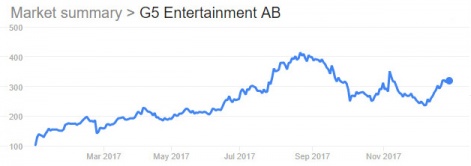

As is often the case, the very best performing companies were small cap outfits for who successful new product or restructuring always has an over-sized impact.

But the biggest surprise of 2017 was it was some of largest global games companies which performed strongest.

Most notable was Tencent, which passed $500 billion in valuation, while Activision Blizzard and Nintendo both broke through the $50 billion market cap, although Activision Blizzard couldn’t maintain that level, ending the year worth $48 billion.

On the up

Indeed, across all 26 companies, the sector added $470 billion in market capitalisation during the year, with almost half of this arising from Tencent. This compares with a market value of around $110 billion for games in terms of annual sales during 2017.

Yet, even in this year of plenty, it’s worth sparing a thought for those companies, which for various reasons, saw their stock price fall during the year - DeNA and Sega Sammy.

Indeed, more generally, Japanese games companies - here shown in red - demonstrated the lowest level of share price growth.

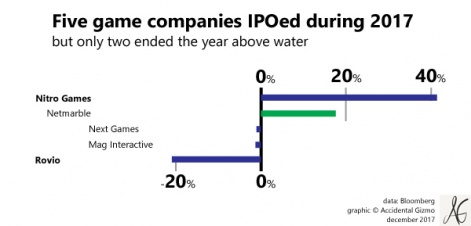

Another broad trend worth noting was the level of new IPOs, with five games companies floating during 2017, and four of these making their debuts in Helsinki or Stockholm.

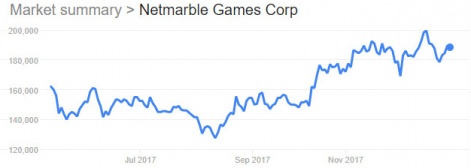

These were mainly small scale floats. The exception was Netmarble’s IPO on the Seoul Stock Exchange, which was the second largest ever in South Korea.

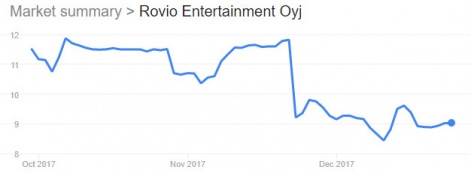

It was one of the more successful too, with its stock rising post-IPO; something only one other debutante managed, with Rovio, in particular, experiencing a heavy decline.

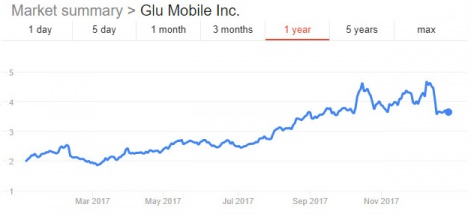

For the purposes of this article, we’re going take a look at the details underpinning some of the key performers when it comes to mobile games, both positive and negative.

And just remember, past performance is no guarantee of future results, nor should any of the following be considered investment advice.

Click here to view the list »