Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com!

The following analysis of Stillfront Group is a concise version of the full company deep dive that was originally published on MTM and Elite Game Developers. It was written by Abhimanyu Kumar and Aaron Bush, the team behind MTM, and Joakim Achren from EGD.

Stillfront Group is an emerging games business that both industry insiders and curious outsiders should prioritise understanding. Even though the company is making a larger name for itself - especially in 2020, which has turned into a breakout year - it remains, in our eyes, underrated and under-followed. It was (and maybe still is) a dark horse of the games industry.

Tripling its market cap year-to-date certainly helps, but most don’t understand how Stillfront’s unique acquisition strategy, group operations culture, and capital allocation skill bring consistency and scalability to an otherwise lumpy, hits-driven industry. In other words, Stillfront’s success is the result of a well-engineered strategy designed to predictably grow shareholder value in a highly unpredictable market. The long-term view of Stillfront’s stock price speaks for itself!

Naturally, we had to take a look under the hood to understand how Stillfront is achieving such striking outperformance. While the full company deep dive can be found here, this snapshot covers various aspects of Stillfront’s history, current business strategy, and our take on the company’s future on a high level. It also builds on top of our interview with Stillfront’s CEO and Co-founder, Jörgen Larsson, which you can find here. Let’s dig in!

Jörgen’s story

The first step to understanding Stillfront is to understand the man behind the business - CEO and Co-founder, Jörgen Larrson.

Jörgen thoroughly describes his entrepreneurial journey up until founding Stillfront in the podcast here, but there are four points about his journey that distinctly stand out to us:

- First, he has loved playing games since his childhood (Chess being his favorite), considers gaming to be a key human need, and believes there’s still much to be explored in online and internet-related gaming.

- Second, he realised and embraced the much bigger business potential of free-to-play (F2P) games versus traditional off-the-shelf titles.

- Third, he’s passionate about building businesses, actually founded four companies in his career, and learned, improved on, and implemented those insights into every successive venture.

- Fourth, he understood the unique business model benefits of managing a portfolio of proven long lifecycle games versus going down the well-trodden path of “just building a great game” that usually has an unfavorable risk/reward ratio.

In short, Jörgen comes across as not only a highly self-reflective and experienced entrepreneur, but he also has a sharp business mind in both a qualitative and quantitative sense. His approach to tackling the F2P market is very different compared to many other entrepreneurs who want to build massive gaming businesses, and we think that distinction is ultimately wise. Stillfront is obviously larger than one man - and our time together was relatively brief - but we suspect the four points above are key factors that led to what Stillfront Group ultimately became.

Stillfront’s journey to present day

Jörgen himself describes Stillfront’s journey in three phases, which we paraphrase as:

- 2010-2015: Before Stillfront went public, many internal processes that lay the foundation for future business growth still need to be improved on. The team used the early years to iterate on multiple elements of the business - strategy, decentralised culture, etc.

- 2015-2019: Recent years have focused on M&A execution and becoming the best home for great industry talent. Elevating the business by attracting and retaining successful studio teams was front and center.

- 2019 to now: Stillfront is currently focused on scaling, plus better understanding and leaning into its competitive advantages, which should take the business to new heights and ultimately closer to becoming a F2P powerhouse.

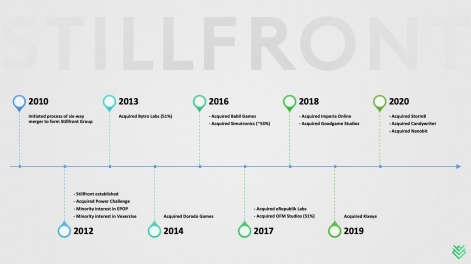

With that context, let’s back up for a moment and start at the beginning. Stillfront was founded in 2010, but truly came together in 2012 when six companies - Stillfront, Coldwood Interactive, OnGolf, Gamerock, VOIPlay, and Verrano - merged. That’s an unusual beginning on the face of it, but the purpose was clear: to create significant value by forming a roll-up entity for consistently profitable gaming studios that ideally have further room to grow. And over the last decade, as depicted in the timeline below, Stillfront has demonstrably executed on its mission.

The timeline offers three observations:

- 1. Stillfront historically acquired and integrated approximately one studio per year (plus other partial interests), but the pace and size of those deals have definitely picked up more recently.

- 2. As Stillfront grew, its bench of leadership talent increased as well.

- 3. Third, there is a clear evolution in the F2P game genres that Stillfront is expanding into through its acquired units.

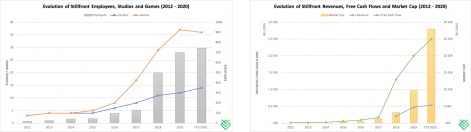

All the above has resulted in some very impressive overall business metrics, which are particularly striking in graphical form.

Stillfront’s strategy

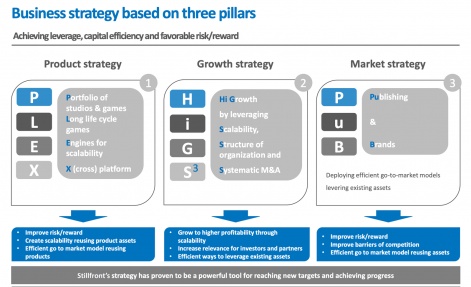

While each of three observations mentioned above are explored much deeper in our essay here, Stillfront’s goal is to consistently and predictably grow value for all relevant stakeholders within a traditionally unpredictable and hits-driven industry. In Stillfront’s eyes, it achieves this through a three-pillared approach called “PLEX + HiGS3 + PuB” (try saying that five times quickly!), which is defined in the image below. In practice, Stillfront brings this to life by executing on the three key strategies:

- Centralising capital allocation decisions, primarily to pursue financially flexible M&A

- Embracing a highly selective acquisition process, while diversifying to reduce portfolio risk

- Keeping studio operations decentralised, while still driving synergies throughout the group

These strategies result in an environment that breeds autonomy, shared upside, minimised risk, a focus on high margin, recurring revenues, and a constant eye for new deals. This approach has scaled remarkably well in other industries (thinking about Constellation Software, Transdigm, etc.), but it’s still relatively unique in gaming, which is traditionally viewed as a hits-driven business.

And when this strategy was put forward 10 years ago by Jörgen Larsson - at a time when mobile gaming was still beginning to ramp up - it was even more of an under-the-radar opportunity. We deeply explore the intricacies, impact and risks of each of the three above mentioned strategies in our deep dive here.

Looking ahead for Stillfront

Stillfront’s future consists of relatively clear knowns and unknowns. What’s known is the company’s ambition, long-term mindset, growth strategy, decentralised proclivity, and approach to culture and knowledge sharing. In essence, we know the general framework for how and why decisions get made. That means that Stillfront’s future can likely be boiled down to “more of the same, but bigger, faster, better, and more diversified.”

Of course, everything else is unknown. Understanding the company’s strategy - especially in a mostly growth-by-acquisition business - tells us nothing about what will be acquired next, when, or at what terms.

The same goes for specific game launches. The details are entirely up in the air, and not even Stillfront’s leadership can know exactly what the business will morph into. Is that a bad thing? Not at all, as long as opportunities abound and management remains diligent.

Of course, there’s a difference between strategy and competitive advantage, which we didn’t touch on much. That’s because Stillfront doesn’t yet hold many traditional competitive advantages (like major network effects, powerful brands, flywheels, or being a low-cost producer), at least in big ways — although perhaps at greater scale this can change — but it holds many micro-advantages that result from its the wide variety of things it owns. We get more specific in terms of tactics that Stillfront is likely pursue in our deep dive here.

Will Stillfront succeed in its quest for further scale? We think so. Winners tend to keep on winning, and Stillfront’s strategy definitely can work over multiple years. The industry is massive, and Stillfront remains a relatively small business.

There are risks, though. The first is creative, while the second is financial. Both are explored deeper in our essay here. But all in all, if Stillfront effectively executes and continues winning attractive deals, there’s little reason why it can’t become a much larger gaming business, especially in mobile. The company already has made tremendous progress, but it remains half the size of Zynga and a tenth of the size of EA. If management continues making savvy decisions, then the gap can continue to close. However, the gap won’t close because out outsized IP but rather a system that breeds diversity, consistency, and diligence in a way others can’t easily match. That’s the special Stillfront way.

Conclusion

Stillfront is best understood through the lens of its history and strategy, a game plan that continues to play out in bigger, higher stakes ways. We think the company’s focus on scaling high margin, recurring revenues through long lifecycle games is wise, and we admire the team’s savvy and diligence when it comes to growth-by-acquisitions.

It’s certainly worked exceptionally well so far! Similar to Stillfront’s past, the company’s future is dependent on how well leadership executes on that strategy, because without it the edge that makes Stillfront special and so valuable begins to fade away. That said, even if the pace or attractiveness of deals ebbs and flows, we currently see no reason why Stillfront can’t continue striking notable deals for many more years. There’s only so many large acquisition targets, to be fair, but there’s plenty of growth left from here as long as the industry holds steady and management doesn’t screw up a major deal.

Importantly, Stillfront is more than just an acquirer; its approach to company building isn’t common in the industry, and its approach to sharing knowledge and incentivizing independent teams should be studied more widely. At minimum, digging into Stillfront is a reminder that not all games companies need to chase the next mega-hit; diverse, consistent, and profitable approaches - even if at smaller scales on a per game basis - can still turn into something big and praiseworthy.

And, of course, if management continues to defy expectations and scale this consistent profit generator to new heights, Stillfront truly could become much larger than observers expect. In other words, despite remarkable performance over the past few quarters and years, maybe Stillfront still is the underrated dark horse that many now recognize it was. Check out our full company deep dive here!