And Finnish outfit Smaato has wheeled out its usual set of disconcerting monthly statistics, providing such an opportunity.

The first thing to understand is what Smaato does. It has an aggregated mobile advertising platform, which offers more than 40 ad networks.

Through these, it serves 8 billion mobile ad requests per month in more than 220 countries via the games and apps of over 6,000 publishers. In comparison, the largest ad network, AdMob does about 18 billion impressions per month.

Doing the do

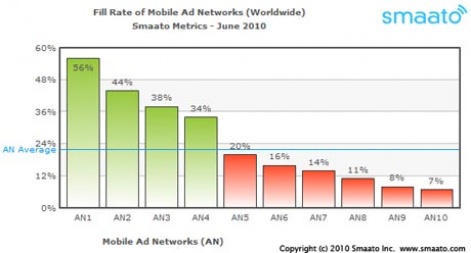

One key element of ad networks is how many requests for ads they actually fulfill.

Surprisingly the global average on Smaato is a mere 22 percent - roughly one in five requests - and in June 2010 only four networks performed better.

The best network fulfilled 56 percent of its worldwide requests. Smaato doesn't reveal specific data about the networks in question, anonymising its findings.

Partly this performance is due to the fact that many networks are locally concentrated.

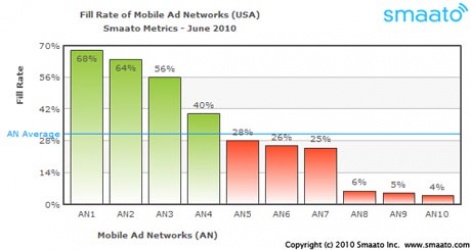

For example, in June, the best network in South Africa fulfilled 92 percent of requests, while the best network in Europe fulfilled 86 percent and the best in the US (see below) fulfilled 68 percent.

Hence, choosing the right network for the markets you're operating in is clearly significant in terms of the response and the revenue you're likely to generate.

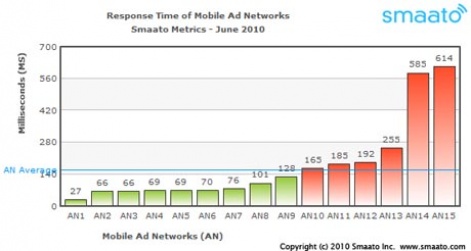

Speed to serve

Another fundament is the speed of an ad network to fulfill a request. Again Smaato's performance range is large, with a best of 22 milliseconds, versus an average of around 160 milliseconds.

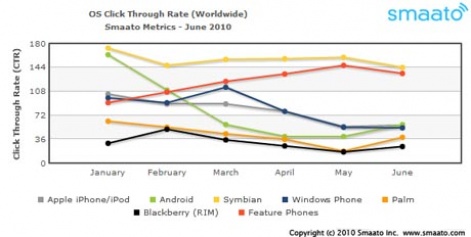

The final fundamental Smaato highlights is the click thru rate (CTR), something it breaks down in terms of region and mobile device type.

This is a little confusing, especially in terms of making comparisons between devices in specific territories.

For example, while Symbian is the biggest global smartphone OS, it's a tiny market in the US, making its status there as having the highest CTR hard to objectify or use as a comparison point.

What's perhaps more significant are monthly click thru rate trends.

Taking a global perspective, Symbian and feature phones offer roughly the same level of CTR, while on Smaato's normalised graph, all other smartphone OSes offer around half the CTR, and that on a downward trend.

"Putting this into perspective, we have to consider the sheer number of Symbian devices compared to Apple devices, but it should again also serve as further proof to advertisers that the iPhone is far from the be-all and end-all in mobile advertising," Smaato points out.

You can read the full post about June's figures, which include a comparison between the South African and the US markets on Smaato's metrics site.