In 2024, the games market is expected to recover and grow, but it'll be a lean year for gaming companies. Multi-game subscriptions may see slower growth, leading companies to focus on developing premium games. Mobile developers are shifting towards PC gaming and the next Nintendo console is anticipated to launch with a new 3D Mario game.

Also, Xbox plans to launch a mobile store on Android, while nostalgia becomes a key driver for live-service games. Generative AI will speed up game production and open-world Soulslike games will be in the spotlight.

This comes from a new market trends report from data and research firm Newzoo which shows that despite the highs and lows the industry encountered in 2023, this year's outlook, “Will be similarly exceptional" as 91% of games industry leaders believe that the global market revenue will increase in 2024 while 9% disagree.

A recovering market

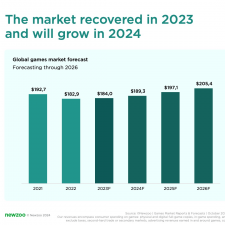

Newzoo's data shows that the market will continue to recover and grow in 2024 as the PC and console gaming market outlook is optimistic, rebounding in 2023 after a decline in 2022. This recovery is expected to continue through 2024, driven by the expanding install base of the Xbox Series and PlayStation 5.

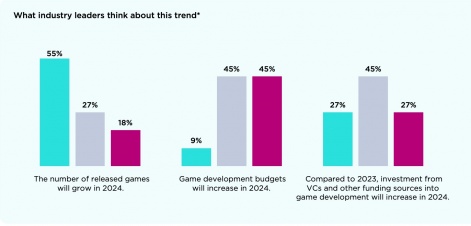

While this year's game releases may be less impressive, growth will be fueled by live-service games and back catalogue sales. 55% say the number of released games will grow in 2024 while 18% disagree. For game development budgets this year, the result is tied as 45% of experts say it'll increase while 45% disagree.

Companies will take fewer risks in 2024

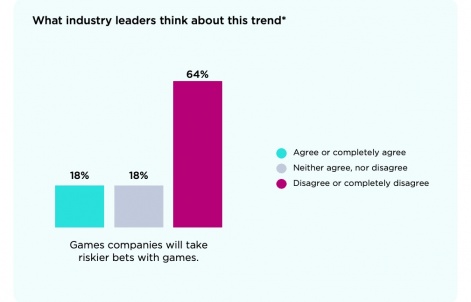

Projects entering the competitive games market face challenges, with live-service games requiring prolonged player commitment, limiting opportunities for new projects. Post-2023 layoffs and unsuccessful gaming ventures make 2024 financially lean for many companies. The industry has been adjusting to post-COVID realities and rising interest rates but the pandemic-induced funding has diminished significantly.

To mitigate risks, companies opt for risk reduction strategies, favouring sequels and established IPs over new ones. The focus also includes small-experience AAA titles like Assassin’s Creed Mirage and Marvel’s Spider-Man: Miles Morales. The survey results show that 91% of experts completely disagree with new IPs dominating the market. 28% of leaders also believe that companies will take riskier bets with games while 64% completely disagree.

Multi-game subscriptions will reduce

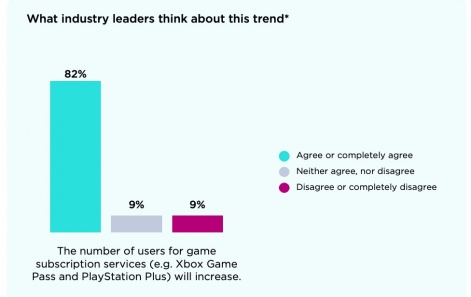

The growth of multi-game subscriptions is slowing down, with lower forecasted growth for the next three years. Indie game companies are less willing to sell licenses, resulting in reduced deal sizes. Unlike streaming music and TV, Newzoo's report shows that multi-game subscriptions won't dominate the gaming ecosystem due to the active nature of gaming.

Providing day-one access to new games risks cannibalising premium revenue for gaming companies. Gaming platforms like Fortnite and Roblox pose a new threat by offering diverse free-to-play experiences, resembling multi-game services but with the key distinction of being free.

We'll see more premium titles

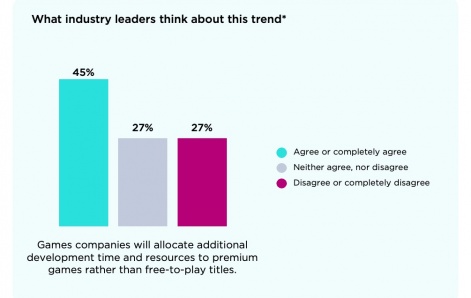

The live-service games model remains dominant for revenue, but the rush to create new ones is slowing down due to intense competition. Recognising the zero-sum nature of the space, many companies are returning to the premium model for higher financial success chances.

The PC and console markets have become too saturated as well, with only a few games capturing a significant portion of playtime. Although more live-service titles are expected, engagement is declining as people opt for good quality premium games as 45% of leaders agree that companies will allocate more resources to premium games rather than free-to-play titles but 27% disagree.

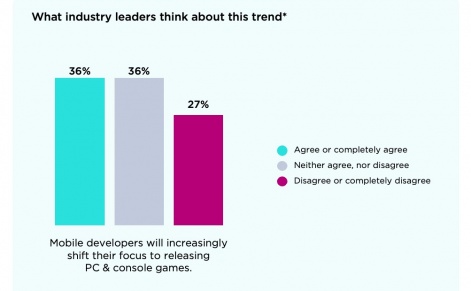

Developers could give up on mobile

In 2023, challenging market conditions and privacy regulations led to the second consecutive decline in the mobile gaming space. To address rising user acquisition costs and market saturation, game companies are focusing on evolving existing games instead of launching new ones. Launching mobile games on PC is seen as a strategy to enhance retention and engagement by providing access across platforms.

Diversification also involves developing new games for PC and console, leveraging the expertise of mobile developers in monetisation, acquisition and retention. And although 27% of leaders disagree with mobile developers shifting focus to other platforms, 36% completely agree. Leading mobile game companies are now establishing dedicated studios to develop games for other platforms.

However, despite facing challenges in user acquisition for the past two years, Newzoo's report shows that mobile gaming is also expected to recover through 2024.

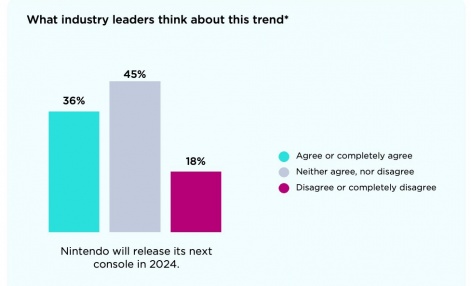

A new Switch console... And an Xbox mobile app

Newzoo predicts that Nintendo is set to launch a new console later this year, marking almost seven years since the Switch's debut. They suggest that the next generation of console will be accompanied by a new 3D Mario game, while existing Switch users might be able to seamlessly transfer their Nintendo accounts to the new console, allowing for a smooth transition without losing their existing game libraries.

Xbox also plans to launch a mobile app store on Android and an iOS release afterwards. Microsoft's $68.7 billion acquisition of Activision Blizzard, along with the earlier acquisition of King in 2015, reflects a strong interest in competing with Apple and Google in the gaming app store market. With access to a wealth of gaming IPs, including Candy Crush, Xbox aims to leverage its cloud gaming capabilities and Xbox Game Pass service for broader reach on mobile.

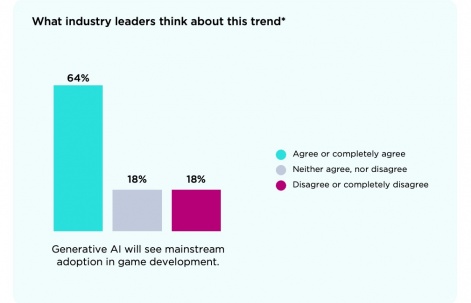

AI is sticking around with souls-like games taking the spotlight this year

Generative AI sparked controversy in 2023, hailed by industry leaders for potential cost-saving benefits in game development. The technology garnered praise for transforming NPC interactions but also faced criticism from fans and voice actors who opposed its use.

Despite the controversy, many studios are already employing AI tools and their usage is expected to increase for efficiency gains. However, in 2024, the impact of generative AI on game production at scale is limited, with most use cases being selective and proven. Up to 64% of leaders say generative AI will see mainstream adoption in game development while 18% disagree.

A wave of open-world Soulslike games is expected this year, mostly influenced by the success of Elden Ring in 2022. Confirmed releases include Another Crab’s Treasure, Rise of the Ronin, Black Myth: Wukong, Enotria: The Last Song, and Flintlock: The Siege of Dawn.

You can read the full ‘Games market trends to watch in 2024’ report here.