Understanding emerging markets and how to best tap into their potential is vital for growth in the gaming market. Considering how competitive the industry is, knowing how to tap into these areas could provide a much-needed revenue boost and solidify your presence early in a market that is projecting continued growth over the coming years.

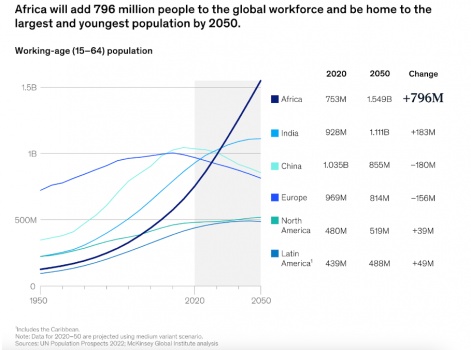

One such emerging market is Africa, which boasts the most youthful demographic in the world and has shown a keen interest in gaming, particularly on mobile. This market presents an excellent opportunity for game developers and publishers alike.

In this guest post, Senior UA and Admonetisation Manager at Carry1st, Claire Rozain, shares insight into Africa's gaming market, its projected growth and how developers and publishers can better understand the region.

After a little break and a lot of projects, Pocketgamer.biz gave me the opportunity to come back with a new column focusing on emerging markets. This topic has fascinated me since I joined Carry1st, the leading mobile publisher in Africa.

My name is Claire, Senior UA and Admon Manager at Carry1st, and with mobile adoption booming, Africa's gaming market is set to generate $2B+ by 2025. As the leading publisher in Africa, Carry1st has unrivalled insights into this opportunity.

NOTE: These views are my own and not necessarily representative of Carry1st.

Mobile gaming market growth

Driven by Emerging market growth, innovative advancements and increased accessibility of gaming platforms, by 2028 the global gaming market is estimated to grow beyond $376.08 billion, reflecting some of the biggest vertical growth currently. Across demographic and geographic boundaries, the expansion of the gaming industry has been facilitated by the democratisation of smartphones, the rise of high-speed internet in emerging markets and strong growth in the addressable market - especially in Africa.

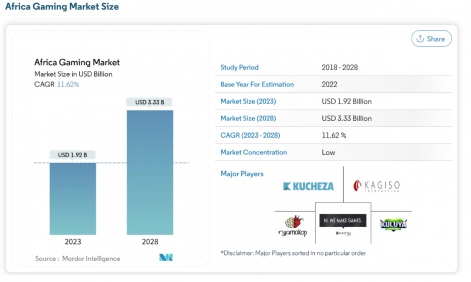

Indeed, according to Mordor Intelligence, the African gaming market may be one of the biggest opportunities to get incremental growth for gaming publishers and tap into a blossoming market which will be worth 3.33B USD by 2028.

Africa's mobile market growth

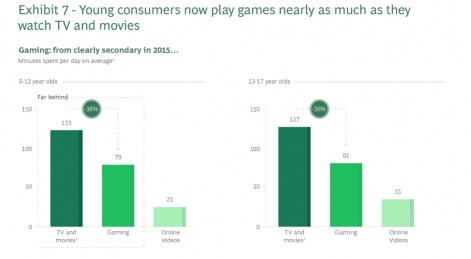

As of 2022, around 40 percent of the African population was aged 15 years and younger, making it the continent with the youngest population worldwide. This younger demographic may be the next biggest opportunity for mobile game publishers, as they have one of the highest penetration for mobile games. The younger audience are digital natives, making them even more inclined to play games rather than watch TV, according to BCG.

Now, mobile game developers need to leverage their knowledge about the continent, better localise content and nail their understanding of the payment infrastructure in order to tap into this rapid growth and tap into the opportunity.

How to best address the African market growth for mobile games?

Africa’s gaming audience: Mobile-oriented

According to Newzoo, in Nigeria, 82% of web traffic was generated via smartphones, 16% via PC devices, and the remaining from other sources and this is forecasted to continue; according to GSMA, smartphones will account for 61% of total connections by 2025. With strong mobile habits, the African market may be one of the most significant opportunities of our century to reach players deeply engaged on their smartphones and excited to play games!

This is reflected in casual games playtime. In Africa, people play casual games for twice as long as in the US on average: 26 minutes in Africa versus 15 min. in the United States. The appeal for mobile game developers and demand for casual games in the region is evident. This reflects an opportunity for mobile game developers to extend their audience to an additional 1B people across 54 countries, including 650 million mobile users in Africa (far surpassing Europe and the United States).

This extended time spent using mobile games is related to the population's strong mobile usage and the use of mobile games to socialise.

The African audience is definitely mobile-first, but needs to be understood in order to be scaled. This is especially true as latency and device storage are among the biggest challenges our industry has yet to solve.

Diverse and localised audience

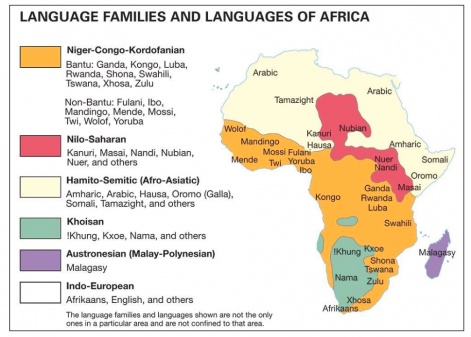

Geographically, Africa is as large as China, Europe, India, and the United States combined. With its 54 countries and over 3000 native languages, Africa may be the least well explored continent in any other region to scale profitability. However, it remains one of our industry's last pockets of growth.

The continent is fragmented between different audiences, languages, accessibility challenges, distribution channels and payment solutions - but the African market still represents 1B people keen to play games, who actually have one of the highest casual game playtimes across the entire planet.

According to Google, for 58% of mobile players, it is important or extremely important for a game’s content to be localised to their country or region. Working with a partner who understands Africa to leverage gaming content will become as mandatory as leveraging local partners in APAC.

However, Diamond Lobby's research has exposed an apparent problem with diversity in gaming. Indeed, according to Diamond Lobby.

- 61.2% of characters in games are white.

- 9.5% of games only have a playable white character, i.e. they have no other ethnic representation.

- Just 5.3% of games do not have a playable white character.

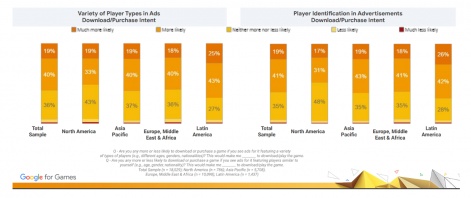

In order to crack Africa, publishers will need to understand the diversity and richness of Africa if they want to deepen their ability to localise. This should directly be reflected in revenue growth as 60% of people say they are more or much more likely to download or purchase a game if they see ads for it featuring players similar to themselves (e.g., similar age, gender, nationality).

With an addressable market of 1B people, inclusive design for Africa seems to be an obvious shift gaming publishers need to address nowadays in order to get an advantage out of this rapid growth.

To conclude

In short, while Africa is growing, mobile game developers need to invest and deepen their perspective on the continent.

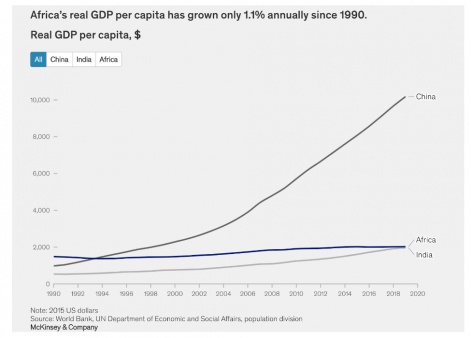

Africa is a mosaic and a perfect reflection of diversity. With 5.1% annual GDP growth from 2000 to 2010 and 3.3% growth per year between 2010 and 2019, there is no doubt that the first gaming studio to best adapt and invest in this market will have a significant competitive advantage - and will experience growth in upcoming years. However, this isn’t and cannot be possible without a deep understanding of the continent, local payment solutions and deep localization.

Edited by Paige Cook