It's a year since I first came up with my Monetiser column.

And it's been an interesting ride: somethings I originally took for granted have been proven totally wrong, while 12 months of crunching data have thrown up deeper insights that I initially would have hoped for.

But, if nothing else, Monetiser remains a work-in-progress.

And that's always been my prime motivation.

I'd rather always be moving towards a better understanding however rough the current situation than attempting to force a definitive view; especially in an industry as fast moving as F2P mobile games.

The golden ratio

Which brings me to my current obsession.

For the past couple of months, I've been playing around with what I call Popularity and Success metrics, which combine into a Monetisation Efficiency ratio (Success divided by Popularity).

As with many aspects of Monetiser, the approach has proven to be less robust that I initially hoped, but the more data I crunch, the better understanding I get in terms of how to use it, and more importantly, how to evaluate the results.

This is particularly the case because the metrics are effectively just ratios of a game’s performance in the US App Store charts.

(You can change the country you index against, but in the case of most games I look at, the US is the biggest market and also has a close correlation with western Europe.)

This means the more successful a game has been, the closer it is to the perfect 1.0 score.

N.B. Popularity measures peak download position and Success measures peak position in terms of top grossing charts. (See a fuller explanation here.)

However, this means that we lose mathematical range for successful games, particularly when it comes to Monetisation Efficiency, because we're dividing two numbers that are close to one.

For example, the perfect game would have a Popularity metric of 1.0 (i.e. it was #1 on the download charts in all countries), and a Success metric of 1.0 (it was the #1 top grossing game in all countries), and hence a Monetisation Efficiency of 1.0.

Finding our range

In some ways that’s fine because an ME score of 1 is still high. Most games will have metrics of much less than one, more likely closer to 0.01 or 0.001, so we can generate useful information even from successful games.

But where Monetisation Efficiency really works well is to measure how much better a game ranks in terms of its top grossing chart position compared to its download position, particular if one of these position is high.

Over the months, I've looked at a range of game from a few companies including Glu Mobile, Zynga and NaturalMotion, and Scopely, as well as a selection of paid games and the regional spread (i.e. US versus Japan) for games such as Square Enix's Deadman's Cross.

In all cases, I've tried to compare like-with-like, even to the level of not directly comparing data from Google Play with the Apple App Store, because they work in different ways.

It's a long explanation, because the details always matter, but following a recent interview with social casino developer Ruby Seven, I decided to take a look at this genre of games.

Rolling the die on social casino

I was interested partly because we know that these game are highly monetised and because they tend not to have performed relatively well in terms of their downloads numbers (compared to Candy Crush Saga etc), I thought they would be an interesting case study.

I also know very little about the social casino genre (these are games in which you can spend money but you can’t win real money); something I hoped this process could change in a short period of time.

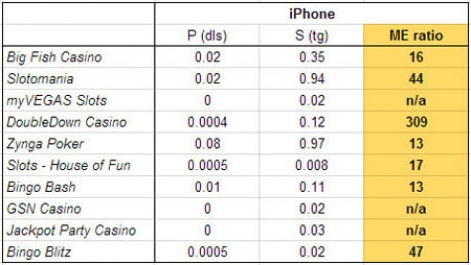

As can be clearly seen from the graph below, when it comes to performance on the US free download chart for iPhone games, most social casino games have a low Popularity ratio.

That's to say, the best title - Zynga Poker - scores 0.08, but 6 of the top 10 can't even manage 0.01, which is our rule of thumb for a decently performing game in terms of downloads.

Indeed, three games rate smaller than four decimal places.

However, when we look at the Success ratio, things are a very different. Now, all but one game ranks within 0.01, and two games - Zynga Poker and Slotomania - are very close to scoring a perfect 1.0.

And what's really fascinating is that when we look at the Monetisation Efficiency column, all the games that return a number are over 10 i.e. very high.

That means that for each peak download chart position, a game is rating more than 10 times higher in terms of its top grossing chart position.

These games are not just monetising well. They are monetising phenomonally well.

Of course, there is a note of caution to be made. We're not saying that all these games are making the same amount of money. That sort of commercial success is controlled by our Popularity ratio, which says Zynga Poker, Slotomania and to a lesser extent Big Fish Casino are the big cash generators.

However, what our ME ratio does says is that per download, all of these games are monetising very well - with Doubledown Casino being off-the-charts.

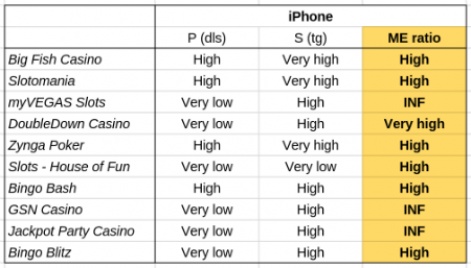

In case people are confused by the numbers (which at this level are sort of meaningless), I've created another version of the graph, where INF stands for infinity.

On the bigger screen

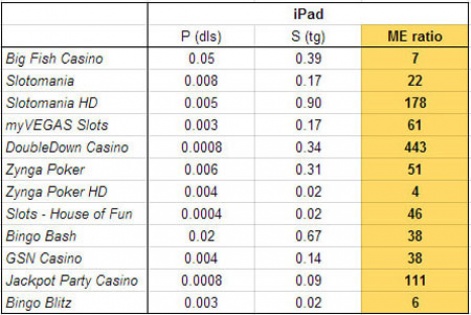

Of course, iPhone isn't the only platform for social casino games, so we should have a look at how these games perform on iPad too.

In some ways, the situation hasn't changed much, but we do see some more detail.

As a group, the games have performed better in terms of download rank; there are no 'zeros', but no game has performed particularly well.

When it comes to top grossing performance, all the games have performed relatively well. Indeed, with the exception of Zynga Poker, pretty much every game has a higher Success ratio on iPad than iPhone.

Perhaps this is something that's in tune with the bigger screen and perceived more wealthy userbase of the tablet compared to the phone.

Hence, there are no surprises that for many games their ME ratio on iPad is higher than for iPhone.

Onto Android

The final platform to look at is Android.

We treat this differently because Google Play works in a different way to the App Store, particularly in terms of top grossing placement.

Yet, when it comes to social casino games, the fundamental issue on Google Play is that the US audience that is key to these games' success is a much smaller part of the install base.

Hence, not one of the games we considered returns a ratio for Popularity, which in turn means no Monetisation Efficiency ratio.

All we can look at is the Success ratio for the games.

Perhaps as we'd expect Zynga Poker and Slotomania are, once again, the key brand, but with Big Fish Casino not in third place. In fact, it's one of the worst performers.

Conclusion

So what have we learned?

Perhaps the headlines seems a bit obvious. Social casino games are massively strong monetisers, most likely the strongest - although we'd have to compare card collection games like Puzzle & Dragons to be sure.

These games perform well on iPhone and most do even better on iPad. They also generate cash on Android, although it's not as natural as platform in terms of per user revenue.

Yet we also have a little bit more data.

Across both iPhone and iPad, Slotomania and particularly Doubledown Casino were by far the top monetisers per user - at least as measured by our Monetisation Efficiency proxy.

But to return to the beginning, as with the entire Monetiser process, the goal has been not necessarily to come up with answers but to better understand the questions we should be asking about the F2P game industry and the trends within it.

To that extent, then, this is just another small piece of research to build on.