Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry-moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com!

On Wednesday, Stillfront Group delivered its Q4 and FY 2020 earnings report. The quarter’s results continue to make the company look good:

- 19 gaming studios and 1000+ professionals across 15 countries

- 22 million MAUs, which is +274 per cent YoY and yet to include players from 3 new acquisitions

- 42 current live games with 20+ titles in the pipeline for soft-launches in 2021

- ~$127 million in bookings, which is +96 per cent YoY and paired with a 37 per cent adjusted EBIT margin

- ~$26 million in free cash flow prior to acquisitions and financing

- ~$425 million in cash and debt reserves waiting to be put to good use

As we covered in our Stillfront deep dive, the company’s selective mobile-first acquisition strategy, decentralised operations culture, focus on group synergies, and capital allocation skill continues to work. Stillfront’s recent results showcase a strong underlying business with a decent amount of financial flexibility to continue to fuel further growth through M&A. For context, they’ve been able to maintain a steady rate of one acquisition per quarter even over the pandemic-ridden 2020. Most recently, Stillfront acquired Moonfrog Studios for $90M, the company’s first foray into the Indian games scene.

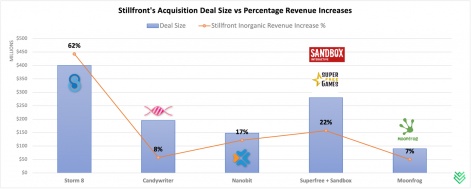

As we analysed in Embracer’s case (and see across industries), even though building a federation of entrepreneurs and teams is fascinating, quality growth by acquisition is a tough treadmill to stay on long-term. This is probably underscored by the current pace of mobile games industry consolidation, which is showing no signs of slowing down. Stillfront is and will continue to live in a highly competitive M&A market with a limited pool of proven, high-quality studios that not only have long lifecycle games but also are looking to join a Stillfront-like entity to unlock their next stage of growth. And the reality is that Stillfront will not always acquire the creme-de-la-creme, which means maintaining healthy growth over the long-term will mostly come down to performing increasingly larger acquisitions of high-performing studios. As seen below, Stillfront’s $400 million acquisition of Storm 8 speaks for itself versus other acquisitions over the last 12 months.

M&A isn’t everything, of course. Pushing for continued organic growth - a function of both new product launches and stellar live operations - is another source of value creation. Organic growth is a decent proxy of whether Stillfront’s older acquisitions continue to contribute upside and whether Stillfront’s group-wide synergies are actually paying off as expected. According to management, current organic growth is “decent,” and this is important to maintain as access to fitting M&A targets ebbs and flows. We’ll also want to study what type of returns on invested capital management is able to achieve over time as more and more capital gets used for acquisitions.

All in all, new mobile game launches aren’t guaranteed successes, and revenue growth through live operations is all about slow and steady growth. Continued organic growth is important, but M&A is still Stillfront’s key driver going forward - the prime source of opportunity and risk. We’ll keep an eye on Stillfront in the quarters and years ahead, and it’ll be interesting to see what deals they strike next.

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To receive future editions in your inbox sign up here: