Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry-moving news, but also short analyses on each.

To check out this week’s entire meta, visit www.masterthemeta.com.

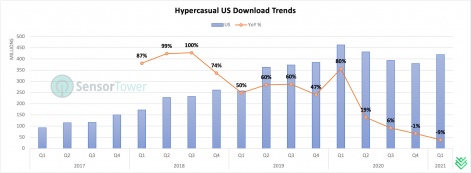

This past week, Sensor Tower released a COVID-19 App Impact report. One notable tidbit is hypercasual’s stagnating download volumes in the US (hi-res image here). Even more striking: the year-over-year growth rate continued its longer-term downtrend and was even negative for the very first time.

I found this data especially puzzling to see in a key mobile gaming market, since we know mobile gaming at large had a booming 2020. There are a couple of ways to look at this data.

One perspective is that this is COVID related, such that the US mobile gaming audience had more time to spend on games, but chose to spend it on deeper and more engaging games.

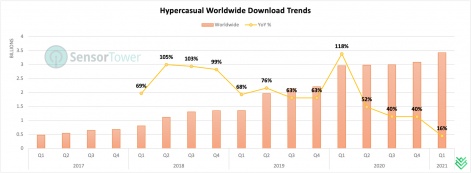

If this were true, I’d imagine the same behaviour to have played out across the globe, but interestingly, hypercasual worldwide download volumes actually grew over 2020 despite the US’s decreasing download trend.

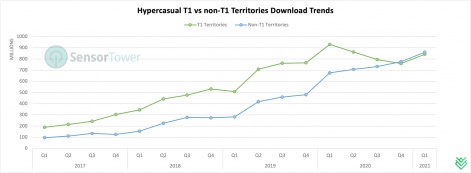

The second perspective has to do with splitting the downloads between Tier-1 (T1) and non-Tier-1 (non-T1) territories. Hypercasual clearly found its 2020 growth (hi-res image here) in the non-T1 with countries like India and Brazil leading the pack.

Not only did non-T1 downloads match T1 territories, but it also seems to be on track to surpass T1 territory downloads over 2021. Further, the longer-term uptrend of non-T1 hypercasual downloads signals an ever-increasing need to grow outside T1 territories (high-res image here).

It’s possible that COVID accelerated a user acquisition frenzy across genres, resulting in it becoming too expensive for hypercasual to profitably acquire T1 users comparatively.

In terms of a future outlook, the fundamentals of hypercasual haven’t changed since their rise in 2017. It continues to remain a genre with low barriers to entry, quick production cycles, mass appeal, highly sticky core gameplay, ultra-aggressive ad monetisation tactics and short product lifespans.

That leads to a hypercasual business sustaining through highly frequent new game launches, where LTV beats CPI at a massive scale.

Over the past years, these unique genre dynamics have also resulted in fierce competition, market saturation, a lack of staying power for market leaders and a growing need to innovate and differentiate to stay relevant (read my deeper thoughts on this here).

On top of that, there is the IDFA elephant in the room, the impact of which continues to remain unclear for hypercasual’s ad-driven user acquisition and monetisation model.

There’s certainty around some of the data -

- Hypercasual download volumes continue to grow, and

- YoY download growth rates are slowing.

In other words, while hypercasual will continue to have its place in the future, it’s also a maturing genre. That doesn’t mean it’s stopped evolving, though.

Hybridcasual is a fundamental change to the way the industry approaches hypercasual from design, production, and marketing profitability perspectives.

One evolution is the rise of “Ultracasual”, which are basically hypercasual games without any loss conditions. Imagine icing a cake or painting a house with no chance of doing it incorrectly. In a way, these games feel as casual as game design can get, and may be more of a short term trend.

The more interesting evolution in my opinion is “Hybridcasual” - a fundamental change to the way the industry approaches hypercasual from design, production, and marketing profitability perspectives.

Games like Archero, Mr. Autofire and Art of War are forging the path ahead here. These games mix the best design, production and marketing practices from hypercasual with simplified meta systems, hybrid-monetisation (IAPs plus ads) tactics, and live operation activities from other genres.

The end result is a game that has been de-risked through rapid iteration and market validation, has mass appeal, sustains hypercasual like CPIs, and achieves higher than hypercasual LTVs. That of course results in an LTV > CPI equation that helps build a more stable and long term GaaS business.

Hybridcasual has been a long time coming. I’ve written about it quite extensively over the past years here, here, here, and here, and also contributed updated thoughts here and here.

We’ve also studied this evolving space quite deeply here at Naavik, and if you’d like to learn more about how to build for the 'hybridcasual' future, please don’t hesitate to reach out!

To check out this week’s entire meta, visit www.masterthemeta.com.

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To receive future editions in your inbox sign up here: