Thanks to early success with Facebook games, Zynga still has the whiff of the casual publisher about it.

The years since the release of FarmVille have seen the company evolve, however.

So while social games - including word games and yes, more FarmVille - remain part of its DNA, the company is successful in casino games and - thanks to the NaturalMotion acquisition - racing too.

Yet, for all that context, Zynga hasn't had a successful strategy game; something it's been hoping to change with Empires & Allies.

Attack speed

Launched at the start of May 2015 on iOS and Google Play, the game is itself an evolution of the classic mobile strategy genre (aka Clash of Clan), albeit with a contemporary warfare setting and some gameplay tweaks in terms of in-level power ups and reinforcements.

Nothing too radical mind, but as demonstrated in this week's Charticle, Empires & Allies has found itself a solid paying audience.

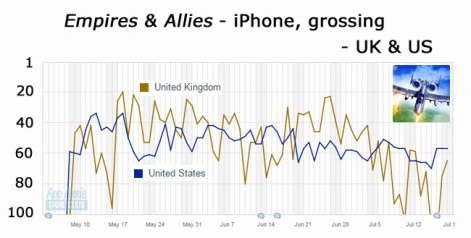

Looking at the key English-speaking markets - the UK and the US - on iPhone, Empires & Allies has found a nice position in and around the top 40 and top 60 grossing, especially in the US.

In the UK, the game has peaked higher, touching the top 20, but more recently fell outside the top 100, before the latest update - which tweaked a number of unit attributes - brought it back.

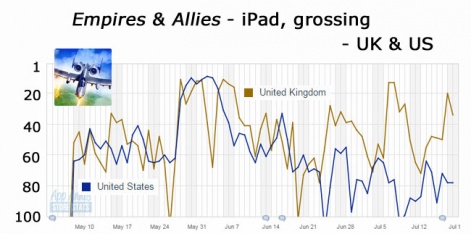

Perhaps thanks to the genre's graphical design, which rewards larger screens, and less chart competition, Empires & Allies performed better in terms of its peak positions on the iPad grossing charts.

It peaked within the top 20 in the UK and the US, and remains high in the UK charts, although setting down around the top 80 mark in the US.

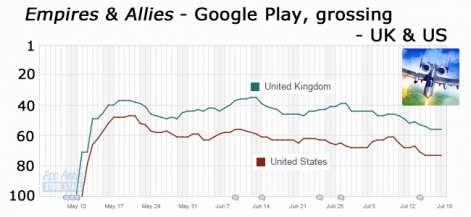

Considering Google Play for the two countries, and Empires & Allies follows the pattern, performing higher in the UK, and solidly within the top 100 in both territories.

The European front

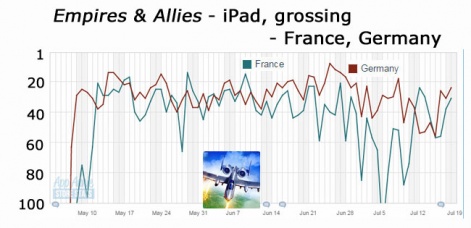

As often seems to be the case with core games on mobile, Empires & Allies has done even better in the two key European countries - France and Germany.

On iPad, it's well within the top 40 in both, having also been in the top 20 in both.

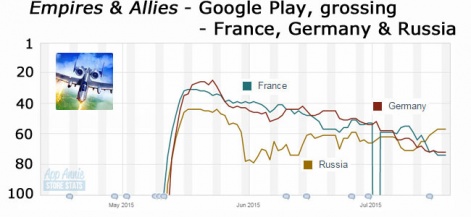

The performance isn't as good on Google Play. This isn't because the chart positions are lower (because of the different ways Apple and Google run their stores, you can't directly compare the two), but we can see a clear decline in both markets over time.

Indeed, adding in Russia, we can see that Empires & Allies started slower here, but is now improving, being inside the top 60, and higher than France and Germany.

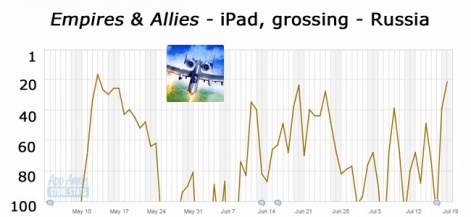

And there's also a similar trend on the Russian iPad grossing chart, with the most recent update boosted the game around 80 places higher.

Eastern promise

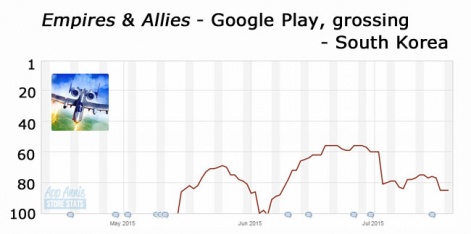

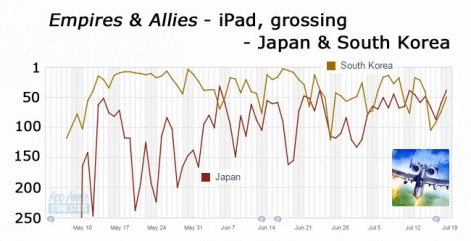

Looking wider afield, one country in which Empires & Allies has performed well is South Korea.

It's a majority Google Play market, and the game is within the top 100.

A much smaller market in terms of revenue, nevertheless, Empires & Allies has performed better on the Korean iPad chart, being within the top 10 on occasions, and has done even better in the #1 mobile gaming market Japan.

Surprisingly for a western game, and a contemporary warfare one at that, Empires & Allies has risen steadily since release to be solidly within the top 100, and currently within the top 50.

(It's not in the top 100 on Google Play in Japan though.)

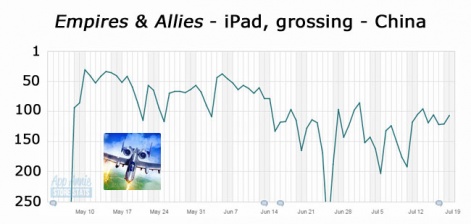

As for that other Asian behemoth, Empires & Allies has experienced mixed success in China. It started within the top 50 but has since slipped outside the top 100.

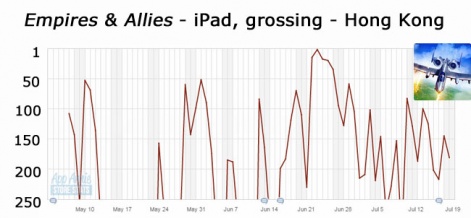

It's been a similar performance in Hong Kong, where at one point the game hit the #1 spot before falling away.

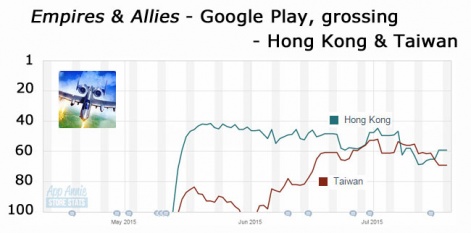

Of course, China doesn't have a Google Play market, so we use Taiwan and Hong Kong as proxies for how the game might appeal on thirdparty Android channels in China.

Again, it's a solid performance in both countries, with the Taiwanese market warming to the game after a slow start.

In conclusion, it seems that Empires & Allies is off to a solid start, especially in the west, but also in Korea, Japan and to a lesser extent China.

For example, market intelligent outfit Sensor Tower estimates it generated around $4.5 million in June 2015, with the US, China, Japan, Korea and the UK the top countries for revenue.

Zynga will also be encouraged to see that its grossing performance has been generated from a relatively small number of downloads. For example, on iPad, in the US the game peaked at #38 in terms of downloads but #9 on the grossing charts.

Of course, real success in the F2P world is about sustaining success, but with the opportunity to further push downloads as well as tweak the gameplay and add new features, there looks to be decent upside potential for Empires & Allies.

You can get an idea of the game's monetisation in the video below.

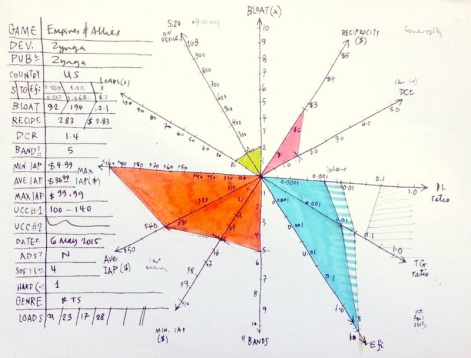

And, finally, our Monetizer graph highlights some key elements of the game, notably

- Good code efficiency - small green area

- Average generosity - pink area

- Good monetisation per download: higher Efi value in blue area

- Standard IAP spectrum - orange area