Such is the scale and profitability of Candy Crush Saga, it has become a byword for mobile gaming success.

Like Angry Birds before it, King's 2012 match-three puzzler is a game that's played in train carriages, offices and homes the world over, reaching an incredibly broad audience.

And not only is this audience still coming back for more, midway through 2017, there's still a core of paying players.

Candy Crush Saga is the kind of hit many mobile games developers would aspire to, but such a success in the free-to-play mobile space also brings about its own challenges.

What's next?

The main one is the dilemma as to whether to launch a sequel.

With the original still generating tidy profits, will a new launch simply cannibalise its predecessor? Is the market big enough, or the public appetite sufficient, to justify a whole new app?

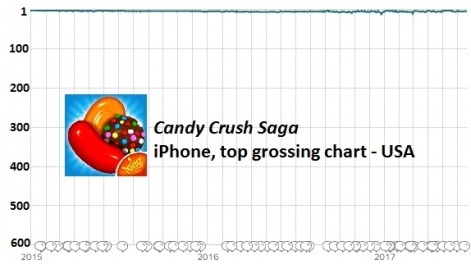

In October 2014, having spent almost every single day of its nearly two-year lifespan atop the US iPhone top grossing charts, Candy Crush Saga got a sequel in the form of Candy Crush Soda Saga.

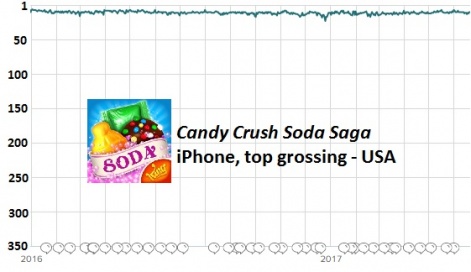

But King made a success of its difficult second album, as Soda Saga shot into the top five in the US iPhone grossing charts.

It remained in the top ten until 2016, when it's performance became a little more spotty - although 23rd remains Soda Saga's all-time lowest US iPhone grossing position, which is extremely impressive for a game now in its third year.

There was no sign of cannibalisation either, with Candy Crush Saga only placing outside the top 10 in the US iPhone grossing charts twice since December 2012, its performance not discernibly affected by Soda Saga's launch.

What Soda Saga does show, however, is an emerging trend of diminsihing returns. While undoubtedly a successful game in its own right, its grossing peaks and troughs are both lower than the game two years its senior.

Building a franchise

The salient fact, however, is that by the end of 2015 King had two top-ten grossing Candy Crush games on its hands - and another in soft launch.

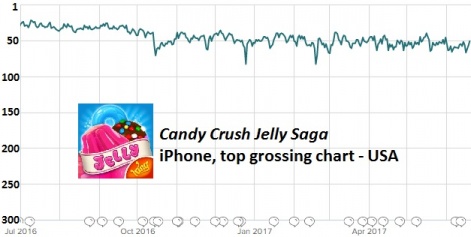

Candy Crush Jelly Saga eventually launched in January 2016, aiming to replicate the success of Soda Saga. Instead, it continued the downward trend with early US iPhone top grossing ranks of around 20th to 25th.

Jelly Saga went on to hit 16th in the grossing chart on February 11th 2016, but to date that's the best rank it's achieved.

In 2017 it's been hovering around the 50th mark, with a low point of 83rd and a current peak of 39th.

Ths saga continues

So with new entry Candy Crush Friends Saga currently in soft launch, what can we learn from this? First things first, there's the somewhat obvious fact that this is a series that makes a lot of money.

It's no coincidence that the only Candy Crush game to hit number one was launched in 2012.

Candy Crush Saga has shown an incredible, enduring appeal over nearly five years, spawning two sequels that have been consistent top 10 and top 50 grossers respectively.

And with Candy Crush Friends Saga bringing what looks like mostly familiar gameplay - albeit with the addition of 3D character art - it's hard to conceive of the game being a flop.

But as Soda Saga and Jelly Saga have made clear, the mobile games market is getting more competitive all the time.

It's no coincidence that the only Candy Crush game to hit number one on the US iPhone grossing charts is the one launched in 2012, after all.

Games with the wide-reaching commercial and cultural impact of Candy Crush Saga don't come along every couple of years, but only once or twice with every new platform launch.

All King can hope for now is to keep building the franchise with more strongly-monetising Candy Crush sequels and spin-offs.