There's nothing our Mobile Maven group of veterans and experts like more than a good debate about a big, breaking new story.

So they were all very enthusiastic about providing their opinions on what will be one of 2015's biggest stories: Activision Blizzard all-cash $5.9 billion acquisition of King.

So we simply asked them:

- Is Activision Blizzard's $5.9 billion acquisition of King a good deal?

John is co-founder of PR and marketing company Big Ideas Machine. Also an all-round nice guy...

Well at $4 a share below the IPO price - whilst still being a 16% premium on current market value - it seems to be a good deal for King, as there doesn't seem to be anything new in the pipeline that can repeat the success of Candy Crush.

It feels to be that this is more about Activision maintaining its position as the world's largest games company.

Blizzard has been rightly left alone to continue to do what it does best, and I would assume that the same approach would be taken with King - as Activision is already publishing its AAA console properties under its own brand, and I can't see a reason to confuse the two.

Ultimately this seems a massive vote of confidence in King and the creative talent there to continue to be one of the best mobile games companies.

Whether the price is a good one? Time will tell.

Brilliant.

Bobby [Kotick, Activision CEO] takes advantage of the short-sellers and picks up King at a good price. Now Activision is the leading console AND mobile game company.

King has the best ratio of paying players in Free2Play. That expertise is going to be equally important as console games move in that direction over the next few years.

Well, as we talked about Nintendo last week, the parallel is that it seems that your investors are going to get annoyed if you're not in the mobile space.

But I'm a bit confused by this. Hearthstone has been pretty successful, so they already have the beginnings of a mobile play.

And is there likely to be much integration (or even relevance) for King's games or audience to the rest of Activision? I can't imagine them trying to cross-sell Call of Duty to Candy Crush players, or vice versa.

Would Activision be better off using its existing brands to get into the mobile space?

I'm a bit confused by this. Hearthstone has been pretty successful, so they already have the beginnings of a mobile play.David MacQueen

It's probably most correct to view this as an acquisition that buys them a completely new line of business. But nearly $6 billion for a business with essentially no synergy with your existing business, and only a couple of hits (albeit massive hits), is a huge gamble.

In a world where $4 billion buys you Star Wars, or the same for the entire Marvel business and IP, does it really represent value? Maybe the investors do want to see a nice new line of business in mobile, and it surely buys that, but what's your return on investment going to be?

To draw a bit of an odd analogy, is this getting a bit like nightclub entry? Late to the party, pay more to get in? The money seems to keep going up and up…

This makes EA's acquisition of Jamdat at a mere $680 million look like a bargain (although it didn't seem that at the time), and Zynga's acquisitions are pocket change compared to this. Signs of a bubble…?

Tony’s career has covered the whole spectrum from AAA console to handheld, mobile and flash titles, working on huge franchises such as Grand Theft Auto, Red Dead Redemption, and Call of Duty.

In 2015 he founded Ant Workshop to develop his own titles and to offer his experience as a design consultant.

Just under $6 billion for just over 0.5 billion players (I think).

$10 per user is steep, but it’s a rapidly growing market segment Activision didn’t previously have in its portfolio.

Oh, and some games and F2P dev talent thrown in to sweeten the deal too.

King struggled for some time on Wall Street and the shares were below the offering price. I doubt we would have seen King shares going up fast anytime soon.

In my opinion it was a good move for King as King might have become the next Zynga over time.

Activision is taking mobile games seriously now and bought into the top of mobile games business. Damn smart move in my opinion. They showed us who is the 800 pound gorilla in the room.

Fact is the market is consolidating very fast.Christopher Kassulke

It will strengthen the position of Activision for sure and put others under pressure. I think we will see more M&A deals now as some companies will be in a hurry to find a good fit.

Perhaps we will see deals done by mobile game publishers - I heard some traditional publishers are looking to find partners as well. Fact is the market is consolidating very fast and one of the big guys is sold already.

Is it a good deal – Bobby from Activision think so. If they can use the knowledge from King for their business they will rule on Number One spot for a very long time!

A games programmer before joining Sony’s early PlayStation team in 1994, he then founded developer Pure Entertainment, which IPO’d and launched a free-to-play online gaming service way back in 1999.

He was also a director of pioneering motion gaming startup In2Games, which was sold to a US group in 2008.

Along the way, he’s been a corporate VP, troubleshooter, and non-exec to a variety of companies and investors in and around the games sector.

Harry was European CEO of Marvelous AQL, a Japanese developer and publisher of social, mobile and console games, known for console games like No More Heroes and Harvest Moon, but now highly successful in the free-to-play mobile and web space in Japan and Asia.

Harry is CEO of Magicave.

Smart move for both companies. Activision/Blizzard/King is now pretty much the market leader in all major parts of the games business.

Going forward, where growth in the sector is less about more users (everyone has a smartphone now), and more about improving revenue per user (eg to the levels we see in Japan, a more mature mobile handed market), combining these two's strengths could be a big win.

Challenges ahead, of course - replicating success on mobile seems more elusive than on console (where money+talent+IP+marketing $ is a pretty solid formula).

But they're well positioned to get it right.

At a guess, I would imagine that this gives Activision-Blizzard the UA power to push Hearthstone at scale.

I'm sure the game's metrics are there, but not in-house knowledge, connections and people.

I could see Hearthstone hitting no. 5 top grossing.

I think Bobby Kotick's quote is interesting where he refers to "a combined global network of more than half a billion monthly active users".

Since King themselves already have half a billion MAU, that means Activision's MAU contribution isn't that big? :)

Smart move for Activision. They now have one of the best western mobile F2P teams that fully retains, and monetizes casual mobile gamers, particularly female mobile gamers which Activision's action-heavy portfolio didn't target specifically.

Bobby Kotick and team now have the pieces to dominate hardcore, mid-core and casual gaming in the west.Ben Vu

Bobby Kotick and team now have the pieces to dominate hardcore, mid-core and casual gaming in the west.

I think comparing this acquisition to Lucasfilm or Marvel is a bit like comparing apples to oranges.

Those were evergreen brand portfolios that any major media conglomerate could formulaically monetize. In the near term, Activision will definitely monetize from King's existing franchises but the bigger gains will most likely come from what they build next.

It will be interesting to see how Activision's competitors react to this deal.

Who will be next? Will this deal create greater urgency for the Chinese, Korean, or Japanese to acquire more of the Western mobile games market before all the big pieces are gone?

Ben said "In the near term, Activision will definitely monetize from King's existing franchises but the bigger gains will most likely come from what they build next."

I'm not quite so sure about this. The question is, what could they possibly build that has large enough synergy effects?

Activision might have had a ton of EU profits lying around that they can't repatriate without a large tax burden.Christoph Safferling

Sure, it's nice if you're the biggest player and you "dominate hardcore, midcore, and softcore target demographics", but what can Activision build that will benefit from King's reach in the softcore market?

What can King build that will benefit from Activision's reach into the hardcore market?

I see it more of a "we need this, so let's buy it" move. Appease shareholders, that are anxious if the company does not "do mobile, it's the future, duh!"

There might also be tax reasons: King is a European company, and Activision might have had a ton of EU profits lying around that they can't repatriate without a large tax burden.

Aside from those reasons, the question is: is King better off building softcore mobile games (their expertise and core business) with Activision, and is Activision better off building hardcore console/PC games (their expertise and core business) with King by their side?

I'm have no overview on these two companies, but I kind of doubt it.

(Yes, I used softcore instead of casual, because it meshes well with hardcore, and shows how silly marketing/business jargon is. How is someone playing 5 hours of Candy Crush per day considered "casual"? But that's a topic for another month ;o)

[/people]

John is co-founder of PR and marketing company Big Ideas Machine. Also an all-round nice guy...

I don't think that any of Activision's competitors in the console and PC space are still effectively focused on mobile, so to me this is not the start of a bunch of M&A.

Who else is out there? EA have shown that apart from PopCap, its mobile acquisitions haven't gained them a lot that couldn't have been done organically - both with Jamdat and then on social with PlayFish. Although the Tetris mobile license is a whole different story.

Take 2 have done fine with a few ports of GTA, and don't seem that bothered by any major mobile strategy. Beyond that, big publishers have some mobile stuff going on, but I simply don't see anyone out there with the scale to absorb another company and remain focused on multiple platforms in the way Activision can.

There's a big gap from Activision, Square Enix, EA, and everyone else. The other companies are more platform holders with first party or exclusive studios, which are tiny compared to the size of King. So Activision seems a viable fit both in terms of size, affordability, and mindset.

To me this is not the start of a bunch of M&A.John Ozimek

I agree with David that it is a very big price for what does still remain a single golden egg - but I recall saying exactly the same when EA bought Jamdat, and the value of Tetris over time made that a good deal - the rest of the portfolio was less-than-stellar, albeit with some big licensed properties.

Certainly tho, Christopher is right when he says that there were no signs that the King share price would be rising any time soon after a very high IPO.

Interesting factoid: King's current share price of almost $16 is the same as Jamdat's IPO in 2004. At the time, Jamdat was #1 company, as arguably King is now.

10 years on, and it's only people who were in the industry from the start who even remember Jamdat...

There's a great PDF overview of the early deals in mobile games

[/people]

John is co-founder of PR and marketing company Big Ideas Machine. Also an all-round nice guy...

But that's my point - EA's acquisition of Jamdat may have bought it an instant mobile strategy, but in the intervening 10 years I would say that the continued success hasn't come from the business assets they acquired, but rather has grown from the shift of games naturally to become more multi-platform, and the way the iPhone disrupted the carrier-dominated business models of the early players.

Plus there was a teeny game called The Simpsons: Tapped Out that might have done quite well for EA ;-)

Taking a step back and let the market decide if it was a good idea (and the market is always right, right?):

At trade start, Activision share price dropped considerably (so the market initially wasn’t enthused), but has since then crept upwards and is now trading at above their closing price, quite noticeably at +5% currently.

Seems like there are some believed synergies after all!

I think Jon Jordan has nailed it, quite frankly.

...there was no other play to make if Activision wanted to add casual mobile games titles (and a highly competent F2P operation) to its business.

Still, paying $1.9 billion more for (a declining) Candy Crush than Disney paid to own the (effervescent) Star Wars IP doesn’t somehow feel logical.

$5.9 billion is insane. There is not even a work of fiction that can justify that amount of money for King. This is all for one game that has a long but limited shelf life and a studio that has proven they can’t follow up with new IP.

If this was the console era and we were talking about a console game, then each successive generation could be a bigger and bigger hit which would make a lot more sense. But this is mobile and it plays by completely different rules.

When it comes to software as a service style games, they usually have a longer lifespan, but they eventually trail off and no one has been able to figure out how to ship a sequel that comes anywhere close to the success of the original.

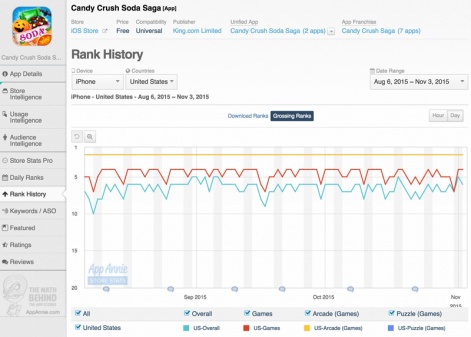

While Candy Crush Soda Saga is doing extremely well, its chart position is less stable than the original and it’s remarkable that while close, it’s not out-performing the original despite it being the latest and greatest version of Candy Crush.

Once Candy Crush is done, King will be a shadow of their current self.Dave Castelnuovo

This should be worrisome news for Activision. While Candy Crush is still performing well, they are buying one game and they only need to look to Zynga as the future in which King is heading.

Once Farmville was done, Zynga was done. Once Candy Crush is done (maybe another year or two) King will be a shadow of their current self.

I think this might be short term EA-like thinking on the part of Activision. EA was famous for buying the studios at the peak of their bubble, all for propping themselves up as the largest game publisher in the world and to gain short term market pumps. They would absorb the studio in a couple years and buy the next studio at the top of the mountain.

This makes sense if you are playing a board game and you need to “make a mobile play” but really, they should only make a mobile play if it makes longterm sense.

If they just want to appease the market, they should have purchased a smaller publisher. Maybe purchase Rovio at bargain basement prices.

[/people]