Liftoff's VP of Global Sales, Joey Fulcher dives into the results of the company's recent survey to lift the lid on why App Marketers are optimistic about the future - despite market challenges.

Today, millions of mobile games fight for attention in an increasingly crowded industry. Even games with global IPs can struggle to succeed in the mobile market. Recent examples include Apex Legends Mobile, The Walking Dead: Betrayal and Full Metal Alchemist Mobile. One report found that 83 percent of launched mobile games fail within three years.

Game developers also contend with a growing number of privacy changes impacting profitability, even years after the introduction of Apple’s App Tracking Transparency. And yet, despite all these challenges, mobile game marketers are under pressure to increase UA and revenue. This raises the question: how are app marketers responding?

To find out, we recently launched our 2024 App Marketer Survey, which surveyed more than 500 mobile marketers working with monthly ad budgets ranging from $50,000 to over $1,000,000 across multiple regions and app verticals. Our survey found that most app marketers are chasing increasingly aggressive KPI targets, have enhanced budgets and growing resources, and are generally optimistic about the future.

While the full report features input from both non-gaming and gaming app marketers, we wanted to share the specifics of how game marketers responded to the survey to help more marketers contextualise industry changes and maximise their return on their ad spend.

Return on ad spend is the biggest priority for game marketers

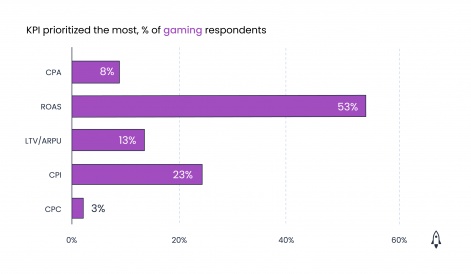

The king of metrics for most game marketers is still return on ad spend (ROAS). 53 percent of gaming respondents cited ROAS as their top priority, followed by cost per install (CPI) at 23 percent and lifetime value (LTV) at 13 percent. Comparatively, 31 percent of non-gaming respondents said ROAS is their primary focus, marking a significant divergence. Another notable difference was that cost per action (CPA) came in second place at 27 percent for non-gaming marketers.

KPI prioritised the most, percent of gaming respondents

Given the key differences between gaming and non-gaming advertisers, the divide makes a lot of sense. Game developers aren’t aiming just to bring new users in—they’re launching complex LiveOps strategies to keep them continuously engaged.

So, while it’s still essential to understand how much it costs to initially acquire a user, having a firm grasp on how much revenue they’re generating over time is a better indicator of the health of an ad campaign. In comparison, non-gaming app verticals (such as dating and fitness) expect high churn rates to scale, so initial install metrics are much more critical.

One of the easiest ways for gaming marketers to boost ROAS is to focus on economical ad formats. Marketers flock to playable ads as they offer the lowest CPI, but playables have the worst return on ad spend. Our 2023 Mobile Ad Creative Index analysed the D7 ROAS of all five major ad formats and found that native and banner ads came out on top at 18 percent and 17 percent, with playables registering at 12 percent.

Access to quality users is critical for demand-side platforms

Demand-side platforms (DSP) are valuable partners to mobile marketers. They provide technologies that enable marketers to radically improve their ad campaign performance through cross-device targeting, creative optimisation, and audience segmentation. For gaming advertisers, top DSPs can provide improved access to high-quality users (those who will most likely become paying users).

Most of our survey respondents agreed with that sentiment, with 58 percent of marketers from gaming and non-gaming apps stating that access to “quality users” is the top priority when selecting a DSP. That marked a 40 percent jump over those who stated the ability to scale campaigns was their primary focus.

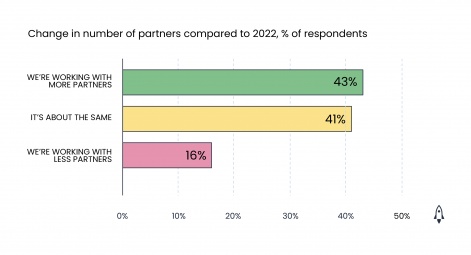

With 43 percent of gaming respondents stating they are working with more partners, choosing a DSP who can help you achieve your goals is more vital than ever. A DSP should be able to offer the best of all worlds, improving scalability but with a specific focus on growing the number of high-quality users. For example, with Liftoff Accelerate, you can reach over three billion unique users in more than 190 countries with advanced machine-learning models that target high-quality app users.

Media mix modelling is influencing ad spend

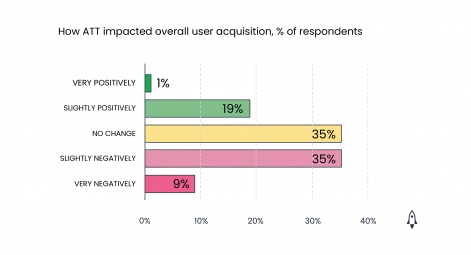

It’s been almost two years since Apple introduced its user privacy framework, App Tracking Transparency (ATT), yet many mobile marketers continue to face its impact on UA. Almost half (44 percent) of the gaming marketers who responded to the survey indicated that ATT continued negatively impacting user acquisition in 2023, with 41 percent saying they spent less on iOS campaigns.

Mobile marketers are contending with the drastic reduction in granular data through media mix modelling (MMM), a more traditional way of gauging the effectiveness of campaigns based on spend allocation. It assesses the influence of marketing and advertising initiatives to understand the combined effects of various internal and external factors on achieving specific goals, such as revenue or any other KPIs.

Almost half of the survey respondents had adopted MMM, with 10 percent using it exclusively and 39 percent using a mix of MMM and a mobile measurement partner’s (MMP) attribution modelling. Of those marketers who use media mix modelling, 61 percent stated they’d changed their ad spend due to the data.

Google’s GAID changes are coming, and few are prepared

While media mix modelling is an excellent solution to some of the challenges ATT poses, more is needed to contend with more extensive privacy changes coming down the road. In 2024, Google is expected to deprecate GAID (Google Advertising ID).

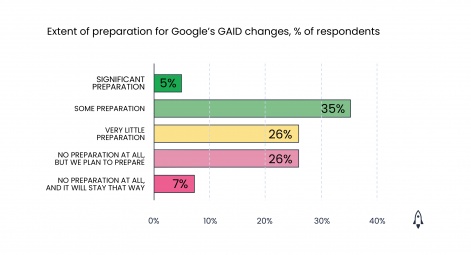

Despite this, many gaming respondents said they had done little to prepare for Google’s GAID changes. Slightly over a quarter of respondents indicated that they had done very little preparation, with a further 33 percent reporting no preparation. Most respondents indicated that they had at least some understanding of the changes, although 28 percent said they were not familiar with them.

Apple’s ATT came into action without much warning, taking a lot of marketers by surprise, whereas Google announced its plans years ago. Marketers stand to benefit from making the most of this advanced warning. They should be looking to comprehensively understand these changes and their impact on how their campaign success is measured.

Much of the same could be said of SKAN 4. Just over a third of gaming survey respondents (34 percent) stated that they are still unfamiliar with the changes Apple introduced, despite SKAN 4 launching over a year ago, meaning they could be missing out on several key benefits. For example, SKAN 4 allows advertisers to receive up to three postbacks based on a different activity window (0-2 days, 3-7 days, and 8-35 days, respectively), enabling advertisers to understand better how users engage with their app up to 35 days after install.

The future looks promising for games marketing

These are challenging times for the gaming industry, but there are many opportunities for attentive developers. Privacy changes are transforming the UA landscape, and layoffs are at an all-time high. Even so, game marketers seem cautiously optimistic about the future, with 52 percent of respondents stating that they feel the next 12 months will be an improvement over the last.

Much of that may be because budgets appear slightly more generous this time, alleviating some pressure of hitting loftier targets. Almost half of all gaming marketers who responded expect their budget to at least somewhat increase in 2024, with a further 18 percent expecting it to increase significantly. Resources also look to increase in several areas across the board, particularly organic social/viral, influencer, and community building.

But to capitalise on the opportunities in the market and make the most of the available resources, game marketers should look to trusted ad partners to help them achieve their goals for the year ahead.