Given EA Mobile has been a market leader since the company’s $680 million JAMDAT acquisition in 2005, it’s a surprise how long it’s taken to spin up to speed in the smartphone era.

As with other veteran developers such as Glu Mobile and Gameloft, EA Mobile’s problem was managing the transition from paid content - which it could sell thanks to its access to big brands - to free-to-play games.

It was only the oft-forgotten disastrous launch and then successful relaunch of The Simpsons: Tapped Out in February (and October 2012), that gave EA Mobile its first true hit of the F2P era. The game has generated well over $130 million of lifetime revenue.

It's been this experience of operating games-as-a-service, alongside the wider global growth of the sector, that’s seen EA Mobile boom over the past 24 months.

The only way is up

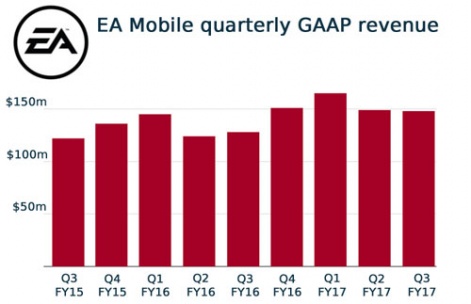

Looking at EA Mobile’s recent quarterly revenues, it’s clear the company has recently broken through some psychological and significant benchmarks.

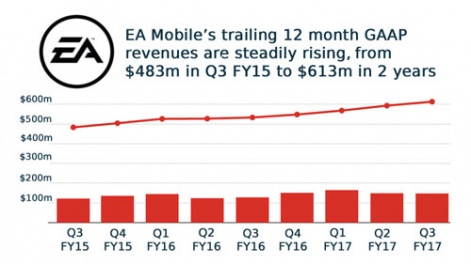

EA Mobile has now broken $600 million in TTM revenue.

The first was posting more than $500 million in a financial year: FY15’s total for EA Mobile was $504 million.

EA’s Sports’ Madden NFL Mobile and FIFA plus SimCity BuildIt were cited as top performers.

The second benchmark was generating more than $150 million in a single quarter, something EA Mobile managed for the first time in Q4 FY16 (January to March 2016), in part thanks to the release of its now biggest game Star Wars: Galaxy of Heroes.

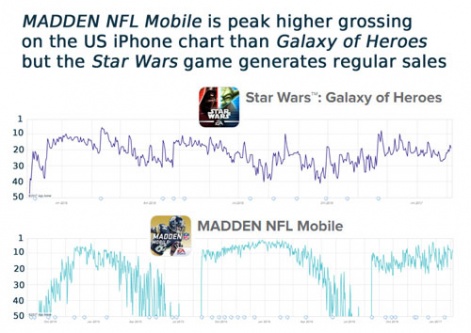

The company doesn’t break out detailed figures for any game but it’s clear from its top grossing chart placement, Galaxy of Heroes is a +$100 million a year franchise.

It's likely already surpassed The Simpsons: Tapped Out in lifetime revenue.

The force is strong

Released in November 2015, it’s been a consistent top 20 top grossing title in the key Western markets on the Apple App Store and Google Play, with big updates in April (Guilds) and spaceship battles (November) pushing the game back up the charts.

Combined with the success of Madden NFL Mobile, which is becoming a less seasonal and more sustained hit every year, Galaxy of Heroes’ performance has driven EA Mobile’s continued growth.

Revenue for Q3 FY17 (the three months ending 31 December 2016) was $148 million.

That’s down 0.6% quarter-on-quarter but up 16% year-on-year.

More interestingly, it boosted EA Mobile’s trailing 12 month revenue to over $600 million.

The trailing 12 month measure is a simple financial metric to smooth out quarterly noise and see the underlying performance of a company, and on that basis, we can see EA Mobile has been on a rise for the past nine quarters.

Certainly, unless something disastrous happens, EA Mobile will announce at least $600 million of revenue in FY17, up at least 9% from the $548 million recorded in FY16.

Indeed, falling deeper down the rabbit hole of financial discourse, we can see EA Mobile’s Q3 FY17 was stronger than the official revenue total reveals.

Between the lines

After many years of not doing so, EA (and all other US game companies) now use the Generally Accepted Accounting Principles (GAAP).

This US standard causes some issues for companies selling digital products, especially via subscriptions and the like, because it doesn’t allow them to record all the revenue they’ve collected in a quarter. They can only record revenue on services which have been delivered or consumed.

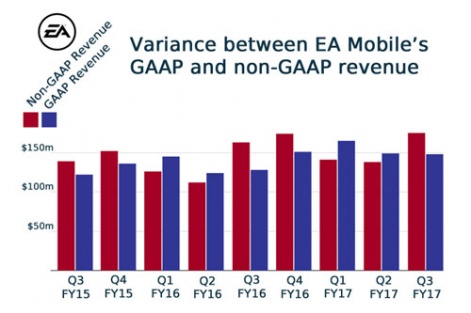

EA Mobile’s non-GAAP Q3 bookings were a record $175 million.

For example, someone spending $100 on in-game currency in Galaxy of Heroes may not spend all the currency straight away. Only the dollars converted from gems into game items can be booked.

There are similar complexities in terms of how EA books digital sales from PC and console, but that’s another article.

And this is why game companies also highlight their booking total, which fall outside of the GAAP rules but provide insight on revenue received even if the services haven’t been used. The difference is labelled ‘deferred net revenue’ and listed as such on the company’s financial reports.

For EA Mobile, while its Q3 GAAP revenues were $148 million, non-GAAP bookings were a record $175 million i.e it deferred $27 million of net revenue for the next quarter.

Obviously, the vast majority of these bookings will have been converted into services during the next three months (January to March), suggesting that EA Mobile’s Q4 FY17 will be higher both in year-on-year and quarter-on-quarter terms.

You can get some idea of how this works in the following graph, which shows non-GAAP revenue in red and GAAP revenue in blue.

For every quarter in which the red column is larger than the blue column, in the following quarter the blue column rises quarter-on-quarter. And the same is conversely true: when GAAP revenues are higher than non-GAAP, the next quarter sees a relative quarter-on-quarter fall in GAAP revenues.

Our focus is to have a very profitable mobile business.Blake Jorgensen

This is logical as higher bookings not yet converted into GAAP revenue (the deferred revenues) will do so in the next financial period - and all-other-things-considered - boosting the total.

EA Mobile’s goal

Of course, EA Mobile only accounts for a small part of EA’s overall revenue.

It typically makes up around 15% of total quarterly revenue or around 25% of EA’s total digital revenue.

But as CFO Blake Jorgensen pointed out during the Q3 earning call with analysts, EA Mobile is important for the company in terms of providing stable and growing revenue.

Its goal isn’t revenue but long-term profits.

“Our focus is to have a very profitable mobile business, which means we're not going to over-monetise or overspend just to try to monetise, and we're trying to build long-term franchises,” he commented.

Roll on $700 million...