The times they are a-changin at Glu Mobile.

Long Term CEO Niccolo de Masi has been kicked upstairs to executive chairman.

Meanwhile new CEO, ex-EA and Kabam exec, Nick Earl has promised radical change with a creativity-first approach that will include a new "mega studio" facility in San Francisco.

Unfortunately, we won't know if this strategy will work until 2018.

Earl has to hire more creative leaders, build new fast-prototyping teams, develop some concepts and then choose the most promising games to be soft launched and released.

That takes time and money.

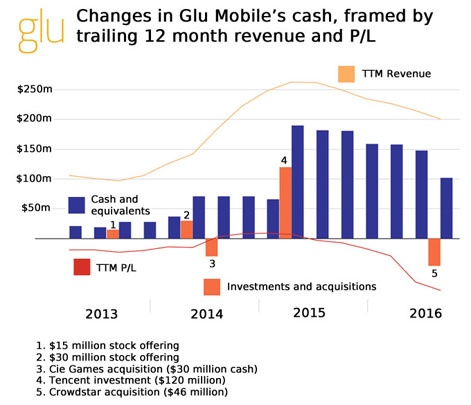

And as this chart shows, it's not clear how much Glu Mobile has of either.

Starting at the top, the yellow TTM Revenue line shows how Glu Mobile’s revenue has changed from 2013 to 2016.

TTM stands for Trailing 12 Months, so the line combines Glu's revenue for the previous past four quarters. It's a simple way of highlighting changes in between a company's formal annual reporting.

Between 2013 and 2015, Glu's revenue more than doubled, but now it's in sharp decline.

As can be clearly seen, Glu's TTM revenue more than doubled in the period late 2013 to mid 2015.

The high life

The highlight of de Masi’s time as CEO, this success was mainly - but not entirely - driven by Kim Kardashian: Hollywood; a game which has generated around $180 million.

Other successful games in this period included the Deer Hunter franchise, Racing Rivals and Contract Killer: Sniper.

Of course, everyone churns in the end, and that's the core reason Glu's sales are now in decline. Its big titles of 2014 and 2015 are now in a slow decline phase. Although new games such as Cooking Dash and Tap Sports have done well, they haven't filled the gap.

This is also reflected in the red line at the bottom of the chart. It shows Glu's trailing 12 month profit (or loss).

During 2013 and 2014, Glu was loss-making, marginally profitable in the peak early 2015 period, and now is increasingly unprofitable.

It's something that's been made worse by the failure of subsequent celebrity games and their associated guaranteed royalties payments.

Cash drain

Finally, let's look at the columns.

These record Glu's cash and equivalents total (blue columns) as well as significant investments and acquisitions (orange).

During the period, Glu has raised $165 million in cash: $45 million through issuing more shares on the NASDAQ exchange (stock offerings 1 and 2) and $120 million thanks to a strategic investment from Chinese giant Tencent, which is the reason Glu Mobile remains a going concern.

Indeed, alongside the Kim Kardashian licence, the Tencent investment marked the highlight of de Masi's time as CEO.

Without either, Glu Mobile would be long dead and buried.

Also marked are two big outgoings: the $30 million cash component of the Cie Games acquisition (the remainder was paid in shares) and most recently the $45.5 million all-cash deal for Crowdstar.

They leave Glu Mobile with $102 million in cash, although it also needs to pay $26 million in terms of more royalty licences in 2017, so in reality it's $76 million of usable money.

Glu predicts it will increase its losses in 2017 compared to 2016, when it spent $20 million of its cash pile in operations. It also says it hopes to end the year with between $50 to $60 million in cash.

And that's the backdrop for Nick Earl's new strategy: another year of slow decline - maybe with a Hail Mary from its Taylor Swift game - and hope for radical and rapid change come early 2018.