77% of players who have ever converted to in-app purchases (IAP) did so within the first two weeks of download, according to Unity’s 2023 Mobile Growth and Monetisation report. As such, players who haven’t made an in-game purchase within this period should be considered prime candidates for alternative monetisation methods, such as in-game advertising.

Unity identifies a price range of between $1.01 and $5.00 as the sweet spot for converting first-time buyers, but also notes the importance of identifying which forms of IAP see the highest revenue: 56% of all iOS revenue and 58% of Android revenue came from in-game currency, sales events, and bundles.

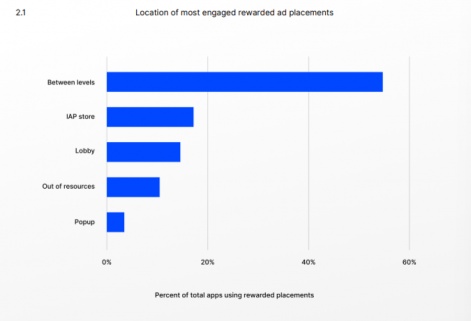

In terms of monetising the existing player base, Unity notes that rewarded ads between levels saw a higher level of engagement than those placed elsewhere in 55% of games. Meanwhile, pop up ads proved to be the least engaging of all forms of rewarded advertising surveyed.

In terms of the top rewards in terms of engagement, additional rewards, in-game currency, and gacha mechanics saw a combined 47%, with additional rewards seeing almost 20% of all engagement.

The importance of a varied approach

The report highlights the importance of introducing varied ad monetisation approaches, such as offerwalls - a form of advertising which gives players a list of offers and challenges to complete in exchange for in-game rewards. A varied strategy can not only complement core IAP strategy, but increase retention.

In games which implement offerwalls, they account for an average of 33% of total ad revenue, with payouts as high as $68 for users who convert on multi reward offers. The report highlights the ability of offerwalls to build resilient and efficient game economies. This is because the method creates more options for players with different engagement levels to proceed, while advertisers are willing to pay more in exchange for high-quality users. Additionally, offerwalls allow game studios to expand the pool of advertisers willing to buy their inventory, tapping into lucrative brands.

Racing and card game players proved particularly receptive to offerwalls, with the method accounting 45% and 42% of ad revenue respectively.

Out of the surveyed genres, only adventure drew less than 20% of ad revenue from offerwalls.

Unity highlights several strategies which game makers can use to maximise offerwall revenue, such as making the entry point visible to users, keeping the offers fresh, and ensuring a consistent branding with the app. Additionally, the report notes that only Android allows for multi-reward offers, making it a more lucrative market for offerwalls.

How to maximise revenue

Finally, the report delves into the methods game makers can use to maximise in-app revenue.

Out of the 15 game genres surveyed, 11 saw the best conversion rates by advertising in hypercasual games. The hypercasual genre itself saw the highest conversion rate when advertising within the genre, with 4.68%. This was followed by racing games at 4.13% and action games at 3.87%.

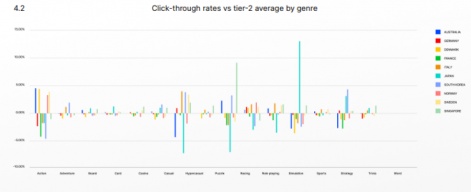

Game makers can increase their chances of success by targeting alternative countries, specifically Tier 2 countries such as Australia, Japan, and South Korea. By identifying which markets have more interest in certain genres, game makers can maximise their return on investment. For example, the click through rate (CTR) for ads for sports games in Japan are 13% higher than the average for Tier 2 countries, while the CTR for racing games is 7% below average. As such, game makers would be wise to take these market preferences into account when deciding where to advertise specific genres.

Finally, custom store pages can allow developers to build bespoke experiences that map to specific creatives and messaging, offering a consistent user experience and improving overall performance. This also allows advertisers to be more efficient with both resources and campaign budgets. The puzzle genre leads the way in terms of custom store pages, accounting for over 40% of all games which utilise the method. This is followed by casino and lifestyle games, both of which account for over 10% of the total.

We listed Unity as one of the top 50 mobile game makers of 2022.