Growth Hackers work with a much lower budget (or none at all) than traditional marketers and usually work for start-ups that look to get their business off the ground.

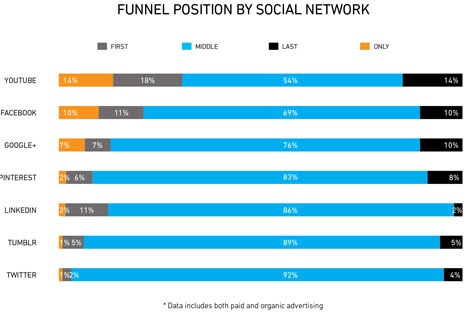

Since there is no such thing as a silver bullet in marketing, Growth Hackers constantly keep an eye on the latest market trends and tend to be early adopters on pretty much anything new.

When something yields better results than average, the Growth Hacker doubles down looking for scale, until the platform saturates or the trend evaporates.

Be agile, act fast

Of course, it never lasts long before a magical parenthesis gets closed down, either because platform holders changes the rules or because word-of-mouth about a particular vehicle's effectiveness will spread, increasing competition for visibility on the channel, and thereby killing its impact.

The Growth Hacking tools of yesterday (FreeAppADay, AppGratis, OpenFeint, App Store featurings by Apple and Google etc) no longer work the same wonders as in the past (if at all), and the leads I'm passing on to you today are bound to cool down within a few months.

Always keep your ear to the ground and your eye on analytics - the targets we aim for in marketing are constantly moving, for volatile human beings are hiding behind these numbers.

Pascal Clarysse started looking for so-called Growth Hacks a good decade before the buzzword was coined.

Clarysse used to be the marketing driving force at Lik-Sang.com, where he was in charge of relentlessly spotting new trends, waves and magic holes. In recent years, he's served as a marketing consultant for various indie studios, participating in launching mobile games and the occasional Kickstarter campaign.

You can follow him on Twitter at @PascalClarysse

Click here to view the list »