Australian casino outfit Aristocrat recently paid $500 million to acquire Israeli mobile game developer Plarium.

This isn't the coin-op machine manufacturer's first foray into the mobile space, having picked up social casino developer Product Madness back in 2012. But that move from physical casino games to virtual ones was not altogether surprising.

This deal, which establishes the firm as a direct competitor to Machine Zone with 4X strategy games like Vikings: War of Clans, is rather more so.

So what did Aristocrat see in Plarium that made it worth splashing out $500 million on, in the process straying significantly from its established business?

Laying the foundations

Founded in 2009, Plarium started out developing browser-based MMOs. The MMO remains the genre in whch it works most, but since 2013 its focus has shifted almost entirely to mobile.

Interestingly though, given its new parent company, one of Plarium's very early mobile titles is social casino game PlaySlots. It's still live, but at 799th in the US top grossing charts' social casino category, it won't have been a motivating factor for Aristocrat's purchase.

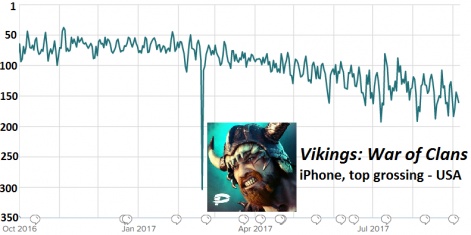

Vikings: War of Clans, the 2015 title with which Plarium has found considerable success, adds far greater value.

The game ranked inside the top 100 for all but a handful of days in 2016, peaking at 33rd on May 10th 2016.

This consistency continues until around March 2017, where it began to slightly decline. As of September 5th 2017, it was 161st in the US top grossing charts.

Vikings: War of Clans is 13th top grossing in Russia, 36th in Germany and 66th in the UK.

Elsewhere on September 5th 2017 the game recorded top grossing positions of 13th in Russia, 36th in Germany and 66th in the UK - more than two years after its original launch.

Strategic portfolio

In addition to Vikings, Plarium has shown its proficiency in the mobile strategy genre with other successful titles.

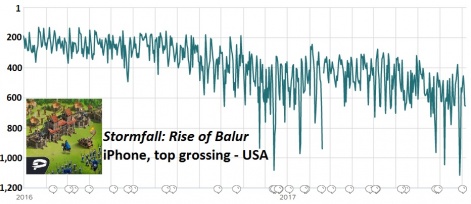

Stormfall: Rise of Balur, which in fact launched before Vikings, hasn't hit the same heights but has still been a key game for Plarium.

It performed well throughout 2015, remaining largely in the top 200 on the US grossing charts, but became less consistent in 2016. As of September 5th 2017, it sat at 655th in US top grossing.

Russia and Germany are once again major markets for Stormfall: Rise of Balur, with the game ranking at 99th and 143rd respectively on September 5th.

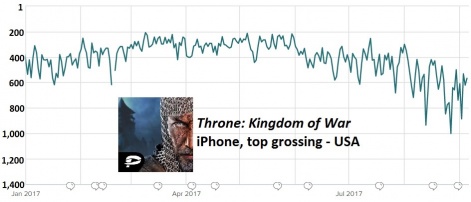

Throne: Kingdom at War launched in November 2016, but hasn't enjoyed the success of Plarium's previous, similar titles. It's yet to break into the top 200 US grossing positions, and after launching in November 2016 it's already slipped to 567th as of September 5th 2017.

But this has been the best of Plarium's recent strategy launches.

Mobile Strike-alike Soldiers Inc.: Mobile Warfare peaked at 289th in the US iPhone grossing charts and now finds itself at 937th, ambitious real-time strategy Gates of War has barely even registered on the grossing charts, while May 2017's Terminator Genisys: Future War has failed to register higher than 317th.

Diversification

So, while by no means in ill health, Plarium does appear to be a company that's slightly lost its way in its own specialist genre.

Plarium appears a company that's slightly lost its way in its own specialist genre.

Upon the announcement of Plarium's acquisition, Aristocrat CEO Trevor Croker said that Plarium will support the company's ambitions by "diversifying into attractive new mobile gaming segments, including strategy, RPG and casual".

And Plarium has already dabbled in the latter, with Rio: Match 3 Party and Family Zoo: The Story both launching in 2017. Rio launched in January and has made little impact on the top grossing charts.

Family Zoo launched more recently, on August 20th. It's been on the rise since then, from 1,342nd the US iPhone top grosing charts on launch day to 374th as of September 5th.

Whether it can rise more remains to be seen, but it - and the company's casual output as a whole - will have to if Plarium is to achieve any synergy with Product Madness, as outlined in its complementary strategy for the pair.

The indifferent performance of Plarium's recent launches shouldn't be too much of a worry right now, given the relative strength of its portfolio. But with its flagship games in decline it will need to start producing more hits soon.

Also pressing is whether this 1,200-strong company, whose primary focus since its inception has been a specific kind of MMO, is now agile enough to change its trajectory and find success with RPGs and casual games.

If it cannot, Aristocrat may be left wishing it had stuck with the comforting familiarity of slots.