Given my previous articles about Gameloft asked if:

- Vivendi had bought “an over-staffed, under-skilled company”, before questioning if

- Gameloft was now “on the road to recovery?”...

You’d be forgiven for worrying if I’m turning into a yo-yo.

The reason, however, is Gameloft’s trajectory under Vivendi’s ownership has been something of a two-sided coin.

Uppers and downers

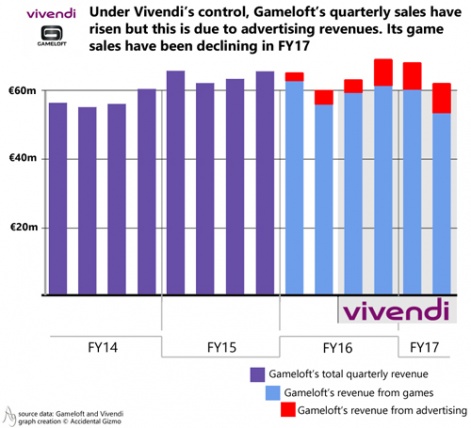

As ever, the best place to start such a discussion is with numbers; in this case Gameloft’s quarterly revenues.

These demonstrate some clear trends.

Gameloft experienced decent growth in FY15, with its full year results up 13% to €256 million (around $280 million) compared to FY14.

However, the first two quarters of FY16 saw sales declining year-on-year. Vivendi finally acquired Gameloft during the summer of 2016, and since then each quarter has seen a return to modest growth.

That’s the good news, but digging into the details shows the two parts of Gameloft’s business are heading in different directions.

Ad-ing sales

Traditionally, Gameloft - like King - always refused to run in-game advertising in its titles. Its thinking was ‘Why encourage our players to leave our games for a competitors?’.

As the amount of cash that could be generated from such advertising - especially in terms of brand advertising and rewarded video ads - increased, this philosophy became unsustainable, even for the likes of Gameloft and King.

Advertising accounted for 15% of Gameloft’s total sales in FY17 Q2, but game sales were down 5%.

Indeed, Gameloft demonstrated the passion of the newly converted and announced it was setting up Gameloft Advertising Solutions (GAS), something then CEO Michel Guillemot claimed would “become a significant new line of business for the company”.

Of course, following Vivendi’s takeover, Guillemot isn’t involved with Gameloft any more, but his words have proven true.

Up from €5 million for the whole of 2015, GAS generated €19 million in 2016 and to-date, in the first half of 2017 has hit €17 million of sales.

Indeed, it accounted for 15% of Gameloft’s total sales in FY17 Q2.

Getting something to stick

Such a growing business unit should provide a springboard for Gameloft’s wider recovery. This isn’t the case, though, because its mobile game revenue is declining.

Q1 game sales were down 4% year-on-year while Q2 sales were down 5%, and this despite Gameloft releasing six new games: Gangstar New Orleans, NOVA Legacy, City Mania, Blitz Brigade: Rival Tactics, Iron Blade and Asphalt Street Storm Racing.

This is a problem. Although these games weren’t the most innovative, they were high quality products, with strong gameplay and decent metagame mechanics that in most cases built on existing franchises. Yet, not even the most generous observer could characterise any of them as being commercially successful.

In its financial statement, Vivendi merely noted “Gameloft is benefiting from the strong performance of its back catalogue”.

All fired up

So what happens next?

On one level, nothing. Gameloft accounts for between 2% to 3%of Vivendi’s total sales, so while it might be embarrassing given Vivendi spent €780 million acquiring the company, even fast growth won’t have any material impact on its parent for years to come.

For the record, Gameloft is currently operating around breakeven in terms of financial metrics such as earnings before interest, tax, amortisation, depreciation etc so it doesn’t impact Vivendi’s profitability much either.

More hopefully, Gameloft has just launched its biggest game of the year - Modern Combat Versus.

A very high-end mobile shooter, which has been designed to also operate as a mobile eSport title, it would be wrong to label it Gameloft’s last throw of the die.

Nevertheless, both Gameloft and Vivendi have a lot of emotional capital riding on it performing better than any other title they’ve thrown onto the app stores this year.