Following another set of disappointing financial results, Japanese social mobile gaming powerhouse DeNA is looking rattled.

Its core Japanese business has now been in decline for 15 months as the popularity of its browser-based feature phone games (mainly card-battlers) has dropped; replaced by games such as GungHo Online's Puzzle and Dragons, which turned over $1 billion.

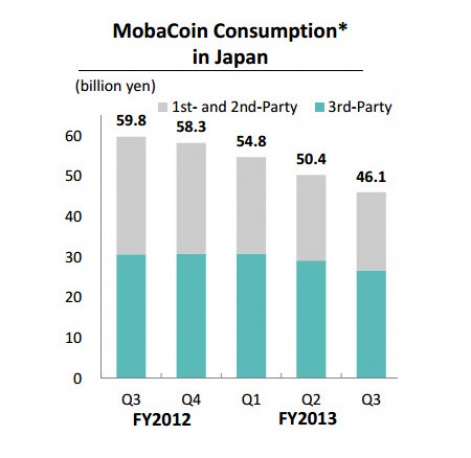

As its financial report puts it: "During the period under review, MobaCoin consumption for Mobage in Japan decreased 11.1 percent year-on-year...."

(This shift has also impacted arch-rival GREE, which runs a similar type of business and has seen similar declines.)

The solution is small

In terms of looking the future, DeNA seems to be taking the approach that in its core Japanese market it needs to keep doing what it's been doing, only moreso.

"The lack of new hit first-/second-party titles during the period is the leading factor behind sluggish performance and as a result the Group has been working on the release of new titles for both browser game and application games to reverse this trend," it says.

Of course, when it comes to operating a platform and publishing business like DeNA's Mobage, releasing more games is the knee-jerk reaction to any problem. It's one that seems to make sense, too.

Releasing more games means more chances of having a hit, right?

No. As companies such as GungHo (6 games), Supercell (2 games), King (7 games), NaturalMotion (8 games) and MachineZone (6 games) have proven, the app store success story is now all about a 'less is more' approach.

In the world where companies are looking to have one or two massive global hits, you need to focus all your expertise, development prowess, marketing money and operational skills on a smaller number of titles.

In the world of superhits, more games is just dilution. In a very real sense, then, for Mobage (45+ games) more is less.

Shifting responsibility

Perhaps even more peculiar in the case of DeNA, however, is that it's also decided to move into game genres in which it has very little experience or expertise.

As it says in its financial statement, "The new titles will cover a wide range of genres, including ones that are targeted for existing loyal users and casual games that can attract user demographics yet to be captured by the Group's conventional lineup."

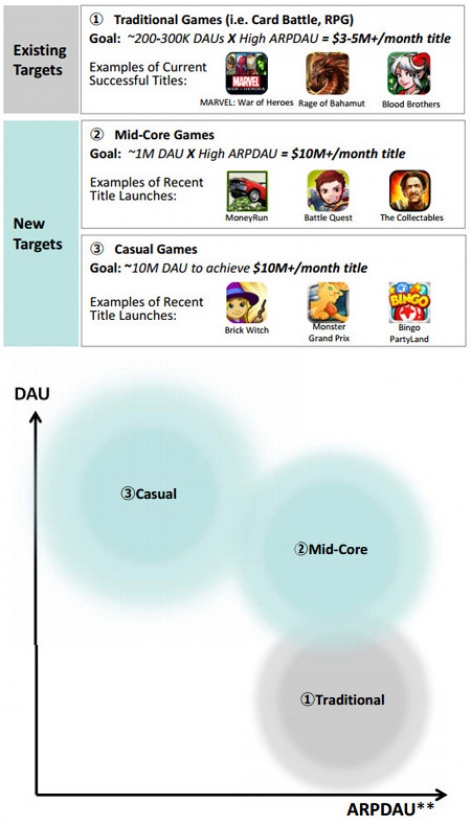

Known for its traditional Japanese games such as RPGs and card-battlers (Rage of Bahamut is the best example), DeNA is starting to release what it calls mid-core games: that is games that use core mechanics but are less complex in terms of deep gameplay.

Heroes & Havok - developed by SuperSaga Studios, published on Mobage

This makes some sense, but recent releases ranging from The Drowning to Team Monster, Heroes & Havok and Lawless have all been decent mid-core experiences which have tanked in terms of their commercial success.

Kingbeater?

Beyond this, DeNA has now announced that in the west it's looking to release casual games. Titles released or to be released include the likes of Brick Witch, Monster Grand Prix and Bingo PartyLand.

As the company justifies it, because of their potentially larger audiences, mid-core and casual titles can generate around $10 million per month, while DeNA's core games tend to be limited to around $5 million per month because of their niche audience.

Yet, when you look at the top grossing charts, there are very few casual games at the top. One exception is King, which like DeNA, effectively operates a platform business in that all of its Saga link into Facebook. The difference with DeNA, however, is that King has been operating only casual games for a decade.

Similarly, the other successful casual game platforms are WeChat in China, LINE in Japan and Kakao in Korea. Good luck trying to complete with them.

Are you feeling lucky?

No. What DeNA needs to double down on is its core core business.

As it's proven with games like Blood Bros., Rage of Bahamut and Marvel: War of Heroes, it knows how to develop and operate such games. And as the likes of MachineZone and GungHo have proven, those games can be very profitable.

Looking to move into the uncharted waters of casual gaming for success is merely shifting the blame into uncertainly. It's time to double-down; double-down on developing and releasing the fewest and best core games it possibly can.

And if that doesn't work, follow the example of EA and Zynga and buy someone who's already doing it.