Games industry deals hit a record $86 billion last year, according to the Drake Star Global Gaming Report Q4 2023.

The record-breaking figure was driven largely by Microsoft’s $68.7bnacquisition of Activision Blizzard, which was finally approved by regulators and completed in 2023 - nearly two years after its original announcement.

The $86 billion figure only includes disclosed figures from completed transactions.

State of play in 2023

There were also 960 deals announced in 2023 valued at a combined $20 billion+.

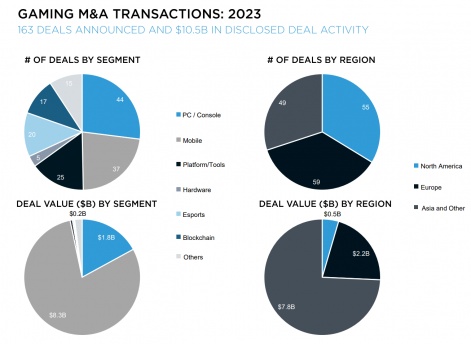

Drake Star said 163 M&A deals were revealed during 2023 with more than $10.5 billion in disclosed deal value.

This included deals such as Savvy Games Group’s purchase of Monopoly Go publisher Scopely, the acquisition of Kahoot by a consortium led by Goldman Sachs for $1.7 billion, and Tencent’s majority takeover of Techland for $1.6bn.

Meanwhile, private games companies raised over $3.5 billion across 750+ funding rounds, up slightly from $3.4 billion in 2020.

Mobile saw the most raises at 168, followed by blockchain at 159, and platforms/tools at 143.

The most active VCs in early to late stage deals included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming. Meanwhile, the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Sfermion and Shima Capital.

In Q4 alone, 43 M&A deals were announced, rising from the 33 in Q3. Meanwhile, over $600 million was raised across 162 private financing deals. Drake Star noted that 85% of these financing rounds were for seed and early-stage companies.

“Investors remained cautious on mid to late-stage financings,” the report said.

2024 predictions

Looking to the future, Drake Star said deals have now shifted to pre-pandemic levels, predicting a steady increase in M&A activity again in 2024. It anticipates the biggest deal makers will likely be Tencent, Sony, Savvy Games Group, Keywords and Take-Two.

Drake Star also predicted more seed and early-stage funding rounds this year, particularly in the AI, tools, AR and VR segments. Meanwhile, companies looking to go public may restart these efforts in the second half of the year.