Just last month, Supercell CEO Ilkka Paananen published another of his annual must-read posts diving into the company’s yearly financial results, identifying successes and failures, and pondering the future. Such is the studio’s success, when Supercell releases a game or Paananen speaks, the entire industry listens.

In his latest post, he identified two areas of he calls the “defining challenge” for games companies over the next decade:

"1. We always have to figure out how to create ANOTHER great new game. (And IF we do, then make it better!)"

"2. We have to keep making that first live game better every day, week, month, and year… forever."

Building the next blockbuster

Only a few publishers have passed the first challenge of releasing repeated hits. Companies like Puzzle & Dragons’ Gungho Entertainment and Monster Strike’s Mixi built titans of Japan’s mobile games market, but couldn’t follow them up.

And it’s a feat only a select few publishers have maintained, and frankly none as reliably as Supercell, which has a 100% success rate for billion-dollar blockbusters.

As Paananen notes, Supercell has achieved this feat by assembling small teams that are often packed with industry leading talent and company founders. It also aims to innovate rather than iterate on other games (something that is not always necessarily true of its killed titles). But in any event, this approach has helped Supercell become a market leader across multiple genres over the last decade, while others are left following (see: Clash Royale clones).

And yet Supercell hasn’t launched a game globally since December 12, 2018.

Paananen ponders a few reasons for this struggle, explaining that he believes it’s tougher to create hit games after finding success as expectations internally increase pressure. Certainly, Supercell’s high bar for success makes this an enormous challenge to overcome.

One interesting note from the blog post was this line, in regards to the times when Supercell’s unique approach to making games works:

“We can attract more players organically (more than 90% of our new users come in organically/unattributed vs. heavy reliance on advertising/UA).”

Supercell has certainly built a huge global fanbase across a portfolio that has accumulated billions of downloads. The Clash of Clans IP was reused in Clash Royale to great success - another multi-billion dollar hit for the developer.

But what’s unsaid is how much Supercell is now leaning on those franchises. That’s not a problem in itself, that’s smart. But over the last five years this strategy hasn’t borne fruit. Public cancellations include: Hay Day Pop, Everdale (now in the hands of Metacore), Clash Quest, and Space Ape’s Boom Beach Frontlines. Clash Mini and Clash Heroes remain in lengthy soft launches, and Supercell is taking another stab at tapping its IP by bringing them all together with Squad Busters.

It speaks to an industry that, particularly with recent cancellations, is struggling at large to launch new games, let alone the huge hits that Supercell is after. For all Paananen says it doesn’t rely on user acquisition, it is surely a factor that comes into play for greenlighting a global launch in a post-IDFA world. The bar is raised even higher, regardless of Supercell’s other identified shortcomings.

Supporting games forever

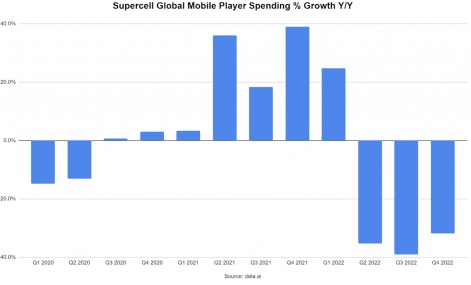

Paananen identifies a number of challenges too, for servicing live ops so that a game is played for a decade or more. But ATT must surely be a challenge here, too. Between Q2 2021 and Q1 2022, Supercell experienced revenue growth across its portfolio, according to estimates from data.ai. From Q2 to Q4 2022, however, there was a steep decline of 30%+ year-over-year each quarter:

Supercell itself officially puts 2022 revenue as down 6% Y/Y to a still eye-watering €1.77 billion, while EBITDA was down 14% Y/Y to €632m. Paananen highlights Newzoo estimates that show the global mobile games market fell by approximately 6.5% last year, indeed highlighting the overall effect of the pandemic-years growth and, importantly, Apple’s App Tracking Transparency rules. But he continues to state the company is not heavily dependent on UA “which was negatively impacted by ATT”. Worth noting also that Supercell revenue was hit by its decision to pull its games out of Russia and Belarus following the invasion of Ukraine.

But it’s hard not to look at the above chart and think that ATT is not an issue for Supercell. The first quarter when iOS 14.5 was released and IDFA deprecation went into full force (except for fingerprinting) was Q2 2021, the following year, revenue was down 35.3% Y/Y.

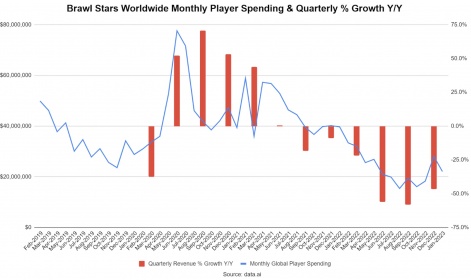

Analysing Brawl Stars specifically, the title generated $57.3 million from player spending in April 2021, and it has never hit that level since. It accumulated $22.1 million in January 2023.

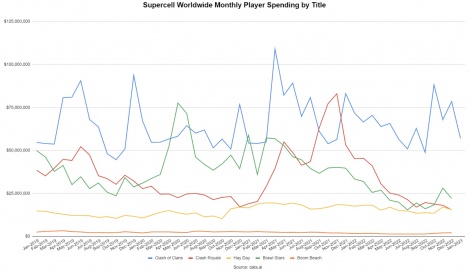

For comparison’s sake to see the impact/lack of effect on other titles in Supercell’s portfolio:

To be clear, Supercell continues to be a highly successful mobile games company and maintains its position as one of the best in the business. Paananen is candid in the challenges he faces in his post, many of which are not mentioned in this piece. But it seems clear that even the mighty Supercell is not immune from the new mobile landscape wrought by ATT, and that is surely one of its biggest, unspoken challenges.