Despite the gaming industry experiencing a decline in revenue last year, the industry is still a strong one. Mobile plays a particularly big role in the market, so much so that big name brands are looking toward the mobile platform to generate new growth.

Hypercasual games have been a popular model within the mobile market for years. These easy pick-up-and-play games appeal to gamers of all skill sets and lifestyles. However, by being so easily accessible much of the hypercausal space is considered oversaturated, so staying on top of trends can play an essential role in getting your game into players' hands.

Azur Games and Google Ads held a joint meetup focused on developing and monetising hypercasual games. In this article, we hear from Analytical Consultant at Google, Daria Yakovleva, on the hypercasual space.

___________________________________________________________________

Let's discuss the hyper-casual market from a macro-level view. It's understandable if you’re feeling some pressure and uncertainty at the moment. But where are these feelings coming from? For example, in 2022, the gaming industry experienced a decline in revenue for the first time ever. However, data from sources like data.ai indicates that overall ad spend on mobile is still increasing. So, despite the revenue decline, everything seems to be on track.

On the other hand, even big players and mature companies within the gaming industry are being forced to shift their focus to mobile markets, as it has become essential for survival.

There's also an opinion that video games surpass Hollywood regarding audience engagement. To be frank, even the economic situation is kind of uncertain. As you can see in the illustration, two articles from the same newspaper on the same day can say very different things, with one highlighting the difficulty of overcoming inflation and the other stating that investors expect the economy to avoid a recession.

Google’s mission is to organise and make the world’s information universally accessible and useful. So, let’s try to organise all the trends into insights for the gaming business.

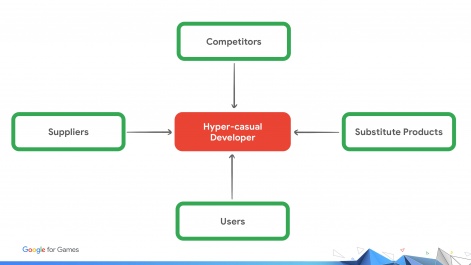

Looking at the four areas I’ve put together based on Michael Porter's framework, known as the Five Forces Analysis. Let's explore these pillars to understand what they are and what trends they reveal, and then see how we can work with them.

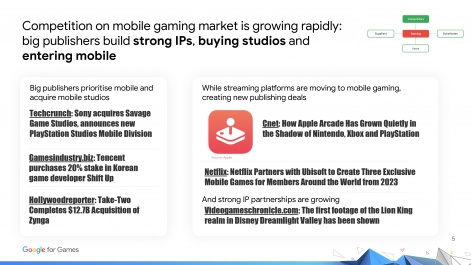

Competition

Competition is on the rise. This is true for the gaming industry as a whole and particularly for hypercasual gaming. Major publishers are prioritising mobile platforms. We can see that many companies, including those that previously did not have a presence in mobile gaming, are now acquiring mobile game development studios. In addition, we are seeing the entry of large businesses such as Apple Arcade, Netflix Games, and other OTT services into the gaming industry. Disney has also formed strong partnerships with studios to create games featuring their characters. The competition is intense, often based on strong IPs.

What about substitutes

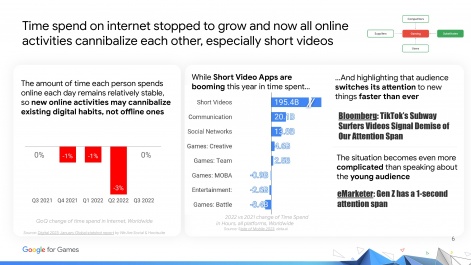

Substitutes refer to almost anything that can entertain people. This is important because the amount of time people spend online has not increased in nearly a year.

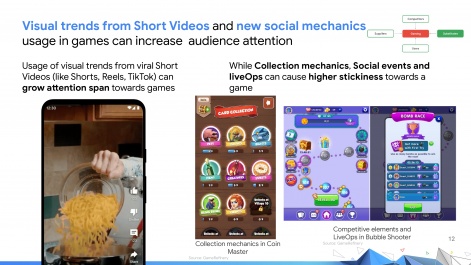

New online activities that emerge from different services often cannibalise older activities. However, the biggest threat to other forms of entertainment is short videos. The time spent watching short videos is growing faster than the combined time spent on social media and some gaming genres.

The other thing worth mentioning is that keeping users' attention for a long time is becoming increasingly difficult.

Actually, let's talk about users.

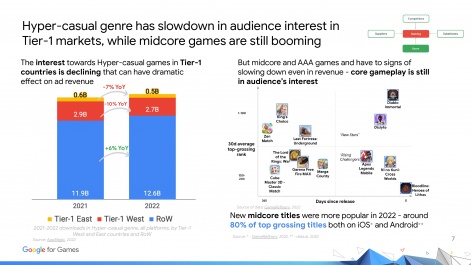

The number of downloads for hyper-casual games in Tier-1 countries of the East and West is decreasing, and the growth is mainly coming from developing markets. However, midcore games are still growing and continue to generate high interest. We can see that over 80% of the Top Grossing games category titles are mid-core titles.

Suppliers

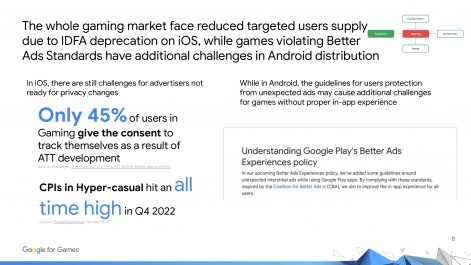

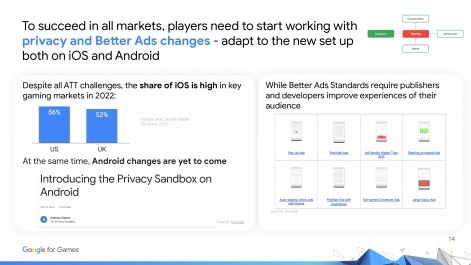

These are the companies that can give you access to your audience, such as Google, Apple, and all other networks. The main issue here is the deprecation of IDFA on iOS, which will also happen on Android. There are also new ad standards that may cause problems with user acquisition if you do not use the guidelines or if you ignore the user experience within your app.

What can you do about all of this? I cannot provide you with a guaranteed way to make lots of money, but I do have some ideas on what you can focus on.

Consider your competition

One option is to partner with various services such as Apple Arcade, Netflix Games, or others to distribute your products within their subscription. Another option is to join a strong gaming publisher or try new market segments like browser games.

However, it's important to note that all free solutions require a strong brand for both your company and your titles. This makes you more attractive to partners and audiences, so investing in your brand is crucial.

Regarding substitutes

The first thing to remember is that short video services are grabbing all the attention. You can use viral trends, visual and sound effects, and more from these services to your advantage. But be careful, as not all trends may suit your project.

The second thing is to find solutions to retain the ever-declining attention. You can do this by adding social activities or, for instance, by encouraging users to collect.

Looking at users

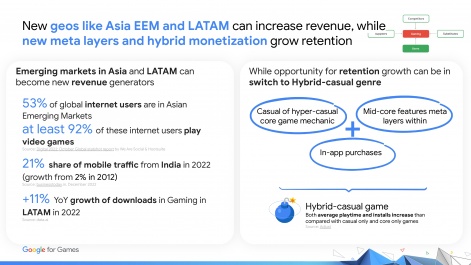

Think about exploring new geos. The promising opportunity lies in Asian emerging markets and Latin America, which are the countries of the next billion users. These markets have many internet users, accounting for more than half of the global users. Moreover, they enjoy spending time playing games, and mobile traffic from these regions is on the rise, with game downloads increasing in Latin America.

Adding new meta layers and in-app purchases can also increase retention and playtime. For example, you can take some mid-core features, add in-app monetisation, and incorporate them into casual and hyper-casual titles. There’s solid proof that hybrid mechanics help increase average retention, among other things.

Finally, suppliers

To succeed in working with suppliers, prioritise privacy issues and adhere to better advertising policies. These actions are crucial in providing a better user experience, including your apps.

In conclusion, a small footnote. The gaming industry is becoming increasingly mature, and you need to pay a lot more attention to a lot more things: partnerships, branding, new trends, hybrid mechanics, and privacy. By doing so, you can overcome the uncertainties and challenges within the hyper-casual market.

Edited by Paige Cook