This article is part of an ongoing series of data-driven articles from PocketGamer.biz and data.ai (formerly App Annie) highlighting trends in the global mobile games sector using data.ai’s Game IQ analytics.

Is the global mobile games market dominated by a few big players and their huge franchises? It’s a topic that most game developers and publishers will have an opinion on. In the past, it was certainly true that key titles consistently topped the charts, but in 2022, is there space for new games to make money?

Using Game IQ’s comprehensive breakdown of subgenres across the whole global market, splitting the data by region, it becomes clear that there are numerous areas for opportunity and disruption for new games and smaller developers/publishers.

Is the mobile gaming market dominated by only a few big players?

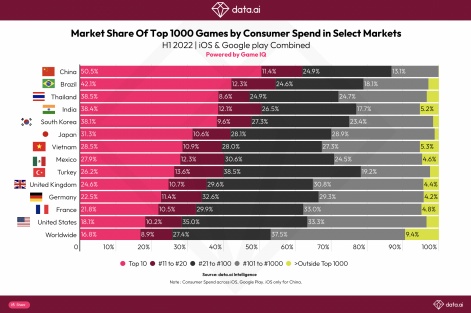

The mobile market is home to some of the biggest game franchises in the world, with the leading titles generating billions of dollars annually. However, looking at the revenue generated across the market as a whole, it can be seen that the top 10 games account for only 17 per cent of the total consumer spend in the first half of 2022. An astonishing 65 per cent of the total revenue comes from titles ranging from 21 through to 1000.

This suggests that mobile gaming remains as dynamic as ever, with plenty of room for fresh innovation and competition from established publishers and newcomers alike.

The European and the US markets follow this trend fairly closely. In the US for example, the top 10 games account for 18 per cent of consumer spending, which implies a significant opportunity for titles outside the top 20 hits to carve out substantial market share.

However, this varies hugely according to region. In Brazil 42 per cent of the total spend goes on the top 10 titles, while in China 50 per cent goes to the leading games. So for developers working in these markets, it’s vital to use tools such as data.ai to understand the competitive landscape, identify partners, and adopt appropriate build and buy strategies.

Let’s get granular

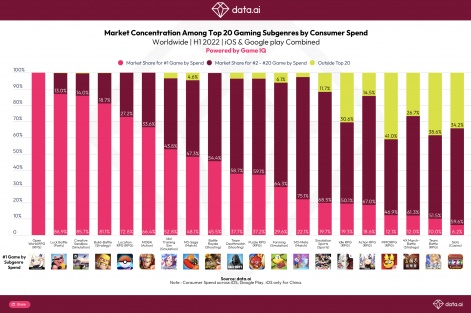

If we dive into the details of each genre and subgenre, we can find out more about each category and game type. We can see exactly how dominant the top titles are within that subgenre in terms of consumer spend. We can find out which areas of gaming are more saturated than others and where the opportunities exist for new and breakthrough hits.

By visualising the data, we can see that those opportunities vary wildly across the different categories. For developers and publishers hoping to enter the mobile market and achieve commercial success, the choice of game type will have a huge impact on the chances of success.

The data showing consumer spend by genre reveals two edge cases - Open World RPG and Casino/Slots - highlighting those enormous differences.

In the Open World RPG genre, the major player: Genshin Impact, accounts for 100 per cent of consumer spend. The other closest genres - Luck Battle, Creative Sandbox and Build Battle - also skew similarly, with the leading games bringing in the majority of the revenue.

However, at the other end of the market, the Casino/Slots subgenre shows a far more diverse range of revenue generation, with a mere six per cent of consumer spend coming from the top title. This makes the category far more open, and competitive with potential for successful new entrants.

While on the surface this could be seen as problematic, it is actually possible to be positive about both scenarios. A genre in which the leading title is the dominant revenue driver is open to disruption once the popularity of the game wanes, Meanwhile, those subgenres with more distributed revenue generators indicate a player base open to innovation and new entrants - a new game, new genre or new gameplay mechanics.

Download Now

DATA.AI’s Q2 2022 Mobile Market Pulse Top Apps and Games offers even greater insight into the global mobile markets and the performance of the leading apps and games in key regions worldwide. The report is available free and can be downloaded here.

Find Out More

If you’re enjoying the insights from data.ai, you can listen in to the company’s new Game Changers podcast, which takes a deep dive into different aspects of the global mobile games market.