Mobile has long been considered a maturing market, yet the value of the sector continues to rise.

This is in particular thanks to China growth - notwithstanding the nine-month licensing freeze in 2018 the local games sector was still worth $37.9 billion - which led to Newzoo valuing the global games market at $134.9 billion last year (with mobile making up $63.2 billion).

While the forecast was lowered significantly because of the China block and what Newzoo called a lack of new global blockbusters, the sector still grew 12.8 per cent year-on-year, driven by a better understanding of live operations and the rise of advertising as a viable business model to monetise not just the single digit percentile of players, but everyone else.

Last year’s biggest trends included the rise of hyper-casual, which fed into the viability of advertising as the main revenue driver.

Publishers like Voodoo have found the balance between user acquisition spend and building portfolios of addictive games that can rack up organic downloads and also fuel cross-promotions, combating the continued increase in user acquisition costs through the biggest channels.

At the other end of the spectrum, actual console quality triple-A games were making the jump to mobile with the likes of PUBG Mobile and Fortnite - in the latter’s case as a cross-platform experience. It’s a trend you can expect more of in 2019, particularly with Microsoft‘s xCloud game streaming service coming into play this year.

How much that latter trend affects the overall mobile market remains to be seen. Fortnite is still a top grosser on mobile, but whether the number of these few successes will increase significantly and if they’ll upend games built for mobile-first is still up for debate.

2019 trends

Trends such as cross-platform play and hyper-casual are set to continue in 2019 as other companies look at what’s been successful and try to mimic those businesses.

It won’t just be ads versus in-app purchases. In many cases now games are increasingly adopting both business models.

Those casual games will be clear revenue drivers, though accurately calculating their success may still be hidden away from the traditional top grossing charts.

But there will be developments in this space - Voodoo has already said it’s eyeing up somewhat deeper experiences, while not forgetting what made its titles a success in the first place.

In terms of monetisation, it won’t just be ads versus in-app purchases. In many cases now games are increasingly adopting both business models as they aim to monetise the entire player base.

Examples of this include Gameloft’s growing Advertising Solutions business and King’s own growing ads business, bookings from which the Candy Crush Saga maker expects to pass $100 million this year.

You can also expect to see RPG and narrative features to play an ever-bigger role in mobile games as developers and publishers look to keep their players engaged. While the likes of Pocket Gems and Pixelberry led the way with interactive fiction through Episode and Choices, Playrix (and now Plarium) are finding success with integrating narrative into match-three and blast games.

Even for companies like King, new IP is a challenge, so expect M&A to play a key part in shaping the industry in 2019.

For those that aren’t just interested in copying these trends themselves, the mobile games industry will inevitably see further consolidation as the big publishers look to diversify their portfolios and snap up high performing IP.

Even for companies like King, new IP is a challenge, so expect M&A to play a key part in shaping the industry in 2019.

UA and advertising trends

But diversifying and having great games aren’t enough. Longevity in the mobile market comes down to astute user acquisition campaigns, and typically the big budgets that go with them.

Whether it’s trying to find new users or monetise ads better, playables look set to continue to grow this year. And not just as in-game ads, but as Instant Play demos on the Android store.

Companies like AdTiming are also working on new ad formats such as enabling live comments in video ads through services like AdMuing. It claims that eCPMs for casual games using the format have increased by 10 per cent on average, with some hitting as high as 20 to 30 per cent.

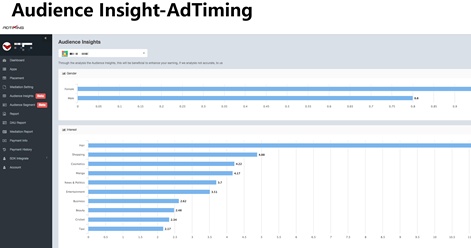

It also offers Audience Timing, a data report tool for developers to gain more knowledge about their users. It may provide guidance to developers on how to set up their waterfall bidding floor and help developers to get a better understanding of users. Developers may solely focus on users’ needs, create a better user experience and obtain higher revenue in an intuitive way.

Many old games may continue to dominate the top grossing charts (for IAP spend). But for all the mobile market doesn’t change, there are a great many more changes happening. You just might not see the effects of 2019’s trends until 2020.

For more details on AdTiming’s services visit the company website.