The history of mergers and acquisitions tells us that it's difficult to combine even complimentary companies at the 'correct' price.

We're not talking about train wrecks like the $164 billion AOL Time Warner deal, though.

Even on a much smaller scale, aligning corporate culture as well as business models can cause longterm issues for the conjoined entity.

At least in the case of the proposed combination of two of Korea's biggest mobile game companies, neither is going into the deal with their eyes closed.

Separated at birth

Both Gamevil and Com2uS are headquartered in Seoul, and over the years, there's been plenty of staff movement between them.

Equally, both have successfully managed the transition from feature phone operations in the early 2000s to a more global-focused business fuelled by the rapid rise of free-to-play smartphone gaming.

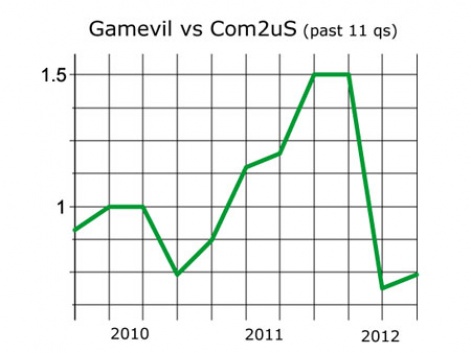

Indeed, they have been two of the most closely compared rivals in the industry (not least by me), with each company's quarterly figures scrutinised to see which is performing best.

Hand on the reins

On that basis, the decision of Com2uS' CEO and founder Jiyoung Park to sell out her family's 24 percent shareholding - also giving Gamevil majority control at the board level - provides the companies with a straightforward future path.

Although no reasons have been given for Park's decision, when the $65 million deal is legally signed off - due sometime in November - it's expected she'll have little ongoing involvement.

That will give Gamevil, under founder and CEO James Song, the freedom required to make the most of the two operations, which during 2012 had combined sales of around $140 million and are currently worth over $500 million in terms of market capitalisation.

Strong together

Given a combined headcount of over 800, there's likely to be some staff losses, of course,

But with Gamevil mainly focusing on publishing and Com2uS having a large internal development staff, it's unlikely to be a US-style cost slashing exercise. After all, both companies are profitable.

And this, as well as their complimentary positioning, are key reasons the deal is more likely than not to be viewed as a success in the medium term.

The pace of Korean gaming market - the third largest in the world - is slowing as the momentum provided by the game platform of social messaging service KakaoTalk becomes diluted for individual companies, by a glut of releases.

This means that Gamevil and Com2uS need to focus more on international sales.

In their most recent quarters, 50 percent of Gamevil's sales and 67 percent of Com2uS' sales were generated in Korea.

More upside, but some issues

And there are other, more subtle, reasons the deal should be positive.

Even after the acquisition, the combined operations will still have a lot of cash - around $100 million.

Gamevil has recently announced multiple, small equity deals with Korean developers, and there have been a couple unannounced deals in the US. More are expected.

Running the two companies as separate publicly-owned corporations will also enable the management to optimise their financial planing in terms of where to book costs and profits.

Historically, Gamevil has had a lower profit margin because when it has a big hit, it has to pay out a lot of revenue to its thirdparty development partners. When Com2uS has an internally-developed hit game, it gets to keep all the profits.

Yet, there will be challenges too.

Both companies are releasing a lot of games - around 90 annually - so they will need to think carefully about the quality and quantity of titles, especially in genres in which they compete, such as baseball and RPGs.

Still, in terms of the mergers and acquisition text book, the deal between Gamevil and Com2uS should be as painless a process as could be imagined, while providing a great opportunity for the combined entity to make the most of growth in Western and Asian markets.

We await the next cycle of financial figures with interest.