This article is part of an ongoing series of data-driven articles from PocketGamer.biz and data.ai (formerly App Annie) highlighting trends in the global mobile games sector using data.ai’s Game IQ analytics.

Around the world, the impact of inflation is becoming clear, with many regions facing recession, and economic turbulence. The global mobile app markets are integral parts of these economic systems and data shows that they are feeling the impact of the trends, affecting developers, publishers and apps of all sizes and genres.

Data.ai has investigated the ongoing effects of the downturn, evaluating the entire app market - including games - through key metrics including downloads, time spent, revenue and user numbers, in its recent State of Mobile Apps During an Economic Downturn report, which highlights how mobile performance data can illuminate a path through these turbulent times for every app developer and publisher.

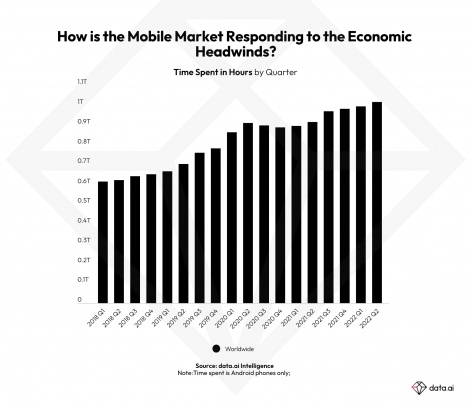

Despite the uncertainty, the popularity of the mobile market is increasing. The number of hours spent in mobile apps in the second quarter of 2022 (Q2 22) is approaching one trillion globally, nearly double that of the same period in 2018.

Game shift

Games continue to be a primary driver of adoption and spending across all markets. In the first half of 2022 (H1 22) first-time download growth was focused on hypercasual genres, such as puzzle games.

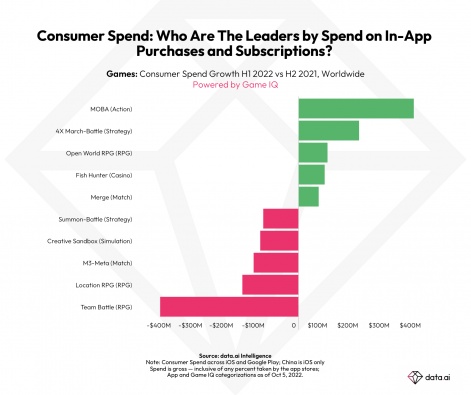

However, the largest year-on-year growth in spending took place in the Multiplayer Online Battle Arena (MOBA (Action)) genre, in which Tencent’s perpetual chart-topper Honor of Kings, along with the 4X March-Battle (Strategy) and Open World RPG genres - with flagship title, Genshin Impact, are rewriting the book on successful live mobile game services.

Across other genres, the data shows a significant shift in the genres and titles in which mobile gamers are choosing to spend money. The total time spent by users has been increasing rapidly in the Creative Sandbox (Simulation) genre, which is led by ROBLOX. At the other end of the spectrum, the time spent on Battle Royale (Shooting) titles has dropped significantly, which mirrors the data from both console and PC.

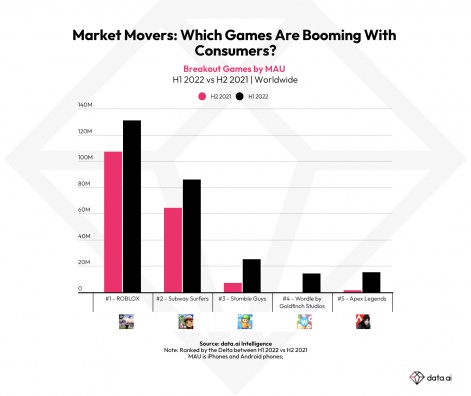

ROBLOX also leads the market in terms of monthly average users (MAU) across the first and second halves of the year with over 130 million MAU in H1 and H2 closing the gap with over 107 million users to date. The sandbox giant is followed by another perennial favourite - Subway Surfers - which delivered over 85 million MAU in H1 and is on course to match or exceed this in H2 with 64 million players to date.

Following these two breakout hits, Stumble Guys comes in at number three (H1: 25 million users, H2: 7 million and counting), Wordle by Goldfinch Studios at four (H1: 14 million users and Apex Legends (15 million) hitting the number five spot.

Other apps

Taking a step back and looking at the broader app market, the impact of social platforms and entertainment-sharing apps can be appreciated.

Media Sharing Networks (Social Media) apps were among the raw download growth in the first half of 2022, adding 152 million installs globally versus the H2 21.

In terms of in-app consumer spend, Short Video (Entertainment) apps - of which TikTok is by far the largest performer - have emerged as leaders. Close to $606 million more was spent in these apps during the first half of 2022 than in the six months prior. Over The Top (OTT - aka streaming TV/film content) and Dating (Social Media) apps were also standouts, as were Audio Books (Books & Reference) apps.

Short Videos and Social Networks apps were also some of the largest positive outliers from H1 22 in terms of growth in total time spent within the apps. At the other end of that spectrum, Meeting (Business) apps, saw major growth, as companies around the world embrace remote working. This genre includes now ubiquitous business services such Zoom, Google Meet and Skype for Business, along with many others.

Download Now

This analysis and much more can be found in the data.ai interactive report, which goes beyond the worldwide metrics here and surfaces the most recession-resilient apps and categories for a selection of major markets. All of it combines to bring an increasingly fuzzy near-future view into better focus. Get your copy here.

Find Out More

If you’re enjoying the insights from data.ai, you can listen in to the company’s new Game Changers podcast, which takes a deep dive into different aspects of the global mobile games market.