This article is part of an ongoing series of data-driven articles from PocketGamer.biz and data.ai (formerly App Annie) highlighting trends in the global mobile games sector using data.ai’s Game IQ analytics.

The new Mobile Gaming 2022 and Beyond: Defying Economic Headwinds report from data.ai and Deconstructor Of Fun gives detailed insight into the global mobile games market and breakdowns of key consumer habits and genres. In the second article based upon the report, we explore the number of games and the potential for breakout success in 2022.

From outside the mobile games market, it can be easy to look at the huge number of apps and games and assume that there is a huge never-ending deluge of releases, which make the major app stores oversaturated and unsustainable for smaller developers. The reality is somewhat different.

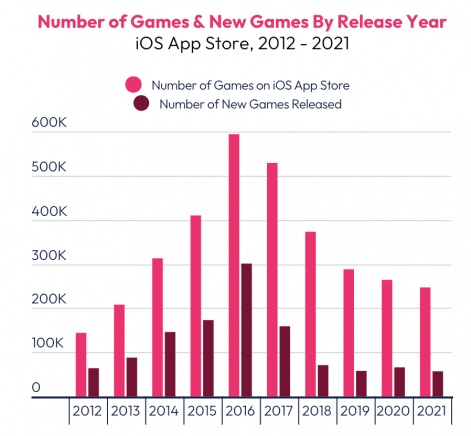

Looking at the data, it’s clear that the number of games being released year-on-year, has been shrinking - consistently - since 2016. The number of games actually available on the App Store has reduced significantly in the same period.

From the high point in 2016, where over 300,000 games were released into an App Store which featured nearly double that number (594,000), the number of games and new releases has tumbled. Since 2019 the total number of games on the App Store has remained under 300,000, while the number of new releases stayed in double digits since 2018, with 2022 marking the lowest number of releases to date, with only 57,000 hitting the market.

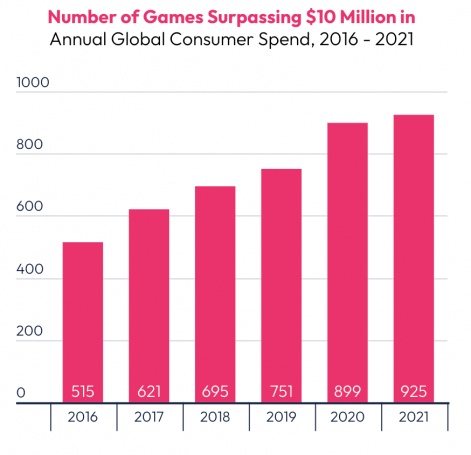

Over the same period, the number of games which are surpassing $10 million in global consumer spend has grown consistently.

From 515 titles which broke the $10M barrier in 2016, 2021 saw 925 titles achieving the same.

The impact of these games varies from market to market, but using the US as an example, shows that there remain clear opportunities for new games and new entrants in the mobile games space. In 2022 63 percent of the overall revenue in mobile was generated by the top 100 games. While this is a slight rise of one percent over the previous year, it demonstrates that there is still significant revenue outside the biggest games for other developers and creators.

This can also be seen in the number of games which enter that top 100. Across the board in 2022, more games reached the magic $10 million mark, more quickly than in previous years. Though as the report notes: “Titles with larger than typical launch budgets and strong IPs to support the increased spending have helped lift this metric.”

25 new games in 2021 hit the top 100, compared to 19 in 2020. 34 percent of the games in the top 100 were also there in 2017, a decline of 4 percent. In terms of the time taken, the average in 2021 was four months, compared to the seven-month average found in the first half of 2020.

While ongoing consolidation is undoubtedly changing the face of the mobile market, the data reveals that there is still much to play for - even from smaller developers and new titles - as we head into 2023.

Download Now

This analysis and much more can be found in data.ai and Deconstructor of Fun’s new interactive Mobile Gaming 2022 and Beyond: Defying Economic Headwinds report. Alongside key economic trends, the report drills down into the performance of the leading game genres, with the market leaders and strategies for the rapidly evolving marketplace. Download your copy here.

Find Out More

If you’re enjoying the insights from data.ai, you can listen in to the company’s new Game Changers podcast, which takes a deep dive into different aspects of the global mobile games market.