This report is by Daniel Ahmad, Analyst, Niko Partners in conjunction with Sensor Tower.

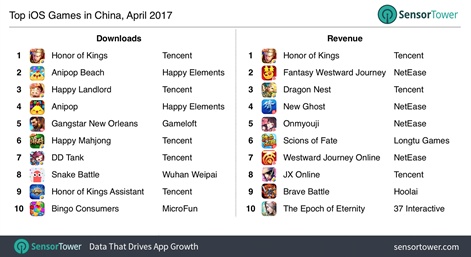

China is the most important market in the world for mobile games. In April, multiple trends were in play driving the rankings. Tencent continues its market dominance with several titles in the top 10 rankings for iOS downloads and revenue.

Casual and social casino games remain popular. With PC online games at the heart of Chinese gaming, mobile games that are adapted from popular PC games are seeing major success. Korean and Japanese IP / graphics styles continue to be popular among Chinese mobile gamers.

Finally, April’s rankings included new titles as well as a surprise hit. Sensor Tower provides the game rankings charts and Niko Partners provides the analysis.

Tencent is the #1 publisher by revenue and downloads

In April 2017, Tencent was the #1 games publisher on iOS by both revenue and downloads. The company has several titles in the top 10 lists including Honor of Kings at #1 on both the downloads and revenue chart.

Honor of Kings is a 5v5 MOBA game that is very similar to League of Legends on PC but has been tailored for mobile devices. The game had more than 50 million daily active users (DAU) at the end of 2016 making it one of the most popular games in the world.

Total downloads for Honor of Kings in April 2017 increased 44% YoY and total revenue was up 74% YoY.

Both increases were driven by new content, in-game events and eSports competitions. Honor of Kings is so popular in China that the Honor of Kings game assistant was the #9 downloaded game app that month.

Casual Games make a splash

Happy Elements had two casual games in the top 10 download chart for April. Anipop Beach Holiday ranked at #2 and Anipop was #4. Anipop is a simple match-3 game that has over 30 million players worldwide and is one of the most popular casual games in China.

Another popular casual game in China is Snake Battle by Weipai Network which was #8 on the download chart. The game is very much a clone of Slither.io which found success in the West earlier this year.

Social casino games remain popular

Happy Landlord and Happy Mahjong, both published by Tencent, claimed spots in the top 10 download chart. Both games saw an increase in downloads compared to the same month last year. Social casino games are very popular in China, but converting winnings to RMB is prohibited.

PC to mobile game adaptations perform well

A trend that we continue to see month after month is the continued success of PC to mobile game adaptations.

NetEase’s Fantasy Westward Journey, which released on PC in 2004, launched a mobile version in 2015. Since then, both versions of the game have performed well and Fantasy Westward Journey Mobile was the #2 grossing iOS game in China during April.

A trend that we continue to see month after month is the continued success of PC to mobile game adaptations.

NetEase has repeated this success with New Ghost and Westward Journey Online, both of which originally launched as PC games, charting at #4 and #7 in the grossing charts.

Tencent has also had success with PC to mobile game adaptations, Dragon Nest Mobile, which launched in March 2017, had an extremely successful second month.

Tencent also saw continued success with JX Online, a mobile version of the PC game of the same name. Tencent recently acquired a 9.9% stake in Seasun Holdings Ltd, the developer of the JX series, for USD$142.6 million.

Korean and Japanese IP and graphics styles are popular

NetEase’s Onmyoji, which ranked #5 on the grossing chart, is based on Japanese mythology with anime-style graphics, a style that appeals to Chinese gamers.

Dragon Nest and The Epoch of Eternity are based on Korean IP that also has been popular in China for a long time. China recently issued a temporary ban on certain Korean consumer products, including new game licenses, because of political issues.

New games enter the charts

Gameloft’s Gangstar New Orleans was the biggest surprise in the top 10 downloads chart. The open-world ‘Grand Theft Auto’-like game has been extremely successful worldwide, including in China.

One other new entry in the downloads chart this month was DD Tank by Tencent, a strategy title based on the web game of the same name. DD Tank is similar to the PC game Shellshock but with more stylised graphics and even flashier moves.

Scions of Fate, a mobile MMORPG, based on the Korean martial arts comic, debuted at #6 on the grossing chart. Brave Battle, an RPG with an auto battle system, launched on April 20th but still entered the top 10 grossing chart at #9 due to strong promotions via live streaming and free in-game gifts.

Total revenue generated by the top 10 grossing iOS games grew 40% YoY. The increase was primarily driven by the continued growth of Honor of Kings as well as the introduction of two brand new games in the top 10.

Mobile games are the fastest growing segment in the China games market and the segment is projected to generate higher revenues than PC online games in 2018. Please refer to our China Data Report and China Mobile Games Topic Report, both available for sale on our online research store, for more details.

Methodology:

Each month Niko Partners provides analysis in this column on trends in mobile gaming in Asia based on data provided by Sensor Tower on monthly rankings of game apps by downloads and revenue. The country is selected by Niko Partners, out of the list of eight countries we track regularly: China, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Taiwan (Chinese Taipei), and Vietnam. Sensor Tower’s mobile data analytics provides information on iOS and Android mobile apps in all countries except China, where they currently cover iOS only.