This report is by Daniel Ahmad, analyst for Niko Partners, in conjunction with Sensor Tower.

China is the most important market in the world for mobile games.

By 2022 there will be over 716 million mobile gamers that generate nearly $25 billion in revenues. 2018 has been an interesting year for the market so far as growth was overshadowed by the regulatory environment.

China’s State Administration of Radio and TV (SART) has halted new game approvals in China since March 2018 due to ongoing reorganisation of the newly created agency.

Our recent blog post covers this in detail here. Despite the tough regulatory environment, legacy titles and new titles in new genres have performed well during the first half of 2018.

Everything is battle royale

After securing the PUBG license from Bluehole, Tencent released two mobile games in the PUBG brand known as PUBG: Full Ahead and PUBG: Exciting Battlefield.

Exciting Battlefield is developed by Tencent’s Lightspeed & Quantum Studio and focuses on the traditional battle royale experience. Full Ahead is developed by Tencent’s Timi studio, the same team behind Honor of Kings, and focuses on expanding the traditional PUBG experience with innovative land, sea and air battles.

Full Ahead recently added in the ability to build structures in the game, similar to Fortnite.

The success of PUBG on mobile resembles the success the title found on PC in 2017. The mobile games have been downloaded more than 100 million times in China and have over 50 million active users.

However, the games have been unable to monetise as they lack the relevant approval from SART to do so and therefore both games currently have no in-app purchases. Tencent is working on receiving approval but there is an unstated, ongoing ban on South Korean game imports.

NetEase’s self-developed title, Knives Out, has also been a hit, ranking at seventh on the download chart. NetEase was able to release the game in November, three months earlier than PUBG Mobile.

Whilst the game hasn’t been able to achieve the same number of downloads as PUBG Mobile, it has been able to monetise and has been fairly successful in both China and overseas.

Honor of Kings remains the king

The number one grossing game for H1 2018 was Tencent’s Honor of Kings. The 5v5 MOBA has become the largest game in the world with over 200 million active players. The game also was fifth on the download chart for H1 2018 compared to first for H1 2017.

Despite the lower number of downloads, engagement and spend was significantly up with the game achieving a record DAU figure during Chinese New Year and with revenue for the six-month period almost doubling year-on-year.

The competitive gameplay, new content updates and new modes that have been added to the game has kept it exciting and fresh. One new addition to the game was the introduction of a battle royale mode.

Tencent has also been driving engagement through its esports programme. Honor of Kings esports went global this year with the Arena of Valor (Western title) World Cup and the Honor of Kings International Invitational.

Tencent also franchised the King Pro League, providing long-term security for teams and players whilst allowing for further investment.

Tencent and NetEase dominate

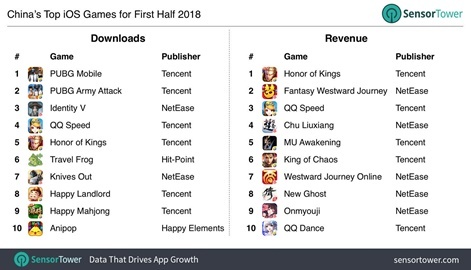

A quick glance at the revenue chart will show you how much of the mobile games market is dominated by Tencent and NetEase. All 10 of the top grossing games are published by the two companies, as well as eight of the top downloaded games.

Tencent and NetEase account for more than 70 per cent of total mobile games revenue. Whilst that number is daunting for competitors, the Chinese mobile games market is big enough to support a number of top players and new players such as Alibaba and Wanda are looking to compete at the top of the market.

NetEase continues to find success with its legacy MMO titles. Fantasy Westward Journey, Westward Journey Online and New Ghost rank at second, seventh and eighth compared to second, sixth and fourth during the same period last year.

NetEase launched a brand-new MMORPG title called Chu Liu Xiang, based on the novel of the same name. The game became an instant hit, reaching fourth on the download chart. Onmyoji continues to be a top 10 game for the company and Identity V is a new survival horror game in the asymmetrical battle arena genre.

Honor of Kings remains Tencent’s top title. Whilst NetEase has seen stable performance from its hit MMORPG games over the past few years, Tencent does not have any other games in the current top 10 grossing chart that were there during the same period in 2017.

Tencent titles are still quite popular, and we believe that Tencent and NetEase will continue to be the biggest competitors in China mobile games in 2018 and 2019 as well.

Top 10 iOS games by revenue and downloads (January to June 2018)

Methodology:

Niko Partners regularly provides analysis in this column on trends in mobile gaming in Asia based on data provided by Sensor Tower on monthly rankings of game apps by downloads and revenue. The country is selected by Niko Partners, out of the list of eight countries we track regularly: China, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Taiwan (Chinese Taipei), and Vietnam. Sensor Tower’s mobile data analytics provides information on iOS and Android mobile apps in all countries except China, where they currently cover iOS only.