Henry Wang is director of product marketing at Moloco. He has five years of experience working in the mobile programmatic space across both demand and supply side.

He also led global product marketing at Google AdMob from 2013 -2016 and more recently led product marketing for Liftoff from 2019 -2021.

Nearly 70% of global iOS bid requests now originate from devices that have opted to limit ad tracking (LAT), and while the transition to a post-IDFA advertising world has impacted the entire mobile advertising landscape, each app category has responded in unique and often contrasting ways.

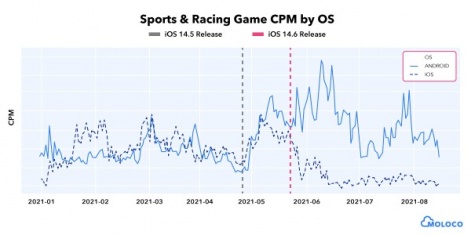

A closer examination of sports and racing game ad traffic, for example, reveals that the release of iOS 14.5 marked the beginning of a divergence in ad prices between iOS and Android.

For sports and racing titles, the post-IDFA world is one in which the value of iOS traffic — the majority of which is now LAT — pales in comparison to the demand for Android traffic, which still affords marketers the benefit of user-level identifiers.

A closer look reveals an instructive series of events that marketers can use to prepare for future market shifts:

Unpacking the impact

Before the launch of iOS 14.5, advertising costs on both iOS and Android platforms were typically tightly correlated.

The days of relying exclusively on user level identifiers are over.

The occasional exceptions — like one observed from January to February 2021 — were short-lived and reverted to the mean within weeks.

Soon after the initial release of iOS 14.5, advertising costs rose steadily for both platforms and then abruptly diverged following the release of iOS 14.6.

This mandatory update presented all users with Apple’s ATT prompt and started the shift towards iOS traffic becoming primarily LAT.

Android prices continued to grow, peaking in June before eventually declining. iOS costs, on the other hand, dropped significantly immediately following the iOS 14.6 patch as targeting capabilities fell away.

The divergence aligns with a massive shift in advertising spend from iOS to Android in direct response to privacy restrictions.

In hopes of minimizing the negative impact that a loss of targeting information would have on their campaigns, marketers reallocated resources to Android where they could continue taking advantage of Google's Android Advertising ID.

The initial rush on Android traffic pushed up costs before eventually reverting to levels closer to, although still higher than, pre-iOS 14.5 averages.

How to adapt

For marketers, the lesson to be learned is that mobile advertising is undergoing a fundamental transition, and could likely do so again.

The days of relying exclusively on user level identifiers are over — especially as Google is considering privacy upgrades to the Android Advertising ID.

If and when these changes take effect, Android and iOS prices will likely once again equalize, and marketers will need to be prepared to explore new solutions that will allow them to navigate the transition.

Sports and racing app marketers need to embrace new strategies that make the most of both LAT and contextual targeting.

There are several promising opportunities:

- Minimize risk by diversifying UA channels: Advertising prices for all app categories have been changing since the launch of iOS 14.5, and much like trading in erratic financial markets, diversification is key to mitigating risk. Marketers that maintain an active and diverse media mix can insulate themselves from the uncertainty that comes with major market changes and ensure their campaigns still yield positive results in aggregate.

- Optimize campaigns for ROAS: While it may sound easier said than done, modern marketing tech stacks can take advantage of powerful machine learning and artificial intelligence technologies to optimize campaigns not just for top-of-funnel engagement, but for return on ad spend (ROAS). Wherever resources allow, marketers need to be investing in the performance platforms and toolsets that make this possible.

- Actively experiment with new platforms, creative, and targeting strategies: Even as the market undergoes changes, there’s no substitute for a strong body of research specific to your unique product and its audience. Renewed focus will need to be paid to ad creative in the absence of user-specific identifiers, and an active A/B testing regimen can ensure your team is working from a place of knowledge.

The future is privacy-centric

The effective sunsetting of IDFA is not an isolated event. There’s a growing demand for stronger privacy protections at consumer and government levels.

Apple and Google’s new policies follow the lead of California’s Consumer Privacy Act (CCPA), Europe’s General Data Protection Regulation (GDPR), and other newly-passed legislation.

While transitioning ad spend to Android platforms is a short-term fix, marketers will need to think long term if they’re going to future-proof their efforts against coming market changes.

By diversifying their spend, prioritizing bottom-line results, and looking afield for new solutions, sports and racing game marketers can navigate the coming months with confidence.

You can find out more about Moloco's services via its website.