The mobile games industry can be defined by two core qualities: it is data-driven and it moves incredibly quickly. Decisions made without a deeper understanding of the driving influences of the sector can and will be costly.

With over 15 years of experience analysing the games industry, Piers Harding-Rolls, Ampere Analysis research director and head of the games research team, breaks down the biggest trends in the mobile and broader games industry in his monthly column, Insight.

As an industry, we are progressively shifting towards an environment of on-demand consumption, having been through waves of industry development over the last 25 years as platforms become connected and new business models emerge.

The concept of on-demand consumption is to give players access to content across devices, when and where they want. The idea is to deliver the broadest audience in the most efficient way. Progressively, this sort of consumption fits well within the subscription monetisation framework.

The catchphrase ‘Netflix of Games’ has been bandied about for many years. It immediately conjures comparisons with other entertainment sectors. At its most basic, it suggests access to a catalogue of content but it also suggests that the games sector is poised to shift in the same way as we’ve seen in the video and music sectors to markets increasingly dominated by subscription services. This in turn stokes fear that third-party developers and publishers will be progressively squeezed as the rules of monetisation and engagement shift.

The games sector is unique

However, while there are some similarities, the games sector is fundamentally different from other entertainment sectors. As you will know, most spending on games is on in-game monetisation, and primarily in F2P titles. As such, I think the chances of games content subscriptions becoming the dominant form of monetisation is very unlikely. Across western markets, content subscription services were worth four per cent of the total market in 2021.

Additionally, the use of hybrid monetisation – in-game monetisation combined with subscriptions – means that the commercial framework for putting games into subscription services in the games space is very different from the subscription video space. It’s not just a question of replacing premium sales with subscription revenue.

In fact, getting access to an engaged audience which than can be monetised in-game means that subscription services can be considered user acquisition platforms. This also means the ARPU ceiling is potentially much higher for games subscription services.

Another difference is that most games in subscription services are also available outside of those services. There is very limited true service exclusivity. That will eventually come, but at present subscriptions are an incremental opportunity to existing monetisation.

Drivers for licensing games into content services are varied

There is very limited true service exclusivity. That will eventually come, but at present subscriptions are an incremental opportunity to existing monetisation.Piers Harding-Rolls

The drivers for adding content to games subscription services are therefore more varied that other entertainment sectors. Of course, direct revenue from subscription operators is a key driver. There are a lot of variables here and the commercial terms depend on a range of factors. Giving exclusivity and a day-and-date release offer the most revenue opportunity, but for many game devs and publishers that is quite a tough decision to make – weighing up the commercial pros and cons of that strategy and how it could impact premium sales, if relevant.

As such, most deals will be done for catalogue titles and the revenue opportunity will provide an incremental opportunity. Deal terms obviously vary by service and will depend on the priorities of the service operator.

Aside from direct revenue opportunities, subscription services can be used to build awareness or as user acquisition platforms. They can raise the profile of a franchise before the release of a new game, give access to a highly engaged audience, raise the visibility and discoverability of games, and have a network effect driving more premium sales.

Our consumer research reinforces Microsoft’s own findings that suggest that Game Pass subscribers spend more on games content than non-subscribing Xbox gamers. And this is across all forms of monetisation. Getting access to this audience therefore has its benefits.

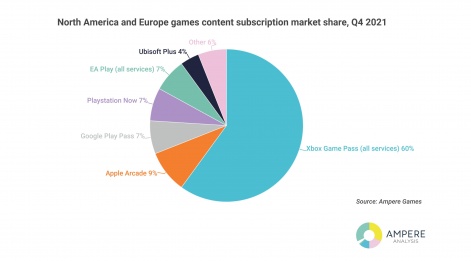

Microsoft’s Game Pass dominates the market

If we look at the individual service landscape across the main international subscription players, it is clear which service is currently dominating – Microsoft’s Xbox Game Pass. Following the Zenimax and upcoming Activision Blizzard acquisitions, the pipeline for first-party new releases is set to grow. And this has implications – certainly in the context of Xbox consoles – which will remain the dominant platform for Xbox Game Pass consumption in the medium term.

I expect there to be more focus on the biggest franchises and those titles which are GaaS-based within Game Pass. Single player titles from lesser-known studios will become increasingly squeezed if those titles sit outside the service. Discoverability could also be negatively impacted.

The inclusion of new releases has a notable impact on adoption of Xbox Game Pass. In the second half of 2021, volume of ‘day one’ games mirrored the increase in subscribers. New releases are a key USP for Xbox Game Pass. I’m not expecting the other services to compete at this level. Sony has already confirmed that day one first-party releases are not coming with the new PS Plus but it could include more day one third-party titles though.

Although Microsoft’s ambition is to expand beyond the console, at present the service is mostly linked to consoles and the console user, so this is where the effects of its dominant subscription market position is going to be focused.

But there are other opportunities out there for content owners. For example, beyond the established international players, there are at least 13 different content subscription services in Europe across telco and smaller direct to consumer players. All these services need content, and while the opportunities are relatively small, being added to these catalogues offer an incremental benefit to studios and publishers. With lots of telcos wanting engaging services to promote 5G and full fibre services, there is a window of opportunity now for games developers to engage these distribution opportunities and build a worthwhile revenue stream.

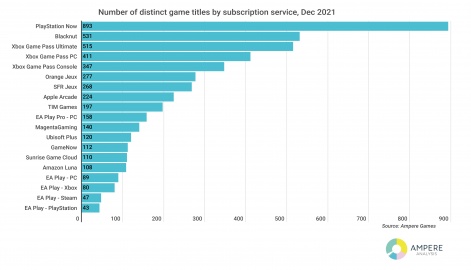

Catalogue sizes vary but remain small; competition for licensing ‘slots’ is already quite strong

Most of the services that we track have under 300 titles and the refresh rate across these services is low. While there a strong need for content now, competition to get games onto these services may reset the negotiating leverage that content owners have at present.

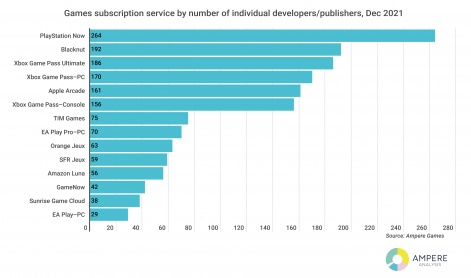

In terms of company activity across 14 services that we track, there are over 700 studios and publishers active in licensing their games. Many of these companies only have one or two titles active, and are experimenting with the opportunity but it does suggest that there is already a certain level of competition to get access to these catalogues.

An incremental opportunity rather than existential threat

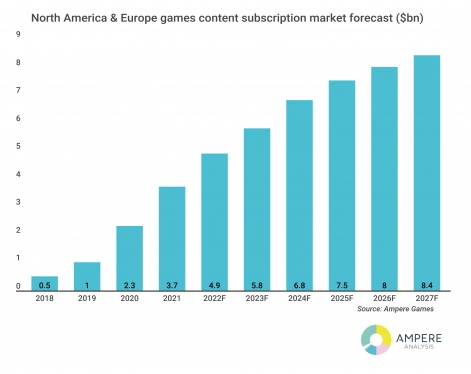

The games subscription market is set to grow strongly, but compared to other entertainment sectors, it won’t have the overwhelming impact it has had on these other industries. That said, games developers and publishers should investigate the various opportunities to distribute their games through these services as the revenue streams they provide tend to be incremental to existing monetisation although that depends a little on the approach taken.

However, the dominant service, Game Pass, is likely to increasingly focus on the latest games, biggest franchises and service-based games and maintains a catalogue size that isn’t growing a great deal. That could result in third-parties being left out in the cold if they don’t fit the criteria for these high-engagement areas.