The mobile games industry can be defined by two core qualities: it is data-driven and it moves incredibly quickly. Decisions made without a deeper understanding of the driving influences of the sector can and will be costly.

With over 15 years of experience analysing the games industry, Piers Harding-Rolls, Ampere Analysis research director and head of the games research team, breaks down the biggest trends in the mobile and broader games industry in his monthly column, Insight.

Demand for content and talent drive game industry deals in Q1

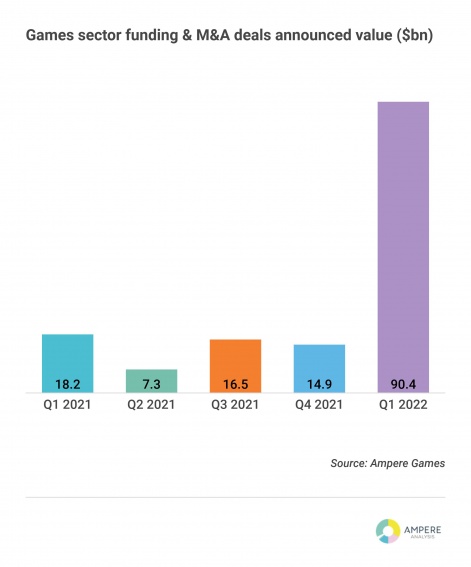

Games industry funding, mergers and acquisitions were hotter than ever in the first quarter of 2022. Declared value of deals reached a huge $90.4 billion* up from $18.2 billion in Q1 2021 and $14.9 billion in Q4 2021, driven largely by Microsoft’s announcement that it intends to acquire Activision Blizzard for $68.7 billion.

Deal volume increased six per cent compared to Q1 2021 with the sector showing little sign of slowdown. Activity post-Q1 continues at a rapid pace but with more challenging macroeconomic headwinds adding complexity to the deal-making process.

*Note Ampere counts deal value at announcement not when they are finalised

Why is there so much deal activity in the games sector?

The biggest games companies have become increasingly active in terms of studio and games company acquisitions as competition for talent and IP has escalated substantially over the last few years. The competition is coming from big tech, entertainment companies such as Netflix, and games publishers that are expanding globally, particularly Tencent and NetEase.

The metaverse concept, alongside NFTs and blockchain gaming, is also driving investment and deals across the industry. The level of activity is unprecedented: the result of a perfect storm of factors coming together at the same time.

Interest in games from the biggest tech companies has resulted in competitors that possess broad array of technical skills, leading cloud-based capabilities, and very strong financial positions. This makes them formidable opponents. Not only is there continued high games industry demand due to the proliferation of companies, storefronts, and services active in the market but there is also increasing demand from adjacent sectors such as film and TV that have a growing need for games dev skills.

The high valuations of games companies through the pandemic also helped fuel investments and acquisitions: higher valuations mean studios are more likely to listen to offers and existing big games companies have more leverage to make acquisitions.

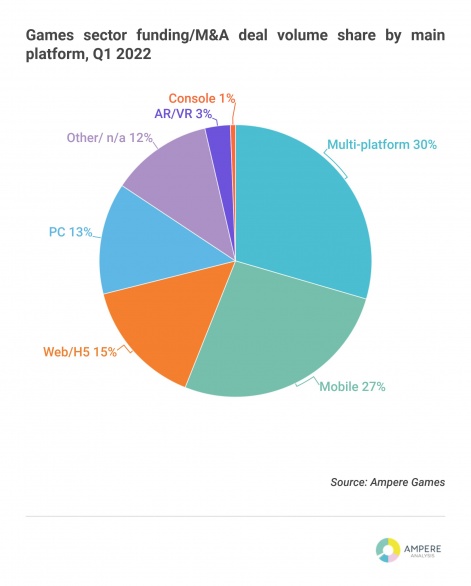

Mobile-focused companies were the target for 27 per cent share of all deals in Q1

For several years, mobile gaming has been one of the hottest areas of the games sector for raising money and acquisition activity, perhaps unsurprising considering the growth trajectory of the market over the last decade. The investment trend is continuing in 2022 with additional impetus driven by industry consolidation from a very competitive part of the games sector.

Explicitly mobile-focused deals represented 27 per cent of deal volume in Q1, with only companies that are multi-platform relevant taking a bigger share at 30 per cent, which may encompass mobile. Activity is being driven by various factors including market competition, legacy games companies seeking increased exposure to mobile games markets, and new market entrants.

Standout mobile-related deals from Q1

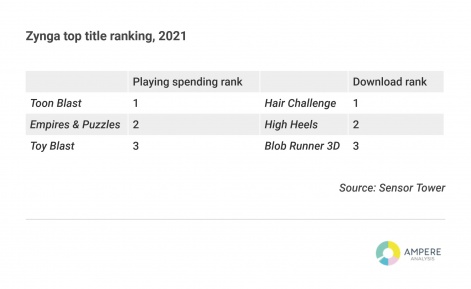

Across the 44 mobile-related deals Ampere tracked in Q1, there were 17 acquisitions, of which Zynga was easily the largest at $12.7 billion. A lot has been written about what Zynga brings to Take-Two: most obviously a substantial mobile games business and an evolving ad monetisation capability.

According to our friends at Sensor Tower, Zynga had 922 million downloads and $2.2 billion in mobile games gross revenue worldwide in 2021 from player spending across the App Store and Google Play (including from the different publishing entities that Zynga acquired through the year). While not at the scale of Activision Blizzard or EA’s mobile games businesses, it at least puts Take-Two on the same playing field as these two, currently more diversified, competitors.

Once the deal closes, Take-Two will immediately be propelled into a major player in the mobile games market, with the opportunity to transfer its console and PC gaming IP more comprehensively into the mobile space. Sensor Tower data also shows that Zynga's largest market for player spending in 2021 was the US, followed by Japan and Germany. Its top country for downloads was also the US, but was followed by India and Brazil, suggesting that Take-Two will be able to build its presence in a broad cross-section of globally important territories.

Turkey maintains its hot streak of mobile games deals

Outside of Zynga, the biggest mobile games deal done in Q1 was a substantial Series C raise of $255m by Dream Games, valuing the company at $2.75 billion. This takes total funding for the company to a massive $467.5m. The size of these later rounds reflect the success of the company’s only game – Match-3 title Royal Match - and investor appetite for Turkish mobile games companies following the acquisition of Gram Games, Peak Games and Rollic Games. According to Sensor Tower data, Dream Games’ Royal Match title generated $232m of gross revenue from player spending and was downloaded 28 million times during 2021.

There were yet more deals involving Turkish companies during Q1. 80 per cent of mobile casual and hypercasual gaming firm Alictus was acquired for $100 million by US-based SciPlay to add further content to its portfolio of casino-based titles allowing it to diversify its revenue streams with a stronger onus on in-app advertising. It also intends to use this expanded network to grow the active users of its casino titles, using Alictus’ games as acquisition funnels. Sensor Tower data shows that Alictus’ portfolio of games generated 186 million installs in 2021, a rise of 112 per cent compared to the previous year.

Additionally, Turkish mobile games start-up Spyke Games raised $55 million in a seed round to fund the growth of its Royal Riches title, a social casino game. The company was founded by a group of ex-Peak Games executives. While the money invested reflected the track record of the founding team, it also shows the hyper-competitive nature of the market and the need to spend big on user acquisition to reach substantial scale.

Other deals worthy of note included Stillfront Group continuing its acquisition-based growth strategy with its move to acquire 6Waves. 6Waves was founded back in 2008 during the heady days of Facebook PC social gaming and over the years the company has fully transitioned into a mobile games company.

The acquisition gives Stillfront a much stronger exposure to the Japanese market, with 97 per cent of 6Waves’ revenue coming from the region. Sensor Tower estimates that 6Waves games generated $124 million in gross revenue from player spending in 2021, which was down 2.2 per cent on 2020 performance.

Lastly, strongly growing casual games company Tripledot Studios raised $116 million in a series B funding round at a valuation of $1.4 billion. This follows a series A round in April 2021 at $78 million. According to Sensor Tower, the UK and Belarus-based company generated 48 million downloads across its portfolio of titles in 2021, up 167 per cent on 2020, a validation of the company’s strategy to focus on evergreen games that engage users over a long period.

Blockchain gaming remains hot, but will it last?

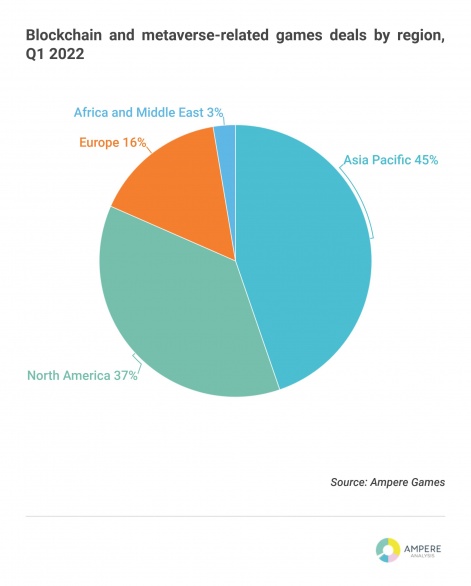

Metaverse and blockchain gaming-related deals experienced a rapid escalation in volume during 2021 and investment activity in Q1 2022 continued at a quick pace. In terms of volume, there were 38 different deals falling into these categories over the first three months of 2022, with deals as small as $1 million and as big as $450 million in funding for Yuga Labs, which plans to use the cash to build out its games and NFT-focused metaverse.

The climate for raising money in these newer areas of the sector remains favourable as a new wave of blockchain games start to enter the market. Ampere expects the performance of these new games to have a knock-on impact on the appetite for investment into blockchain games probably by the end of the year, so we’ll be watching closely how they perform in the coming months.

While companies in the Asia Pacific (APAC) region were responsible for 25 per cent of all games deals in Q1 2022, it was home to a much larger 45 per cent of the combined blockchain gaming and metaverse deals struck in the quarter. Indeed, Europe at 16 per cent of deals is underweighted in these areas compared to its average of 34 per cent across all deals, with APAC and the US clear centres for securing investment.

Based on the funding landscape, if blockchain gaming successfully transitions to broader consumer appeal (which is not guaranteed), Europe is at risk of being left behind as US and APAC-based companies enjoy first-mover advantage and start to establish their brands.