Master the Meta is a free newsletter focused on analysing the business of gaming.

MTM and PG.biz have partnered on a weekly column to not only bring you industry-moving news, but also short analyses on each.

To check out this week’s entire meta, visit www.masterthemeta.com.

May 3rd, 2021 marked the beginning of the Epic versus Apple antitrust trial.

While there are many journalists covering the play-by-play court proceedings, all the publicly available evidence has given unprecedented insight into the inner workings of two companies that tend to keep things pretty guarded.

I found Epic’s data more interesting and specifically wanted to extract learnings from the cross-platform anatomy of Epic’s largest revenue generator Fortnite (approximately 80 per cent versus Unreal’s approximately three per cent and Epic Game Store’s approximately 10 per cent).

Hat tip to Matthew Ball for the inspiration.

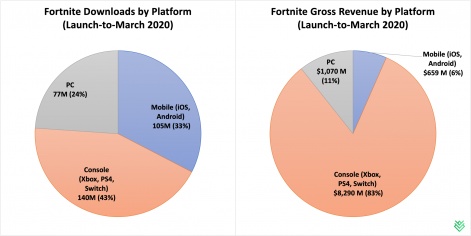

On a very high level, here is what the launch-to-date (March 2020) numbers for Fortnite look like.

1. Cross-platform does not always cannibalise audiences

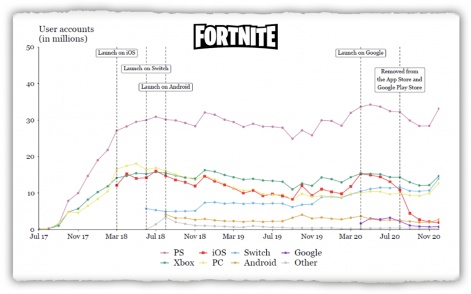

The graph below makes it absolutely clear that Fortnite’s cross-platform presence has not cannibalised user accounts between platforms. This presentation states that "38 per cent of daily new accounts in Fortnite came in on mobile - (2019 average)".

In other words, Fortnite’s multi-platform presence has been successful in bringing new audiences to the game. This is quite critical given a lot of speculation around the negative impacts of audience cannibalisation by launching the same game on multiple platforms.

2. Access to more platforms can drive existing audience engagement

This presentation states that "Approximately 15 per cent of mobile players go from mobile-first to console" and "40 per cent of mobile players have also played on non-mobile platforms". Not only does this mean that 15 per cent of these new mobile audiences are engaging in crossplay behaviour, but also that having access to the game across platforms contributes to increased engagement of already existing audiences.

This is really encouraging to see as it signals that console/PC players are using mobile to play/hang out with their friends in Fortnite more often, even though a majority of their playtime might not be on mobile.

3. Think cross-platform from the get-go

When considering the mobile-only players, it is slightly shocking to see a four to six per cent D30 retention for one of the biggest games on mobile that have 80 per cent MAUs from T1 countries. Mobile’s longer-term retention is also 80 per cent lower than that of console and is likely the key driver for the 85 per cent difference between mobile’s and console’s D180 CRPIs.

While this could be because many purely discover Fortnite on mobile, it is also possible that playing Fortnite on mobile is just an inferior experience relative to that on console. There are many gameplay, UX, graphical, and device-related reasons for this, and it goes to show how important it is to consider building a game cross-platform from the get-go. Of course, it also uncovers an untapped business opportunity for Epic by improving its Fortnite mobile experience.

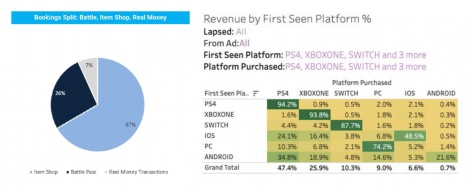

4. Social is critical for cosmetic-driven economies

Apart from Fortnite just being more fun on console, the game is also a highly social experience that is driven by a deep cosmetics economy. Therefore, showcasing vanity to other players during gameplay is critical and is a key driver for Fortnite’s monetisation engine. This is supported by how Fortnite’s revenues are heavily skewed towards the "Item Shop" (approximately 67 per cent).

But what I found more interesting was how mobile platforms show the lowest revenue by first seen platform percentages. In other words, the majority of players who played first on mobile made their first purchase of cosmetics on console/PC. This is especially noticeable on Android.

Apart from various cosmetics generally looking better on console/PC and driving the purchase decision, my gut says this purchasing behaviour is more driven by players showcasing a higher propensity to convert while they are playing with their friends on console/PC. Conversely, this would further support mobile being more of a game discovery and quick session platform, versus the platform where players deeply engage with their friends, the game and its economy.

All these learnings together tell me that going cross-platform with Fortnite has been only incremental to Epic’s entire business.

Not only were new audiences acquired and monetised through mobile, but existing console audiences were even more strongly retained within the Fortnite world.

That said, Epic still has some ways to go to truly capture its mobile opportunity and I’ll definitely be keeping an eye on the same.

I should also mention that all the data above is just a sliver of the data gold mine exposed in various case evidence files. I’m sure we’ll be touching upon more in the coming weeks and as the full legal drama unfolds. (written by Abhimanyu Kumar)

Master the Meta is a newsletter focused on analyzing the business of gaming. To receive future editions in your inbox sign up here: