The past couple of weeks have been a period for financial reports.

So, this week, we asked our Mavens:

With companies such as Zynga and Rovio, we've seen how hard it can be to sustain the massive success of a single global brand, especially in the eyes of investors and shareholders.

So do King's financials, which suggest we've reached 'peak' Candy Crush Saga, mean it will 'go the way of Zynga'?

Or will moves such as the acquisition of core developer Nonstop Games mean that King can successfully diversify its portfolio?

Everyone knows that making a hit game is as much an art as it is a science, which is why replicating success is so difficult.

Having a massive success under their [King's] belt certainly helps them understand the process of bringing a hit to market - soft launch, iterate, iterate... but timing, creativity, fun factor, viral potential, emotional connection and luck all come to play as well - which is how you get a Kim Kardashian: Hollywood to top the charts in the US.

They'll certainly milk Candy Crush for a while (Candy Crush Soda Saga will be interesting to watch).

However, it's becoming more and more of a global playground and different genres connect in different markets.

King can continue with sequel and reskins, but the Nonstop Games acquisition is the right move as diversifying will be key to longterm success.

Adam has been in the mobile game industry since 2007, creating games independently. He's since grown into a full 50+ person studio manager.

Recently he's taken a position at Wooga in Berlin to sharpen his design skills and work with the world's best to create amazing, well-crafted products onto the mobile marketplace.

King's financial report and acquisition of Nonstop Games show that King's faith in the royalgames.com to Saga model is fading.

They are publicly showing that they are diversifying and are in the same hunt as the rest of us for what the next big hit on the App Store could be.

I think everyone expected that internally King was diversifying more than just the match-3 genre, but to see it publicly really shows that the Saga genre isn't as massive as it once was.

It's great news for the industry which I feel has been feeling strangled by lack of innovation for quite a while.

What I found incredibly interesting was King has struggled to increase retention in Farm Heroes Saga post-launch:

- "...the number of DAUs or the reach of Farm Heroes which is very high is lower than our expectations. And the reason for that is we expected the retention of Farm Heroes to improve over time because that’s what we’ve experienced in the past with Candy Crush and Pet Rescue, as we develop the games and added features we were able to positive impact here the retention of the game."

They've spent months iterating on Farm Heroes Saga, but have not seen any positive changes (it seems) to their retention. This could be a sign of Facebook, it could be a sign of the market's desires changing, or it could point to a different root cause.

What doesn't change is that King has a substantial user base and an extremely powerful user acquisition machine. They have a great shot at creating a new hit. They will struggle the same as the rest of us to create and find that new hit, but if they find it, they have an excellent shot at putting it in front of the world's eye's.

Nonstop has a very talented team and will benefit from working with King's user acquisition machine.

Overall, I think its just far too early to say whether or not they will have the same fall from the top ranks as Zynga has had.

A games programmer before joining Sony’s early PlayStation team in 1994, he then founded developer Pure Entertainment, which IPO’d and launched a free-to-play online gaming service way back in 1999.

He was also a director of pioneering motion gaming startup In2Games, which was sold to a US group in 2008.

Along the way, he’s been a corporate VP, troubleshooter, and non-exec to a variety of companies and investors in and around the games sector.

Harry was European CEO of Marvelous AQL, a Japanese developer and publisher of social, mobile and console games, known for console games like No More Heroes and Harvest Moon, but now highly successful in the free-to-play mobile and web space in Japan and Asia.

Harry is CEO of Magicave.

Possibly the main lesson I've learned in the games business is that, whenever a company decides it has cracked the formula for success, two years later it's crashing and burning.

Making games, especially ones without triple-A budgets is, despite the wealth of analytics, brands and middleware available nowadays to developers, an inexact science at the best of times. The right combination of money, talent, timing and luck sometimes comes together and the magic happens which turns a good game into a smash hit.

VCs and public markets want growth, not sustained revenues.Harry Holmwood

What we've seen over the last few years in mobile is a small number of companies creating incredibly successful games, and fantastic revenue streams, and then looking not just to sustain but exponentially grow their businesses. That's difficult. VCs and public markets want growth, not sustained revenues.

When a company's success has come from an exceptional, surprise hit - where the magic has, indeed, happened - replicating it isn't easy. If I find a fifty pound note down the back of my sofa, that's a huge stroke of luck. If I then dedicate the rest of my life to looking down the back of sofas, that's not a great business model.

Of course, a successful game can be built upon. Customer base, play patterns, technology, brands - all these things can be replicated and enhanced for a while - but not forever. To succeed, these highly successful companies need to both build upon their successes but also maximise the chances of another magical surprise hit.

Game genres come and go...and come back - remember when Rock Band was a license to print money, and then a license to lose it? Or when Ubisoft came back into the dance game genre (which everyone else pulled out of years earlier) and cleaned up with Just Dance?

Supercell is a great example of a company which has embraced the unpredictability in the business, and structured teams around innovation, iteration, and blame-free failing fast. Rovio has done a good job of building a successful mobile game IP into something much bigger. A company that gets both right is a rare beast indeed.

The potential problem with Zynga and King is not down to ability - both can and will continue to make great games I'm sure.

It's down to market expectation of companies which have grown really fast, that growth having at least some element of 'magic' or luck to it..

If my revenues have grown from $10m last year to $1bn this year, maintaining the same level of growth means I've got to have $100bn next year - and that's bigger than the entire games industry.

Trying to grow to that $100bn level to keep the markets happy is a suicidal strategy - it involves scaling up way too fast, losing the focus, efficiency and talent that helped the magic to happen in the first place.

That's why companies at this level acquire - in a way, that's an admission of the fact that they know they can't replicate earlier success so need to buy in products and teams to feed the userbase.

Whether the Nonstop acquisition turns out to be a great move, or another OMGPOP remains to be seen. I've seen too many good studios shuttered a year or two after acquisition to think it's always the right thing to do.

First thing I would add is that I think it’s far from over with Zynga. While its clear they have severely stuttered in the last 2 (maybe 3) years they have a CEO and the wherewithal to make a comeback.

They acquired too many companies for silly money and are carrying too much overhead which they have been trimming. Don’t know if they have yet trimmed enough.

As with Facebook, they failed to see mobile early enough and that was a big contributor to their decline and this coincided with a period where they failed to innovate and got distracted by the lure of real money gambling. I think [CEO Don] Mattrick has now re-pointed the ship in a better direction and is focussing in on where he thinks they can be strong.

I think it's possible to buy success in nearly any industry these days.John Griffin

I expect them to recover somewhat – not necessarily back to where they were but enough to correct their current financial trajectory.

Perhaps controversially, I think it's possible to buy success in nearly any industry these days with deep enough pockets and King, for sure, have the coffers to do so.

For a company with the financial resources of King there is no shortage of potentially valuable IP out there for sale. They have the channel, the know-how, the systems, the expertise AND the cash to turn a good game into a hit.

Whether they can develop that IP or end up having to buy it will be interesting. If they end up having to buy it (they are fairly acquisitive themselves currently, which means they are covering all bases) then they will need to be pretty ruthless with their own trimming to avoid a Zynga-like decline.

As mentioned already Zynga and King are still big companies with deep pockets. We will see many more M&As the next months.

King did a good job to buy Juha and his team from Nonstop. It also shows that they will not only produce match-3 puzzle titles.

Innovation and awesome products are the key and normally those companies can get those different products and talents if they look outside their companies. I would be happy to be in King's position with such a warchest. You could buy a huge part of the market.

What I learnt in the 15 years in the mobile industry is that new boys will regularly join the ring and some older will leave the market.

A lot of VC money was burnt in the past but I am sure we will see Zynga and King for a long time in our market. So surprise us King and all the other gorillaz in the market. Make your next steps wisely ;)

John is co-founder of PR and marketing company Big Ideas Machine. Also an all-round nice guy...

To my mind, the question of whether King will follow in the steps of Zynga has two aspects - whether it can sustain its triple-A product aspirations, and whether it is at risk of a severe drop in value. Obviously the two are linked.

I have always thought that King's IPO was built on an unrealistic valuation.John Ozimek

Taking the second aspect first, I have always thought that King's IPO was built on an unrealistic valuation, and to be honest I didn't really hear any convincing arguments to the contrary - even from King itself.

To base almost the entire valuation on the revenues from Candy Crush (detailed as 90% of global revenues) leaves no margin for error. The shares dropped as soon as the company went public, and I don't really expect them to recover - at least in the short term.

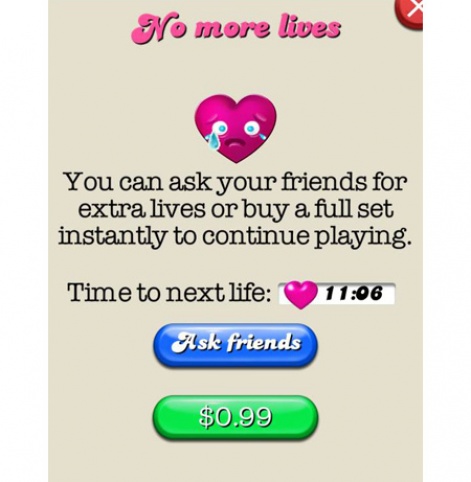

Even with an acquisition strategy to feed the acquisition funnel, it's certain that Candy Crush players will churn as the game gets old, and even if King manages to attract those players to its other properties, how likely is it that they will spend as much as thy have done on Candy Crush?

We saw the same with Zynga, where although the company as a whole was increasing its DAU/MAU numbers, looking closer showed that there was a high degree of churn within its own titles - meaning that the increase in acquisition costs wasn't bringing in as many totally new players, but rather driving players between titles. So you are in effect spending twice to acquire users. This is also without factoring in any increase in the CPI/CPA to find those new users in the first place.

Then, the pressure on the share value leads to accelerated acquisition and launch of 'known' IP, as the company needs to sustain the user growth to keep investors happy.

This is the spiral that Zynga got caught up in, and we all know the economics of the Draw Something acquisition. It feels like something similar could easily happen at King - especially as the share price has come under pressure faster than it did for Zynga.

Let's not forget that even in a diminished state, Zynga is still a very successful company.John Ozimek

As for the first aspect of the question, unquestionably they have some very clever people and some great game designers working day and night to create a new killer title. But you simply cannot plan for the vagaries of the public, and so it may be impossible to bottle lightning for a second time.

Yes, I am sure they will create a strong portfolio of differentiated titles - but only if the investors give them enough time to do so, and have a few failures along the way.

Let's not forget that even in a diminished state, Zynga is still a very successful company with big revenues. King may have disappointed with its financials, but it's still valued in the billions.

The big problem for both of these companies is what the perception of success is - and having both IPO'd at the very top, it makes staying there a more difficult task as it's in the full glare of the public and industry.