The African games market is on the rise and shows no signs of slowing down. With a youthful population and a love of free-to-play games, Africa is increasingly becoming an incredibly promising hub for mobile studios.

In this guest post, associate product manager at Carry1st, Seyifunmi Jesuloluwa, uses her experience in scaling games on the African continent to offer insight into navigating the growing African market, the challenges to overcome within this dynamic gaming ecosystem and its considerable potential for growth.

The gaming industry in Africa is on the cusp of a breakthrough, with projections pointing to a massive growth spurt starting in 2024. The numbers are clear: Newzoo’s report, commissioned by Carry1st, predicts that Africa's gaming industry will cross the $1 billion mark this year. Mobile gaming raked in $778.6 million in 2022, claiming a whopping 90% of total game sales. Nigeria leads the pack, bringing in $249 million, followed closely by South Africa with $236 million. Fueling this surge is Africa's young population, a group passionate about gaming, whether hardcore or casual.

Statista expects that the number of people using smartphones in this region will reach 689 million by 2028.Seyifunmi Jesuloluwa

Technical considerations

The use of smartphones is becoming increasingly important, especially in Sub-Saharan Africa. Statista expects that the number of people using smartphones in this region will reach 689 million by 2028. This growth follows a steady increase in smartphone usage over the past few years, showing how much mobile technology is changing how people connect and access information in Africa. Nigeria, the frontrunner, boasts the continent's highest number of smartphones, laying a solid foundation for the booming gaming scene.

However, this growth comes with hurdles. Internet access remains a barrier, with cost concerns making gamers wary of data usage. The abundance of low-end 2G devices necessitates building games that are not only fun but also lightweight for quick loading and smooth gameplay.

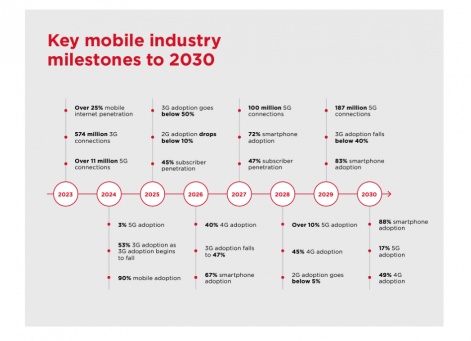

But there's light at the end of the tunnel. GSMA's 2023 report expects a significant rise in 4G adoption, with 5G gaining momentum, especially in cities. This means that game build sizes might not be an issue in the future, but now is the time to ensure that players have a smooth gameplay experience despite varying network conditions on their devices.

Localisation

Localisation is essential to winning in Africa's gaming industry. This means tailoring game content to diverse cultures, making it relatable for gamers across the continent. Carry1st's Africa Glam, a revamped version of Nanobit's Hollywood Story game, is a prime example. They cleverly tweaked the storyline and translated menus into popular African languages like French, Pidgin English, and Swahili.

In terms of pricing, adapting for Africa's spending power, various currencies, and conversion rates will yield more revenue potential than simply setting dollar prices for in-game items. Newzoo data paints a clear picture: over 40% of South Africans, a whopping 24 million people, play games regularly. And it's not just South Africa - nearly 30% of Ghanaians, 23% of Nigerians, and 22% of Kenyans enjoy gaming too. South Africa also holds the trophy for the highest revenue, raking in $290 million in 2021. Nigeria ($185 million), Ghana ($42 million), Kenya ($38 million), and Ethiopia ($35 million) follow close behind. These numbers speak volumes about Africa's gaming market potential, making it imperative to prioritise localised pricing. The report also outlines key players to focus on when conducting price localisation efforts on the continent.

To avoid losing paying players, exploring alternative payment methods is crucial.Seyifunmi Jesuloluwa

Alternative payments for Africa's gamers

Credit card usage in Africa is still low, averaging 3.92% across 28 countries in 2021 (Global Economy data). To avoid losing paying players, exploring alternative payment methods is crucial. Collaboration and partnerships are pivotal in establishing a robust monetisation system and refining payment channels for users across the African continent. Mobile money and digital wallets have emerged as popular and widely accepted options across Africa. This not only enhances the accessibility of in-game purchases but also fosters a sense of trust and familiarity among the user base. Carry1st's Pay1st gateway is a good example, offering a platform for diverse payment preferences.

Through strategic partnerships with local gaming influencers, communities, and industry leaders, invaluable insights are gathered into the nuanced preferences and behaviours of gamers across diverse countries in Africa. Leveraging this intel proves instrumental in tailoring payment solutions to seamlessly integrate with the unique characteristics of each local gaming ecosystem, thereby optimising the overall user experience.

In conclusion, Africa's gaming industry isn't just on the verge of something big; it's a goldmine waiting to be explored. By using these insights, stakeholders can overcome challenges and contribute to the booming African gaming scene. The future is not just promising; it's brimming with endless possibilities.

Edited by Paige Cook