Idle Bank Tycoon was released worldwide in January 2023. Since then, it has rapidly become one of Kolibri Games' most successful projects, boasting the fastest revenue growth at launch in the studio's portfolio. The game incorporates several innovative solutions and has consistently ranked high in very competitive niches (Business and Idle) for several months.

In this guest post, Oleg Aliautdinov, associate producer at AppQuantum delves into the game's gameplay, monetization, and marketing features. Also, a comparative analysis with its closest competitor, Idle Office Tycoon, will shed light on what hinders Idle Bank Tycoon from achieving even greater success and explore potential solutions.

What makes Idle Bank Tycoon interesting?

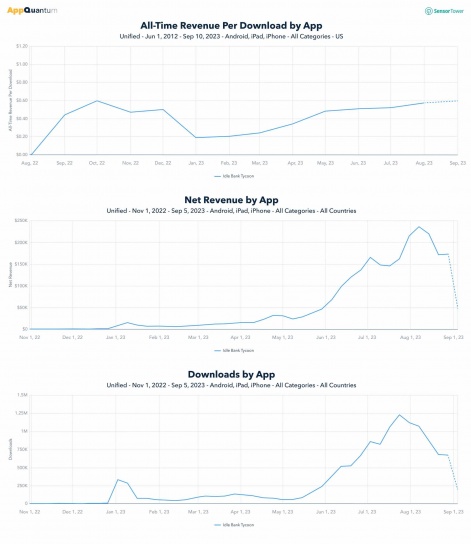

Idle Bank Tycoon's monthly downloads currently surpass those of another hit from the same studio, Idle Miner Tycoon. It ranks in the top three for revenue among all Kolibri Games projects and has experienced the fastest revenue growth at launch.

The game has already outperformed the studio’s second highest-grossing project, Idle Firefighter Tycoon. Despite their gameplay differences, Idle Bank Tycoon has generated over $3,620,000 compared to Idle Firefighter Tycoon's $3,130,000+.

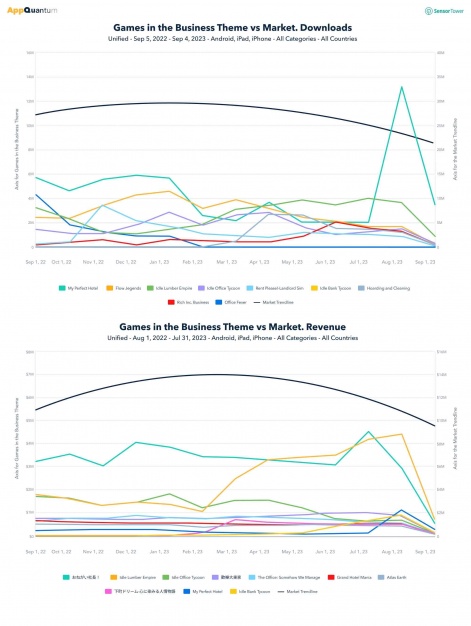

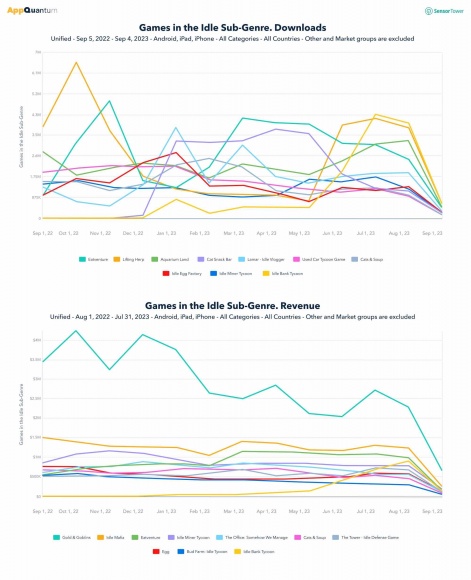

According to Sensor Tower, it ranks high in both downloads and revenue within the Business and Idle game categories.

Market Position

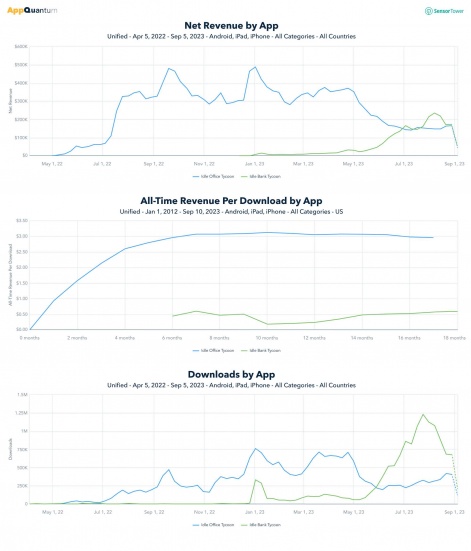

Idle Bank Tycoon experienced a significant surge in downloads and revenue during the summer. The short intervals between peaks in downloads suggest an expansion in traffic purchases. We believe that what ensued was a classic scenario where the team had already acquired the best audience segments. Subsequently, as acquiring new users became more expensive, the traffic volume began to decline.

The breakdown by country for the year shows that:

- The game attracts the most users from Tier-2 countries

- The majority of In-App Purchase (iAP) revenue comes from users in Tier-1 countries

Interestingly, since the last two updates, the game's revenue has slightly exceeded that of July 3rd despite fewer downloads. The Revenue Per Download (RPD) has also begun to increase.

Several updates came out during the purchase:

- May 12. Make Waves in Idle Bank Tycoon – initiated scaling of the purchase and added bank #6.

- June 28. Introducing Match-3 mechanics in the Limited Time Event (LTE) Audit Madness marks the second download peak.

- August 11. Paradise Bank update: decrease in downloads.

- August 23. Adding 5 new managers led to a decrease in downloads, yet maintained revenue levels comparable to July 3rd.

As observed, the game currently exhibits a relatively low In-App Purchase RPD of $0.6 in the US. We also assume that the game shows a low Cost Per Install (CPI) and that a significant portion of its revenue is derived from advertising.

Notably, the game achieves high rankings in two highly competitive niches simultaneously:

Idle Bank Tycoon successfully captured and maintained the fourth position in terms of downloads from July to August. However, it was notably outperformed by My Perfect Hotel.

At its revenue peak, Idle Bank Tycoon nearly matched Eatventure, securing the fourth spot in its niche. Regarding downloads, Idle Bank Tycoon even reached first place in July-August 2023.

Gameplay Overview

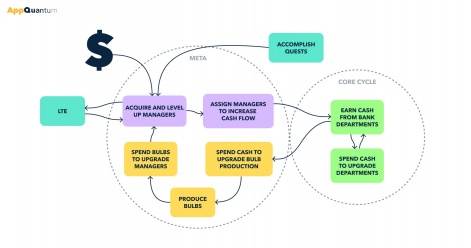

The player takes the role of a bank owner, who needs to develop different departments to complete tasks and ensure successful progression. Upon completing all tasks, the Prestige becomes available, a feature commonly found in the Idle Tycoon genre.

Reviewing the project's ad creatives history reveals that the developers explored more than just the banking setting. They also tested other concepts, including a car wash and a conveyorized car workshop with a distinct visual style. However, in the end, the banking theme was chosen.

Core Gameplay

There are several interconnected "departments" in the bank that influence the player’s soft currency income:

- The Marketing Department is responsible for attracting customers to the bank.

- Service Windows determines the rate of currency accumulation.

- The Vault, where employees use carts to transport money to the safe.

- The Main Hall provides additional soft currency for each customer.

Each department offers various upgrade options, including adding new employees, increasing work speed, and enhancing the amount of extra soft currency earned per client.

Crucially, as players upgrade these departments, they earn reputation points, which elevate their overall level. These points also provide rewards such as hard currency or additional clients and unlock new activities and manager cards, which we’ll talk about in the following section.

Meta Gameplay

Managers

- Managers become available at level 6 of the player's reputation and are a crucial game element. They can be upgraded in two ways: leveling up and increasing rarity.

- Levels are upgraded by spending evolve currency, a specific in-game currency used for upgrades, such as for managers. It is represented by light bulbs.

- Rarity is enhanced with manager cards.

- Players also have the option to exchange some manager cards for others.

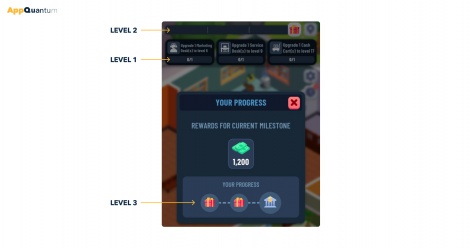

Milestones

Progression in the game is marked by achieving Milestones, which are divided into three interconnected levels:

- Level 1 - Quests

- Level 2 - Progress bar on the screen

- Level 3 - Progress bar in the menu

Completing quests (Level 1) fills the progress bar (Level 2). Once it’s full, a Milestone on the menu's progress bar (Level 3) completes. After all such Milestones are achieved, the game offers Prestige to a player.

Prestige

As is common in many Tycoon games, players are encouraged to move to a new Prestige level after completing all Milestones. This resets their progress, provides rewards, and allows them to move to a new bank.

An interesting aspect of Idle Bank Tycoon is that players retain their soft currency when advancing to a new Prestige level. This allows users to accumulate substantial resources at the current level, facilitating an easier start in a new bank.

Limited Time Event. Audit Madness

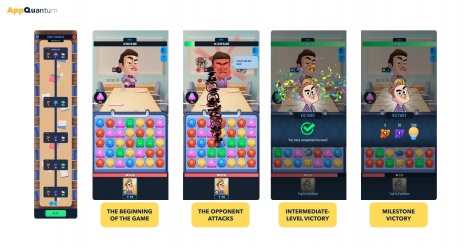

Idle Bank Tycoon currently features a single LTE that becomes available on the second day of gameplay: the match-3 battler, Audit Madness.

Typically, LTEs in this genre are separate from the main game, but Idle Bank Tycoon introduces an interesting detail by integrating managers into the LTE. These managers are essential for progressing through LTEs and enhancing combos, and their cards are awarded as intermediate rewards.

This approach is relatively novel and uncommon in the market. Kolibri Games has incorporated a scaling mechanism into the LTE, aligning it with the player's advancement in the main game. To successfully complete all levels of the event, players need to acquire better managers than those they had at the start. This design effectively encourages in-game purchases or increased viewing of rewarded videos (RV) to obtain the desired rewards.

Business Mode

This additional mode unlocks at reputation level 7 and allows the player to spend soft currency to earn evolve currency (light bulbs) for upgrading managers. To achieve milestones in this mode, players must invest their soft currency and defeat a boss at the end.

Following an update, the concept of the boss battle was completely changed. Initially, filling a special scale with one high-level manager was sufficient, but the mode now incorporates mechanics from LTE, requiring not just a suitable team of managers but also success in match-3 gameplay. This change has made the player more engaged in the process, as victory now hinges on battle preparation, as well as luck and skill. Rewards for winning include lootboxes or hard currency, and evolve currency for completing levels. Bulb storage is limited, so the player needs to launch the game from time to time and collect them.

Monetization

The game features a standard array of rewarded videos, hard currency purchases, and in-app purchases. Let’s take a closer look:

Rewarded Video

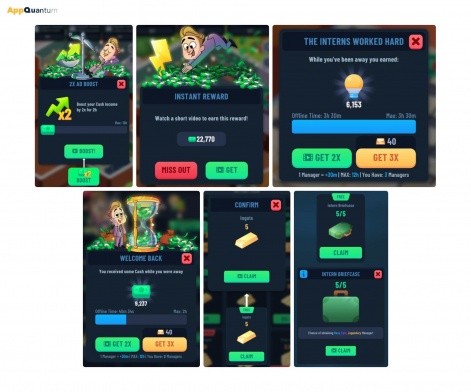

Kolibri Games motivate the player to watch RV with many possible rewards:

- Instant Reward. Small amounts of soft currency. Based on the player’s per-second income.

- Hard Currency. Available in the store in modest quantities.

- 2x Ad Boost. Doubles the player's income for 2 hours per ad view.

- Welcome Back. Offers a choice to the returning player: increase idle income by 2x for watching an RV or 3x for spending hard currency.

- The Interns Worked Hard. Idle accumulation of light bulbs can be doubled by watching ads and tripled for hard currency.

- Lootbox. Watching an RV allows opening a green case with manager cards up to 5 times, with a new chest available every 2 hours.

Hard Currency Purchases

- Daily Deals. A list of items that automatically refreshes every few hours, or can be refreshed up to three times a day by the player for 10 units of hard currency. Introduced as a player retention tool.

- Bulbs.

- Soft Currency.

- Lootboxes. Available for purchase with hard currency or for completing quests.

We assume that the developers faced a situation where players bought most of the store and still had leftover money. This led to the introduction of the Specialist Briefcase and Executive Briefcase, possibly indicating the popularity of Lootboxes as a monetization point, prompting the addition of extra items.

In-App Purchases

Besides the option to buy hard currency, the game offers a limited selection of deals. Notably, the Back To School offer becomes available at the start of the second bank, with no new offers introduced to the player at this stage.

Marketing and creatives

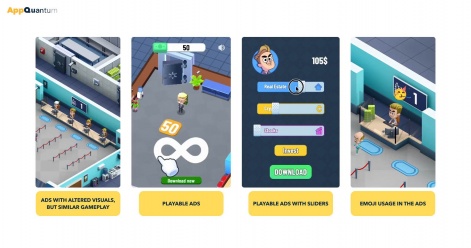

Analyzing the User Acquisition data from Sensor Tower, we observe that most traffic buying occurs on Applovin and ironSource for both platforms. However, a larger number of ad networks are connected on iOS than on Android. This could be attributed to a more affluent audience on the iOS platform.

- On iOS, Kolibri Games predominantly purchases traffic for playable creatives, whereas on Android, the focus is more on video creatives.

- The Android creatives often feature altered visuals but maintain gameplay similar to the game, supporting our theory of a low CPI.

- Using playable creatives with toggles/sliders indicates the studio’s strategy to attract a more mature and paying audience.

- Some creatives include emojis over character heads, aligning with current trends often utilized in creatives to engage the player interactively.

Idle Bank Tycoon vs. Idle Office Tycoon

Idle Bank Tycoon's closest competitor is Warrior Game's Idle Office Tycoon. Both games fall under the same store category, but the office-themed game appears to be more successful. Let’s compare them.

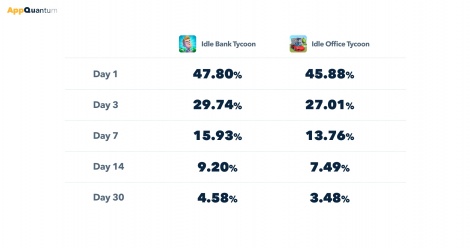

Retention

Both games exhibit similar user retention metrics. However, Idle Bank Tycoon slightly outperforms its competitor, potentially owing to including LTE in the game.

In general, we at AppQuantum stick to the following retention benchmarks:

- D1: 50%

- D3: 35%

- D7: 20%

- D14: 15%

- D30: 5%.

If D3+ retention falls below these benchmarks, it could indicate issues in Idle Bank Tycoon, such as:

- Player progression slows significantly between the first and third day.

- From the 7th to the 30th day, a content deficit becomes apparent: no new mechanics or activities are introduced, and existing ones begin to lose their appeal.

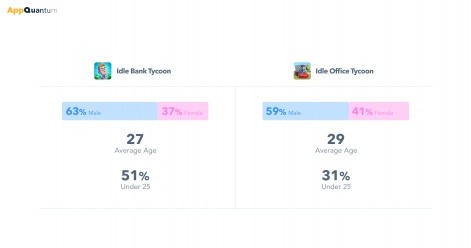

Demographics

The audiences for both projects are quite similar. However, in Idle Bank Tycoon, players under 25 years old constitute 51% of the user base, compared to 31% in Idle Office Tycoon. This age difference likely impacts their spending power and, consequently, the iAP revenue of the project.

Gameplay Analysis

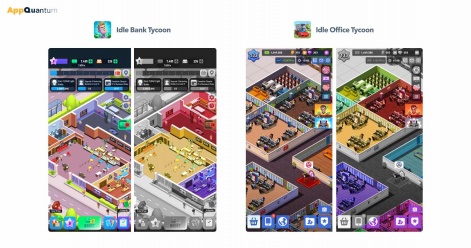

Core Gameplay

A major issue in Idle Bank Tycoon is the zoning. Players often struggle to identify which area on the map corresponds to each bank department and where to tap. This confusion is evident even with only two active game zones at the beginning of the second bank. The issue becomes clearly visible if the playable areas are painted in different colors, and the non-playable areas are highlighted in gray.

Conversely, despite having more game zones in Idle Office Tycoon, each zone is distinctively enclosed by four walls, which helps players quickly orient themselves.

Meta Gameplay

Idle Office Tycoon offers a variety of additional activities, most of which are integrated into the game map. This visual representation of progress — moving to wealthier neighborhoods and larger buildings — enhances player engagement. Available activities include:

- Purchasing real estate and industries for additional income.

- Buying cars.

- Interacting with in-game characters for gifts.

- An offline leaderboard that progresses with real estate, car, and manufacturing acquisitions.

Idle Bank Tycoon lacks this diversity in meta gameplay, leading to quicker player disengagement.

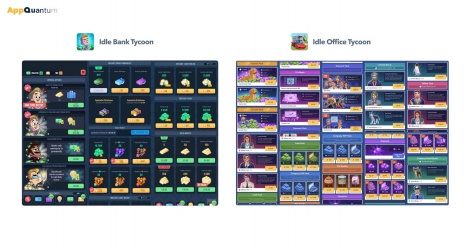

Shop

The in-game store in Idle Office Tycoon offers a broader range of items, which are available just minutes after starting the game and expand rapidly due to the player's quick progression.

In Idle Bank Tycoon, the variety is much more limited, with new offers ceasing early in the second bank. While Daily Deals attempt to soften this, they don't fundamentally change the situation.

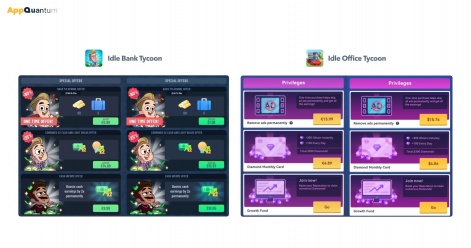

Off-shop offers

The situation is similar to the previous paragraph:

- Idle Office Tycoon. Players are presented with numerous opportunities outside the store to spend hard currency, view ads, and make real-money purchases. The game's balance subtly encourages the use of some RVs.

- Idle Bank Tycoon. Offers fewer alternatives for such purchases.

Regional prices

In both games, regional pricing strategies are inconsistent. Comparing Cyprus and Armenia:

- Cyprus. Prices end in "9", making them visually appealing and harmonious.

- Armenia. Prices lack uniformity, likely due to direct conversions based on local taxes and exchange rates.

Recommendations for Idle Bank Tycoon

To enhance player engagement, the game could introduce a more diverse and regularly updated shop assortment in line with the player's progression. Moreover, Idle Bank Tycoon could expand options beyond the shop and address the zoning issue to facilitate easier navigation for the player within the game space.

One such improvement could involve integrating advertising placements, allowing users to engage with ads while waiting to accumulate the required amount of soft currency. Also, implementing a uniform pricing template across all countries could potentially increase in-app revenue.

Primarily, the game should focus on adding more meta gameplay to keep players entertained with various activities. Possible additions include:

- Buying Real Estate: this could serve as an alternative source of soft currency, adding depth to the gameplay.

- Trading Company Shares: implementing a feature where players can trade shares for a temporary passive idle multiplier and a leaderboard boost.

- Building a Resort for Managers: this could parallel expeditions, where managers relax and gradually accumulate manager cards.

These features make the wait for soft currency accumulation more engaging and open up alternative monetization avenues, such as assisting players in bypassing paywalls differently.

Brief Conclusions

Despite its controversial level design, Idle Bank Tycoon boasts a higher retention rate than its competitor. This rate has the potential for further growth if Kolibri Games continues to develop and enrich the game with additional content.

A few key aspects:

- LTE Integration. The LTEs are closely tied to the core gameplay, requiring managers for completion, thus integrating into more than just the core gameplay.

- Monetization Points. Although there aren't many monetization points in the game, the existing ones have been successful in generating significant revenue. However, introducing new monetization channels could positively impact future revenue and enhance the project's market competitiveness.

- Retention Metrics. A retention rate D1 of 48% indicates strong player interest, but the drop in retention over subsequent days suggests both a content deficiency and a premature slowdown in player progression.

- Lack of Meta Gameplay. The game currently needs more substantial meta-gameplay, limiting players' engagement beyond the main gameplay.

- Player Demographics. With 51% of players being males under 25, the game's ability to monetize might be limited. The use of creatives that echo economic strategies seems to be a tactic to attract a more mature audience.

AppQuantum remains committed to closely observing the market and will continue to update you on the most intriguing projects.