Global analyst and advisory service Omdia brought together a panel of five team members to discuss 10 key questions in the gaming industry right now in their latest online webinar. Spanning every topic from the ongoing wave of layoffs, to AI's place in game development, to the rise of third-party app stores, no hot topic was left unexplored.

All in all, the 10 questions answered were:

- Why are we seeing so many layoffs in the games industry?

- How will "Switch 2" impact the market?

- How is this console generation different from the last?

- Is widespread adoption of third-party mobile game stores guaranteed?

- How do movies and shows based on game IP impact Twitch audiences?

- How do recessions impact the games market?

- What impact will games library subscriptions have on game design?

- Will the Apple Vision Pro rejuvenate the flagging consumer VR market?

- What are developers' spending plans now and in the future?

- Can generative AI revolutionise games development?

And as for those answers most relevant to mobile...

The law of layoffs

Omdia research director Dom Tait attributed global layoffs to a "confluence of contributing reasons" like the "spiralling size of budgets for triple-A games" at a time when the pandemic boom in consumer spending made companies confident to invest in continued growth.

Assumptions that this boost was "locked in" meant companies planned to spend beyond what was ultimately realistic.

In reality, as restrictions loosened in 2022 people spent less money gaming and revenue fell by 5.7% that year, then rising by only 0.9% in 2023, based on Omdia’s data. The industry still generated a huge $166.6 billion globally in 2023, but this was lower than projections that presumed the industry wouldn’t need to recalibrate post-pandemic.

Senior principal analyst Steve Bailey added that recessions have an impact on the industry, noting that recessionary impacts on the games market were first detected after the Sendai Earthquake recession in Japan; mobile gaming growth stagnated in the following year, 2012, before climbing again, while no other major mobile market displayed a similar pause.

This suggests that gaming can indeed be impacted by wider economic factors, and Bailey believes "it’s very likely that the gaming market’s exposure to macroeconomic events is only going to increase".

Live ops, expenses, and AI

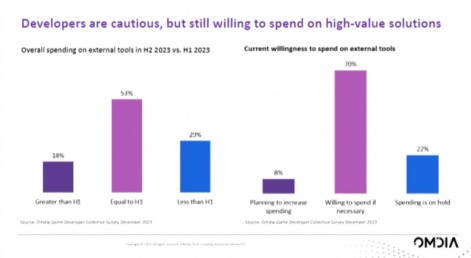

Based on Omdia’s survey of game developers, principal analyst Liam Deane shared that devs are "cautious, but still willing to spend on high-value solutions". Only 1% of developers increased their spending on external tools in the second half of 2023 however, while 22% put spending on hold.

Even so, Omdia has estimated that developers spent $64 billion on tech products and solutions in 2023, and projects an increase of 6% this year.

"There’s still a lot of room for expansion in this market despite the difficult circumstances," said Deane.

Those difficult circumstances include the "ballooning development costs", which may be confronted by generative AI after a steep curve in recent decades. More than 30% of developers are already personally making use of generative AI while 18% are aware of colleagues using it, according to Omdia.

This means that effectively half of studios are using the tech in some capacity. However, Deane noted that only 21% of surveyed developers expect generative AI to have an outright positive result, while 18% expect it to be outright negative. The majority are in the middle, expecting upsides and downsides to generative AI, but there are indeed many devs concerned about further job losses as a result of the technology.

"In the space of one year since March 2023, the number of companies that are in this space has tripled," Deane added.

He also noted that in terms of what devs are developing, and what’s making money, approximately 90% of revenue is coming from ongoing revenue streams rather than traditional upfront payments in the modern landscape. New studios are "disproportionately" aiming for live service games, therefore.

The alternative

While senior principal analyst George Jijiashvili predominantly answered questions around console gaming, senior analyst James McWhirter took the lead on third-party mobile app stores, highlighting the EU’s Digital Marketing Act and its attempts to curb the power of "gatekeepers" Apple and Google.

Both app store giants have already made changes to how first and third-party billing works on their platforms and the situation is "rapidly evolving". Microsoft and Epic Games are making plans to launch their own app stores on mobile this year, but the DMA is already having to investigate non-compliance from Apple and Google so shortly after its introduction, so the future of third-party stores is anything but clear.

What is clear is Omdia’s data on third-party consumer spending: "In 2023, we estimate that globally, just 12% of consumer spend on game apps happened outside of Google Play," said McWhirter.

This was even lower in Europe, where only 4% of spending occurred through "other" app store platforms. Conversely, this rose to an impressive 43% in South Korea as its One Store is a popular alternative to the Western giants.

"Successful adoption in 2024 is far from guaranteed," McWhirter summarised.

This January, Apple lowered its share of game revenue from 30% to 17% in the EU but added a €0.50 download fee - just one of the giant's reactions to the DMA's legislation.

Sign up and watch the full video here.