The 4X strategy sub-genre, which combines various elements such as real-time strategy, world-building, RPG mechanics, and often PVP elements, offers players a layered gaming experience. The genre has become increasingly popular with the likes of Rivergame’s Last War and Century Games Whiteout Survival, both achieving great success.

In this guest article, mobile games analyst Andriy Zmeul takes a closer look at the 4X strategy genre and aims to determine its standing in the US games market. Zmeul explores some of the biggest games in the sub-genre and reveals what has made them successful.

Last year, 4X strategy games appeared on my radar increasingly often, more so than games in other mid-core genres such as RPGs or action shooters. Considering that 4X strategy is just a sub-genre inside a more broad strategy genre, it intrigued me a lot.

My goal in this article is:

- To figure out where games in the 4X strategy genre place in the US mobile games ecosystem

- Pull together details and form conclusions

- Reflect on those conclusions

To make this happen, I'm using data from data.ai for in-app revenue from US users who played the top 1000 games (by revenue) on Android during the 24 last weeks ending January 2024.

The facts

- Total revenue of 4X strategy games is $360 million across 107 4X strategy games

- Six of the top 50 games are 4X strategies, which are generating $135 million (total 24 weeks in the US on Android), or 9% of all the revenue of the top 1000 games and 20% to 25% of the top 50. That is also 40% of all 4X strategy games’ revenue

- In the top 200 grossing games of all genres, 28 4X strategy games are doing $160 million. This number is comparable to the top 50 ($135 million) 4X strategies, so the top 200 and top 50 games' market shares are almost the same. The range of revenue per game here is from $2 million to $10 million (reminder: total for half a year on Android in the US with IAPs)

- All other strategy genres make less than a third of what the 4X strategy genre generates alone

- For the same half a year, MMORPGs gained no more than $40 million, the shooter genre no more than $90 million, or subgenres brawl, MOBAs and battle royale genres combined gained way less than $15 million in total, which makes 4X strategy the biggest sub-genre in terms of revenue

So what makes 4X so successful? Is it the audience size or the audience's readiness to pay?

Examples

As I mentioned above, there are 107 4X strategies in the top 1000 games, 34 of which are in the top 200 by gross IAP revenue. Let’s have a quick look at every fifth game in this list that is between number 50 and 200.

- Name: Last shelter

- Developer/Publisher: Long Tech Network

- Worldwide date: October 2017

- Top Grossing ranking: 55

- Cumulative revenue per download: $58.48

- Setting: Realistic

- Name: Lords Mobile

- Developer/Publisher: IGG

- Worldwide date: March 2016

- Top Grossing ranking: 65

- Cumulative revenue per download: $22.03

- Setting: Cartoon/Fantasy

- Additional genre: Summon troops, line strategy

- Name: King of Avalon

- Developer/Publisher: FunPlus

- Worldwide date: May 2016

- Top Grossing ranking: 80

- Cumulative revenue per download: $41.26

- Setting: Fantasy

- Name: Kingdom Guard

- Developer/Publisher: Tap4Fun

- Worldwide date: March 2020

- Top Grossing ranking: 123

- Cumulative revenue per download: $22.25

- Setting: Cartoon/Fantasy

- Additional genre: Tower defence

- Name: Kiss of War

- Developer/Publisher: Tap4Fun

- Worldwide date: July 2019

- Top Grossing ranking: 148

- Cumulative revenue per download: $34.23

- Setting: Realistic

*as data.ai’s “IQ Classifications” within games of all genres

*as cumulative revenue per download

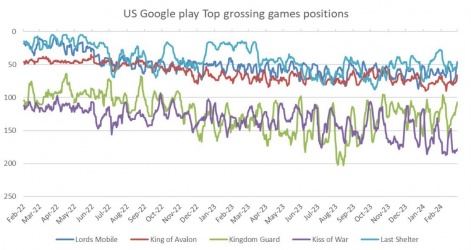

This list of games represents a dynamic of a genre. On the chart below, you can see that the trend is cooling off after Covid peaks.

At the same time, Data.ai reported that total games’ revenue levels on Google Play in the US didn’t change much, which means that new hit games like Monopoly GO!, Triple Match 3D, Honkai: Star Rail and others are compensating lost income after Covid and seem to be paying less in specific genres.

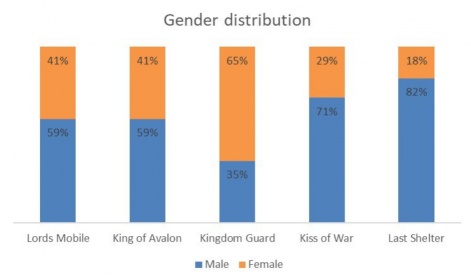

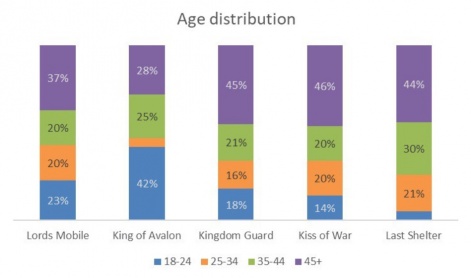

Regarding demographic distribution, not everything here may be as obvious as it seems at first glance. On the charts below, you may see that specific genre, art-specification and additional gameplay mechanics may alter socio-demographic distribution quite significantly.

You may also see that all the games are comparably old. The newest game was released in 2020, and all the others were released more than six years ago. But that doesn’t mean that there were no new releases.

Whiteout Survival by Century Games was released in late 2022 and became a success in early 2023. Now, the game is in the top three by revenue in the 4X strategy genre.

Sea of Conquest was released just around a month ago and promises a good and reliable future for FunPlus.

Call of Dragons was released a little bit later, in 2023, after Whiteout Survival, and it also promised good growth but unfortunately didn’t live up to expectations. The case of Call of Dragons may be interesting to see how the high-budget game descended from the peak to the bottom of the US top 200 grossing games.

Examining Call of Dragons

Call of Dragons’ worldwide release happened in December 2022, but active marketing started to perform in March. In April, the game reached peak downloads (in the US on Google Play). Since then, downloads have dropped five months in a row and decreased six times.

Interestingly enough, the most successful 4X strategy game of recent times, Whiteout Survival, was released one month before, and the cross between the two games was relatively high in March. However, after that, the audience split. On the one hand, 4X-Strategy core fans stayed in Whiteout Survival, while those who liked cartoonish stylisation stayed in Call of Dragons.

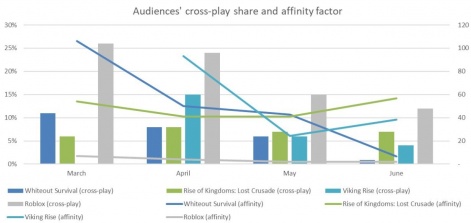

You may see on the chart below how the common audience split month by month.

There are also several games to compare: Roblox as a standard benchmark - the game is huge and has the biggest crossplay shares with almost all the games - and Rise of Kingdoms, which is the biggest game from Lilith Games.

Viking Rise is just another recent 4X Strategy release that came out in April 2023 and was taken for benchmarking purposes. You can see that crossplay decreased in all the games except Rise of Kingdoms. It might be caused by cross-promotion between two games or just the strength of a brand.

Unfortunately, this cartoonish stylisation confused players because the game itself - as players claim - is not just grindy but more focused on pay-to-win mechanics and has hard-core elements like resetting progress during the change of seasons.

Among other things, players emphasise these problems of the game:

- Specific stylisation, i.e. unappealing heroes look

- Comparably low possibilities to grind soft and hard currency playing the game

- Random elements of the skills progression of heroes which make it hard to control progress

- Season resets that partially reset progress of the player with every new season

In conclusion, despite the slow stagnation in revenue of this segment of the market, it may be said that taking into account current games, old and new, the perspective to release a successful game is very promising:

- The niche is comparably big, and the level of revenue is high

- Number of representatives of the genre in the top 200 by gross revenue is quite significant

- There is room to experiment. Actually, only because of such experiments did the genre survive, despite its controversy. This misleading gameplay mechanics during the early period let CPI be lower and, in the end, made ROI positive

Taking all this into consideration, why then is it not a new merge or match-3? Why are the launches of new games in this genre left only to some specific Chinese companies?

Industry reflections

I decided to ask the community about the genre's prospects and the development of 4X strategy games.

The answers varied; somebody argued that “CPI is higher than LTV, and this is it”, which is obviously not the case; otherwise, why do developers that already have successful 4X strategies do a new release?

Others argued that games that succeeded have luckily coincided with events in their origin, such as setting and audience interest, cost of development and ‘time-to-market’, team’s experience and the possibility to make a big team cheap, LiveOps and scalability. This is an interesting point, but it looks like most developers can recreate success with some variations, which means that ‘coincidence’ and ‘luck’ here are not the major points.

I personally liked the idea that Western developers are afraid of uncertainty while their Asian counterparts are not because there is little or no uncertainty for them there.

- First of all the breakeven point in those games are over 100th day with initially high CPI

- Then an experienced and good team of professionals should be already on the spot and ready

- High cost of mistakes, in-game balance is comparably sensible with high CPI and pretty long user lifetime

- There must be experience in misleading gameplay in early players' experience and be tolerable to hate from frustrated players who will blame developers for deception

All in all, it was a surprise that historically Asian developers became better at managing risks and that economic factors made them very successful with 4X strategy developers in comparison to their Western counterparts.