Genshin Impact was released across various platforms, including mobile, back in 2020 and has since gone on to achieve great success. So far, according to data from data.ai, the title has earned over $5 billion from its players worldwide. However with the release of miHoYo’s Honkai: Star Rail last year we saw a massive boom for that game, reaching 20 million downloads within just two days. It's perhaps no surprise then that such success appeared to result in Genshin Impact experiencing its lowest in monthly revenue soon after.

So the question is, did Genshin Impact players abandon the title in favour of Honkai: Star Rail? In this guest post, mobile games analyst Andriy Zmeul analyses both games, comparing revenue and audience to determine what happened.

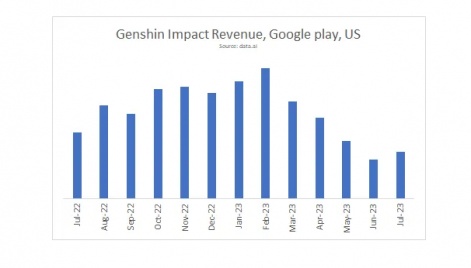

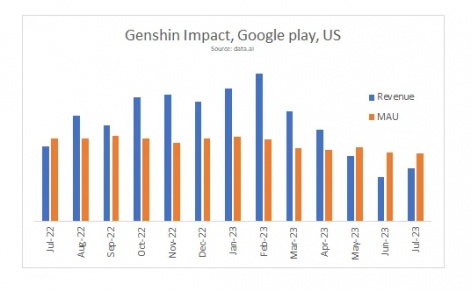

In one of the TWIG podcasts (#245, if I am correct), the hosts raised the topic of revenue drop in Genshin Impact. Participants of the discussion connected this decline with the audience decline, which is harder to notice in comparison with revenue dynamics, though still noticeable:

You may see that revenue is much more sensitive than audience and looks like nothing happens with MAU, but if we start comparing numbers period to period, we will see that beginning with March, the monthly audience dropped -17% and MAU of Genshin Impact became an all-time low starting with the game's launch.

The TWIG’s hosts suggested that this happened because the developer of Genshin Impact, miHoYo, launched its new game Honkai: Star Rail, attracting Genshin's original players. I found that curious because that might be a universal explanation for almost any audience drop in any game.

It inspired me to create a method that could illustrate such user flows, but in reality, there was more to this than just a simple explanation.

So what actually happened with the users of Genshin Impact?

Diving in

Let’s deal with the preconditions first:

- This will be Google Play’s version of the game because ATT makes it impossible to track users across applications on iOS.

- We will be looking at US-only players because this is how we could isolate the local trends from the international controversies that may affect the result.

- The data will be monthly aggregated (where otherwise is not stated) because this is how data.ai aggregates the audiences for cross-play.

- We will use data.ai data of “Cross-Mobile Usage” that utilises the company's own panel of users and extrapolate it to the total audience.

The above brings some risks of skewed data, so take this research with a grain of salt if you want to apply the results to other situations.

Cross-Usage

We see that MAU started to drop in March, at least one month before Honkai was released. April continued the trend, May was stable, and the summer months also showed a decline.

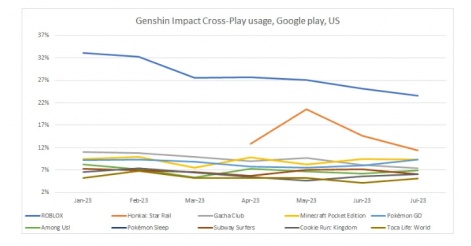

Below, you can see the top 10 games by cross-play for Genshin Impact:

Along with a synchronous drop of MAU with the launch of Honkai, we also see that there were no big launches of new games in that time (that month or the month before) that might have caused such a decline. First, let's check the situation with Honkai: Star Rail and see how players of Genshin Impact may have moved to a new game.

Honkai: Star Rail

Users from the US started to appear in the game on April 23rd. You can see on the chart above that 12% of Genshin’s players played the new game in the same month. The following month, concurrent players became 20% and then immediately went down in June to 15%, and in July 11%, which may mean two things:

- Players stopped playing Genshin in favour of Honkai.

- Players played Honkai, then returned to Genshin and never relaunched Honkai.

On the chart with MAU, we see that Genshin’s monthly audience dropped and hasn’t come back to pre-Honkai’s levels with the same or higher number of new users. Thus, we can conclude that players did not return to Genshin from Honkai in masses.

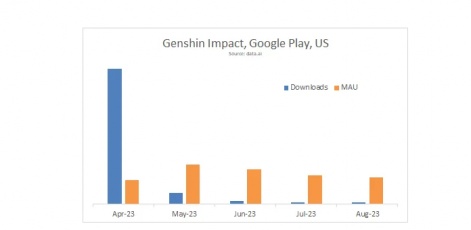

We know that in the highest month in May, Genshin Impact ‘gave’ 20% of its monthly audience to Honkai, and by coincidence, it was also 20% of Honkai’s audience. But we also see that in further months, MAU for both games decreased; in July, it was 5% less for Genshin compared to May, and for Honkai, the decline consisted of 20%; you can see this dynamic on the chart below.

You also can notice how significant the downloads/MAU ratio is caused by the wide marketing of the ‘pre-download’ feature in the Google Play Store. In the case of Honkai: Star Rail, the effectiveness of this feature appeared to be 18%, and every 6th downloaded turned into ‘first open’.

So we know that 20% of Genshin’s audience played Honkai in May, and 11% played Honkai in July. MAU in March and April (before Honkai’s launch) dropped 15% compared to February, and in July (after the launch) dropped another 5%. I don’t have access to players’ IDs to track everyone, so I assume that 10% of the audience left for Honkai and stayed there, dropping Genshin. 10% of the audience is still playing both games, and 10% of the MAU left the game for “something new”. This “something new” is also interesting to investigate because it might become the primary source for future problems of the game.

Something new

As you can see on the “Cross-Play Usage” chart it will be hard to find where people were going.

- Another major game aside from Genshin Impact is Roblox, and the share of cross-play dropped there, too, considering that MAU also declined in Roblox (especially in July), which means that players left both games.

- Some titles increased the concurrent players, like Cookie Run and TokaLife, in February to decline in March, but most stayed at the same level or decreased.

- Also, there are no major new games in the top 10 list.

But 15 games in total have more than 1% of the audience in common that appeared in shared audiences, like ‘Make a happy Baby’ that launched in February and got 4.22% shared audience with Genshin Impact in the same month. And more than 30 games increased significantly (more than 25% growth) in cross-play in February.

It looks like players are not choosing one single game to go to. When a game loses its audience, it favours tens of games in granular numbers.

Conclusion

At the beginning of this research, I set out to illustrate the flow of users from Genshin Impact to Honkai: Star Rail, but while gathering the information, I found something else. To summarise:

- Genshin Impact's audience started to fall 1–2 months before the launch of Honkai: Star Rail, and later on, in the summer months, the audience declined in both games.

- Cross-play of the two games consisted of a maximum of 20% of Genshin’s monthly audience, and the total loss of audience in Honkai’s favour was around 10% or less.

- Games that Genshin usually shared an audience with did not get any of its users. The audience was mainly spread over tens of other new and existing games.

- One more bonus takeaway of this research that wasn’t mentioned before is that most of the audience of Genshin Impact likes to play games of the same genre. There are a minimal number of games from puzzle, strategy or RPG genres and mostly those are action, arcade and simulation games, showing how the audience of 9–13 year boys are isolated and those who played the baby-care simulation ‘Make a happy baby’ did so by choice made and possible misinterpretation of the title of the game.

Most probably, all of this means that Genshin Impact was not the focus of the development team’s attention on the eve of releasing a big new project. The audience shifted towards other games for internal reasons, not because some other big title was released, especially considering that many users who left Genshin Impact and went to Honkai may have left both titles in the end.

Also, those key points show that even in a demographically isolated group of Genshin Impact players, even with a tremendous user acquisition budget and loyal audience, it is tough to release the game that will pull all of the other project’s players in one short run. The developed method of analysis helped me understand the actual scale of the problem and highlight some of the currents that happen under the surface.

Edited by Paige Cook