New data from AppMagic has shed light on the state of the hypercasual market's performance in quarter four 2023.

Examining the total installs in Q4 and comparing them to Q3 of 2023, a 6% decline is observed. The cumulative number of downloads per quarter meanwhile reached 3.2 billion, similarly marking a slight decrease from the 3.4 billion recorded in the preceding period.

On an annual basis, a 16% decline is evident as well. The installs in Q4 of 2022 tallied at 3.8 billion, contrasting with the 3.2 billion in Q4 of 2023.

Regional dynamics

Tier-1 East and Tier-1 West countries emerge as the primary contributors to the substantial annual decline, accounting for 23% and 21% decreases in hypercasual take-up, respectively. In contrast, all other countries experienced a more moderate 10% decline.

As for the quarter-by-quarter trends, a noteworthy reversal can be seen. While in Q3 of 2023, the Tier-1 East market demonstrated positive growth, the subsequent quarter witnessed a significant 22% decline, representing the most substantial drop across all regions.

The Tier-1 West market also experienced an 8% decrease, with downloads in all other countries declining by 2%.

Familiar faces and newcomers

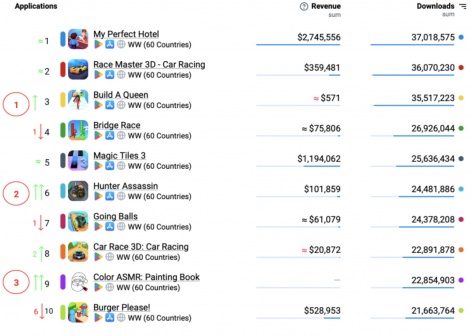

As for the top 10 most downloaded titles, familiar games maintain their presence in the top rankings, much like the previous period, with some showcasing improvements in quarterly download metrics.

Three newcomers stand out. Build a Queen secured the third spot with 35.5M installs mainly by utilising rewarded videos for monetisation. Published in 2019, Hunter Assassin (24.5M installs), gained prominence in 2023 focusing on India as its primary market. The third newcomer, Color ASMR: Painting Book by Zego Studio, attained 22.9M installs, emphasizing Christmas-themed content in December and heavily investing in Applovin during Q4 2023 (80%).

Notable games include My Perfect Hotel, which experienced a notable 23% increase, Race Master 3D with a 24% growth, Car Race 3D registering a 15% uptick, and Magic Tiles 3 demonstrating a modest 6% quarter-over-quarter improvement.

In contrast, a few others witnessed a decline in their download metrics, such as Burger Please experiencing a 13% decrease while Bridge Race faced a 4% downturn quarter-over-quarter. Meanwhile, some games like Going Balls maintained their download figures at a consistent level.