Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week's full edition, visit www.masterthemeta.com!

On September 17th, Stillfront Group announced its acquisition of Nanobit, thereby making the company now 15 studios strong! More notably, this is Stillfront's third acquisition in 2020 — Storm8 (January 2020) and Candywriter (April 2020) — resulting in a very impressive rate of one acquisition per quarter.

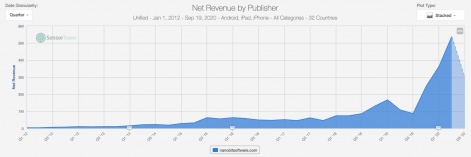

Not only are those acquisitions swift, but they immediately unlock value. If that healthy trajectory doesn't impress you, here is a long-term view of the company's stock price. More specifically, the stock has been on an absolute tear in 2020, and has increased almost +290% since the start of the year! (By the way, we're a couple of weeks away from releasing our deep-dive into Stillfront's business, so sign up here for that!)

In terms of the newly acquired unit, Nanobit is a leading developer of free-to-play mobile games from Croatia, and they focus on narrative lifestyle simulation role playing games (RPGs) that target a female audience. Nanobit counts 29 released titles — 10 apps and 19 games — and more than 145M lifetime downloads. The studio's flagship titles include Tabou Stories (2020), My Story (2017) and Hollywood Story (2015). Key transaction details include:

1. Stillfront will pay a maximum of $148M for the full acquisition, but split into two tranches.

2. First Tranche: 78% of Nanobit shares to be purchased for $100M - 70% payable in cash, 30% in newly issued shares in Stillfront.

3. Second Tranche: 22% of Nanobit shares to be purchased in 2023 depending on how Nanobit’s EBITDA evolves in 2021 and 2022, but capped at a $48M price - 70% payable in cash, 30% in newly issued shares in Stillfront.

4. The implied Expected Value-to-Adjusted EBITDA multiple is 6.4x, which is in line with previous acquisitions.

On the surface, it's a solid deal. The price paid is very reasonable, it keeps the acquired studio incentivized, and paying 22% later lightens the burden on Stillfront's balance sheet today.

The big question is - why Nanobit? Apart from the fact that Nanobit's H1 2020 financials bump Stillfront's H1 2020 net revenues and EBIT by +17% and +9%, respectively, we see four strong strategic reasons.

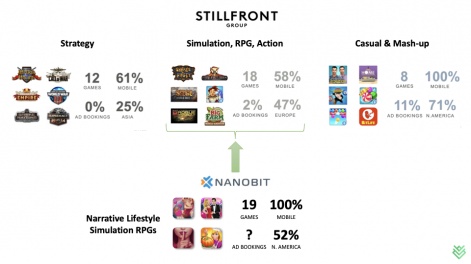

#1 Genre Diversification: Looking at Stillfront's portfolio of key games, two things are relatively clear. First, genre diversification is a key strategic objective to predictably grow the business by spreading risk across different gameplay types and audiences. Second, there are still gaps in Stillfront's genre reach. And Nanobit clearly fills one of these gaps by bringing their portfolio of narrative lifestyle simulation RPGs under Stillfront's umbrella.

More specifically, Nanobit's product portfolio brings a new sub-genre (commonly known as Interactive Stories within the gaming industry) to Stillfront's Simulation, RPG, and Action product portfolio, and therefore fills a clear portfolio blind spot.

#2 Sub-genre Dominance: While genre diversification is all well and good, the next question is whether Stillfront is going after the right sub-genre? And very much related, how does Nanobit position in that chosen sub-genre?

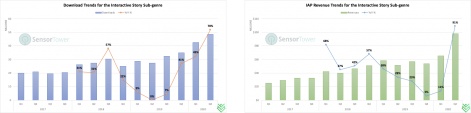

In the highly crowded market of mobile gaming, it is very hard to find healthily growing sub-genres, but they definitely exist. Fortunately, the Interactive Story market is definitely one of them.

As of Q2 2020, download numbers continue to grow at a very healthy +79% YoY growth rate, while revenues majorly spiked resulting in a +82% YoY growth rate. Most definitely, there is a COVID impact baked into to these numbers (especially the massive Q2 2020 revenue spike), but the bigger picture is that this sub-genre continues to remain fertile ground for future growth, and Stillfront made a measured choice with regards to picking a sub-genre to expand its portfolio into.

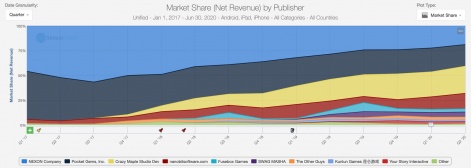

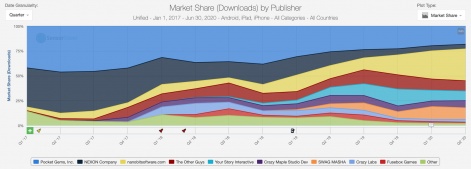

Further, Nanobit is a top 5 market leader in this sub-genre on a revenue basis. As of Q2 2020, it accounted for ~16% of the sub-genre's revenues, which places it at the number 4 position. More importantly, the company has been able to quadruple sub-genre market share since the start of 2017.

Not only does that show a very strong growth trajectory for Nanobit, but also speaks to why Nanobit needs someone with Stillfront's expanded capabilities and resources to unlock their next stage of growth. Having said all that, two risks emerge from the data.

First and as can be seen in the Interactive Story revenue trends graph above, the sub-genre has been showing a downward trending YoY revenue growth rate, until COVID came into the picture.

The COVID effect will eventually fade away as players across the world return to more normal daily routines, which means the sub-genre is showing the first signs of YoY revenue growth rate stagnation. It will definitely be interesting to see how Nanobit traverses those waters and evolves on the current state of the sub-genre to grow revenues even further.

Second, and as can be seen in the graph above, Nanobit is leading the sub-genre in downloads by capturing ~32% of the market as of Q2 2020.

While this high downloads share is a function of increased user acquisition efforts on older titles and the release of their newest title Tabou Stories (2020), it still exposes a gap in the company's download dominance and consequent revenues. In other words, the high downloads are not translating into sub-genre dominating revenues.

It remains to be seen how Nanobit's continued product efforts close this gap in the future and eventually dominate the sub-genre on both fronts. Tabou Stories could be one of the candidates to make that happen.

#3 Audience Expansion: It is relatively obvious that as Stillfront moves into other sub-genres, it also acquires differentiated audiences from these sub-genres. While this has a host of benefits for Stillfront and its portfolio companies, we believe there is a broader audience expansion strategy that Stillfront has been pursuing over 2020.

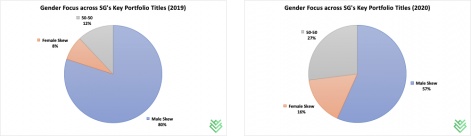

When looking at the key titles in Stillfront’s 2019 product portfolio, there is a clear skew towards male-focused genres. But with the 2020 acquisitions of Storm8, Candywriter and now Nanobit, the gender focus is definitely balancing out across the portfolio.

Male-skewed title count reduced from 80% to 57% between 2019 and 2020 respectively, while gender neutral title count increased from 12% to 27% in the same period, mainly driven by the Storm8 and Candywriter acquisitions. Nanobit's focus on the female audience boosts the representation of female skewed titles from 8% to 16% between 2019 and 2020.

Part of Stillfront's continued growth strategy is to maximise portfolio audience diversity through genre diversifying acquisitions. But 2020's acquisition list definitely highlights a key focus on balancing out the gender skew across the portfolio.

Needless to say, this can prove to be a highly valuable strategic advantage the group provides to future acquisition prospects. Further, having this diversity protects the entire group against a frequently turbulent user acquisition market.

With the IDFA Apocalypse looming, the pressure to cross-promote audiences within Stillfront's titles does increase. Nanobit is clearly a great fit to boost the representation of female audiences within Stillfront's portfolio. These audiences can definitely be cross-promoted to various top performing Storm8 and Candywriter titles, with these subsidiaries likely sending audiences back to Nanobit's top titles.

And finally, the industry has generally been buzzing about creating games for a highly underserved female audience, which Nanobit helps solve for.

#4 Talent and Skill Growth: Nanobit's genre and audience focus is very unique when compared to Stillfront's other subsidiaries. Moreover, maintaining this focus has been working for the company, as can be seen in Nanobit's skyrocketing revenue graph below.

As mentioned before, this revenue spike is driven by increased user acquisition and the release of a new title. Regardless, it is highly dependent on the people behind the games and the company. It's also worth noting that Nanobit's expected adjusted EBIT margin for FY2020 is 17-22%. In comparison, the adjusted EBIT margins in FY2019 for Storm8 and Candywriter were 57% and 59% respectively.

Those margins are still decent, but Nanobit is clearly far behind Storm8 and Candywriter in terms of operational efficiency, which could be a function of their products' revenue potential, the large team size, or even both.

But the fact that Stillfront maintained the same Expected Value-to-Adjusted EBITDA multiple for this acquisition versus past acquisitions does signal high trust from Stillfront in Nanobit realising huge future potential through its planned product roadmap and continued team operations. Time will tell.

All in all, Stillfront's acquisition of Nanobit makes a lot of sense for the group's future, and for Nanobit too. It hits multiple birds with one stone, but some risks remain and need to be proven out. Fortunately, it seems like Stillfront got a great price (as usual), and there's still upside for Nanobit. Now the ball is in Nanobit's court to unlock its next stage of growth with Stillfront in its corner. We're optimistic and wish both teams the best of luck!

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To read this week's entire meta, visit www.masterthemeta.com!