Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week's full edition, visit www.masterthemeta.com!

If you're a regular reader or have been following general mobile advertising news, you must already be well aware of Apple's bombshell move to become user privacy first by deprecating the IDFA, and in turn completely resetting the mobile advertising ecosystem as we know it today. For those of you catching up, here is a refresher.

The IDFA stands for "Identifier of Advertisers" and is unique to every Apple device like iPhones, iPads, and Apple TVs. It helps mobile marketers deliver personalised and targeted advertising, attribute mobile ad spend, and eventually measure user acquisition campaign performance.

In other words, when Company A runs user acquisition campaigns to gain new mobile customers, almost the entirety of the mobile AdTech value chain uses the IDFA to help Company A connect various ad engagement metrics back to Company A's marketing campaign on a per device level.

Using a mix of these ad engagement metrics and in-app engagement/monetisation data, Company A can very accurately calculate ROIs on various mobile user acquisition campaigns across a variety of ad networks.

Further, if Company A "likes" the customers it is getting through a certain user acquisition campaign, it can tell ad networks that it likes these kinds of customers and the ad networks should go out and find more of the similar kind. The ad network then uses the IDFA to profile its user inventory, match these profiles to Company A's specifications, and deliver similar potentially high value customers back to Company A.

On June 23rd 2020 and during its WWDC event, Apple announced a strong stance to protect its customers' privacy. With iOS 14, Apple introduced three pivotal changes. And all three together signal a seismic shift in the mobile advertising ecosystem.

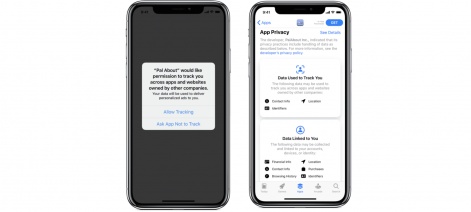

First, iOS 14 will require all mobile applications to showcase a pretty intimidating popup to its users. On first app launch, this popup will clearly state its intentions to track the user across apps and websites owned by other companies.

If the user allows it, the IDFA is delivered to the app developer. If not, a string of zeros is delivered in place of the IDFA. In mobile marketing jargon, this is known as "Limit Ad Tracking" (LAT).

Just to be clear, iOS users could enable LAT even before iOS 14, but the option to do so was buried deep in a maze of Settings menus. With iOS 14, Apple mandates to highlight the LAT option front and center through the above described popup.

Second, iOS 14 will introduce a privacy dashboard of sorts that will allow users to understand the information that various apps are tracking of them. Presumably, users will be able to revoke access to this data from the privacy dashboard, even if those apps had been previously given access to it.

Third, Apple decided to update the functionality of its app install attribution API called SKAdNetwork. Broadly, the new SKAdNetwork will allow Apple to play a key role in attributing mobile ad spend to various user acquisition campaigns, and effectively absorb many aspects of the mobile AdTech value chain within its walled garden.

It is out of the scope of this piece to get into the details of how SKAdNetwork plans to achieve this, but if you'd like learn more please read this.

Long story short, the entire mobile advertising ecosystem has become a $80B market on the back of personalised advertising. Such highly targeted advertising is possible only because of unique device identifiers, such as Apple's IDFA and Google's GAID (Google Advertising ID), being made accessible to advertisers, publishers, and every aspect of the mobile AdTech value chain lying in between.

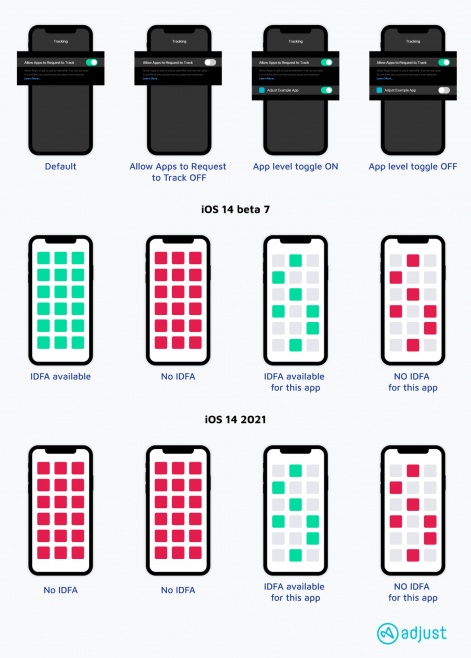

The flip side of the coin is that the entire mobile advertising ecosystem precariously rests on such unique device identifiers. The removal of such an identifier will basically make this massive industry fall like a house of cards, and it will be forced to rebuild itself from the ground up. And with the above described popup, mobile markets expect the LAT opt-in rates to be >70-80% versus the current range of ~10-30% depending on country.

In other words, the current perception of the mobile advertising ecosystem is that with such a popup, Apple essentially renders the IDFA useless without actually killing it.

According to Apple, the above privacy-first move was to take effect with iOS 14's rollout in September 2020. Needless to say, this caused a massive uproar within the mobile advertising ecosystem, as many gaming and non-gaming businesses expected massive drops of ad generated revenue and Apple's short timeline did not give them enough time to brace for impact.

Fast forward to today, almost 3 months after Apple's first announcement, Apple definitely recognised this and has decided to delay the opt-in privacy features of iOS 14 to "early 2021". In a statement, Apple said:

"We believe technology should protect users' fundamental right to privacy, and that means giving users tools to understand which apps and websites may be sharing their data with other companies for advertising or advertising measurement purposes, as well as the tools to revoke permission for this tracking. When enabled, a system prompt will give users the ability to allow or reject that tracking on an app-by-app basis. We want to give developers the time they need to make the necessary changes, and as a result, the requirement to use this tracking permission will go into effect early next year."

While this can be seen as a benevolent move by Apple, we believe it also has something to do with Apple continuing to improve the functionality of SKAdNetwork through deeper conversations with multiple mobile AdTech partners.

Unfortunately, Apple's attribution API continues to stay quite limited in terms of a feature set that allows for a quick, safe, and well-planned transition of deeply embedded AdTech businesses, service providers, and consumers alike, that minimises business revenue impact in a privacy-first iOS 14 world.

Apple too will be using this delay to meet the mobile advertising ecosystem in the middle through further improvements to their SKAdNetwork API.

Apple has merely kicked the can down the road, and many expect Google to soon follow. A privacy-first mobile advertising ecosystem is inevitable. Looking ahead, there seem to be 5 broad trends / key conversations emerging out of what is now being termed as the "IDFA Apocalypse".

LAT opt-in rates: Are mobile marketers' expectations of >70-80% LAT opt-in rates really going to play out once iOS 14 rolls out? Because if it doesn't, then status quo can broadly be maintained within mobile advertising.

Adikteev, a mobile marketing solutions provider, ran a live study within the gaming vertical to measure LAT opt-in rates. And they found that <30% of users opted in for LAT. Said differently, a whopping >70% of users were okay with sharing their IDFA when seeing the a replica of the Apple pop up.

While the results of this study have been highly criticised by some of the top mobile marketers in the industry, the broader point is that nobody really knows what the opt-in rates will be until iOS 14's privacy changes actually roll out and real data is captured in the app market context that ultimately matters.

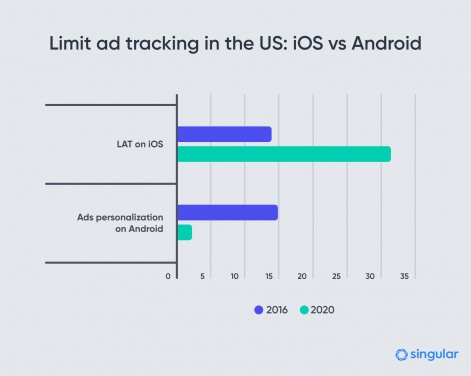

All we know for now, and based on the image above, is that LAT opt-in rates have risen significantly between 2016 and 2020. It is a clear signal that iOS users' concerns around privacy is growing and Apple is making it easier to opt-in. If we had to guess, we'd expect LAT opt-in rates to be >70-80% once the privacy-first changes roll out.

Business value proposition changes across the mobile AdTech value chain: Given all the uncertainty around eventual LAT opt-in rates, various AdTech businesses are planning for the worst and hoping for the best.

Mobile Measurement Partners (MMPs), like Appsflyer, are top of the list when it comes to portions of the AdTech value chain that can completely evaporate. The key value proposition of MMPs is to enable highly accurate attribution of mobile ad spend across a multitude of user acquisition campaigns throughout various ad networks. Therefore, their entire business is highly dependent on access to unique device identifiers.

These businesses are now being forced to question the core designs of their business offerings, and search for alternative methods to keep their value proposition intact. Some MMPs are building up "shortcuts," such as "fingerprinting." This method uses probabilistic algorithms to triangulate between various data points, such as device type and location, and create a "device fingerprint" that could stand in for unique device identifiers.

Most definitely, such methods have questionable accuracy rates, fundamentally go against what Apple is trying to achieve with its privacy-first move, and will likely not stand the test of time as we move to a privacy-first world long-term.

To weather this storm, MMPs and other mobile AdTech businesses will have to come up with solutions that embrace the SKAdNetwork, which is what top MMPs like Adjust and Appsflyer are currently working towards. Although, it is worth noting how the MMP rhetoric is highly desperate for game developer cooperation to test various IDFA opt-in flows in order to maximise the chance of acquiring those IDFAs.

Impact to user acquisition costs: As mentioned before, the $80B mobile advertising ecosystem is built on the back of targeted advertising. With the expectation of IDFA being rendered useless, the downstream impact of today's mobile AdTech value chain losing value will be felt in user acquisition costs.

Broadly, the less advertisers are able to target, the more the user acquisition funnel metrics deteriorate. And the more these top of the funnel metrics deteriorate, the lower the quality of the average acquired user, and the worse the down-funnel metrics like player lifetime value (LTV) will be. To understand the deeper economics of this event chain, please read this.

Obviously, this will come back to hit revenues generated by ad networks. Facebook, the biggest of them all, recently warned how iOS 14's changes could cut more than 50% of its Audience Network revenue and even render it useless within iOS 14.

While ad networks are definitely working towards finding ways to not let such massive revenue hits occur, the pressure on game developers is also building to maintain their businesses in a privacy-first world.

M&A acceleration within the gaming industry: In mobile gaming, genres that are dependent on highly targeted user acquisition lie on a spectrum. For example, the business of various Strategy and RPG genres depends on finding ultra high value customers through highly targeted advertising, given how these high spending players make up for >80% of the genres' revenues. Casual genres maybe not as much, given how average spending players make up for a majority of the revenues here.

Therefore, gaming companies whose product portfolios are dependent on targeted user acquisition and long-tail high value customers face significant risk. Zynga, for example, has ~70% of its revenues generated through its "Forever Franchises", of which CSR Racing, Empires & Puzzles and Zynga Poker are top candidates for being dependent on a mix of highly targeted advertising and high long-term LTV of already acquired players. Their Social Slots business is no different.

So apart from optimising IDFA opt-in flows, how can Zynga continue to acquire users effectively and efficiently and reduce its dependency on user acquisition through at risk ad networks?

Its recent acquisition of Rollic was a purchase of MAUs more than anything else, as Rollic's Hypercasual product portfolio effectively adds 65 million MAUs to that of Zynga's. It essentially gives Zynga more scale by immediately doubling its MAUs.

In the context of iOS 14, this feels like a highly strategic move because while Apple might be rendering the IDFA useless, it is keeping the IDFV (Identifier for Vendors) intact. The IDFV is also a unique device identifier, but stays constant only within the portfolio of a single developer account and not across apps.

Therefore, Zynga's acquisition of Rollic could be seen as a step towards building a mega-MAU ecosystem in which players can be efficiently cross-promoted throughout the portfolio. This would in turn reduce Zynga's dependency on user acquisition through ad networks, and they'll be able to profile high-value players entirely within their ecosystem.

It's possible that Take-Two's recent acquisition of Playdots had a similar underlying strategy. We expect the trend of high MAU acquisitions and creation of mega-MAU ecosystems to continue.

Evolving early game development processes: The final piece is to look at how early game development processes are evolving to make the most of a privacy-first world.

Two highly critical steps when developing a new game is marketing concept testing and prototype validation. Marketing concept testing is broadly used to identify the best art style/theme to target audience fit. Prototype validation is broadly used to identify the best gameplay to target audience fit. Both processes help in massively reducing project risk very early in the game development process, which is more important than ever in a highly crowded hit-driven business.

But as you would've already noticed, both processes depend on being able to access this target audience, which is obviously harder to do when targeted advertising through ad networks reduces in efficacy. Apart from finding other ways to conduct the same tests, game developers are also now being nudged to not create games for highly specific niche audiences.

Rather, game developers are incentivised to create great product experiences with high accessibility that can span target audience groups and eventually grow into brands/franchises of their own.

Supercell probably has the model approach here, given how its key titles generate a majority of revenues through high spending customers but Supercell doesn't double down to highly targeted advertising to make that happen. The focus is purely on creating a great game that can be played by the masses forever.

Sure, this is every game developer's dream regardless of the IDFA Apocalypse, but a shift in early game development thinking is definitely on its way since the existence of the highly targeted advertising safety net to build a game's business is quite questionable.

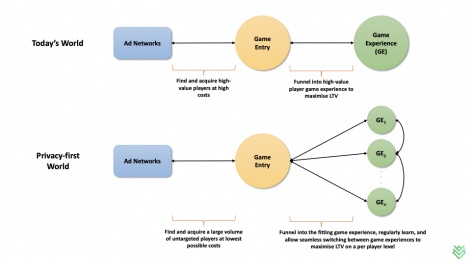

A bold prediction: To wrap this up, we'd like to end with one prediction. At a very fundamental level, the granularity of player targeting that ad networks provide allows today's game development process to learn about target audience preferences before they enter the game, create a fitting game experience, let them in through highly targeted advertising, and then squeeze the LTV lemon. But what happens when this granularity of player targeting is removed from the equation?

Without targeted advertising, we expect a long-term acceleration of game developers implementing in-game player preference learning methods to maximise player LTV. In other words, personalisation of game experiences could be the next frontier in a privacy-first world. Personalisation is not a new concept to games, but it's still at a very primitive state on a wider industry perspective. Player segmented promotions and basic AB testing procedures is where a majority of the industry is currently at.

One of the key factors of King's rise to success was its ability to learn individual play patterns and tune Candy Crush's level difficulty curve to maximise player retention and monetisation. But when King made use of such machine learning (ML) driven methods, ML usage wasn't really a widespread concept within the games industry.

The situation has completely changed now with game technology reaching absolutely new heights, data analytics becoming deeply embedded in studios of all sizes, advanced AB testing methods like multi-arm bandit testing growing in popularity, and highly accessible ML-based tools like TensorFlow proliferating the market.

Imagine a world where game developers acquire a wide group of non-targeted users through ad networks, funnel them off into personalised game experiences, learn whether the chosen game experience is working for the player, and finally allow smooth switching between game experiences without the player ever feeling it.

After all, if game developers cannot find high-value players for their game through targeted advertising, it would only be right to make sure the in-game experience acts as a potent catalyst to evolve as many players into high-value ones.

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To read this week's entire meta, visit www.masterthemeta.com!