At Pocket Gamer Connects London, Data.ai Senior Marketing Manager Chris Uglietta took to the stage to analyse the performance of the mobile market in 2022, and what we can expect in 2023.

The turbulence in the market was reflected in a variety of metrics. While downloads rose to 255 billion (an increase of 11 percent) and a total of 4.1 trillion hours were spent in-app (an increase of nine percent), consumer spend across app stores fell two percent from 2020, generating a total of $167 billion dollars.

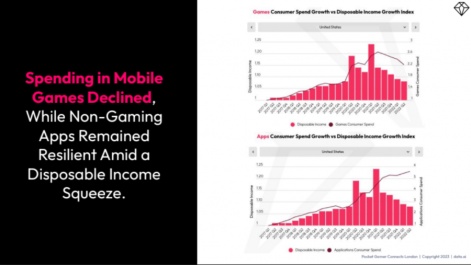

It appears that mobile gaming saw the bulk of the problems, with sharp declines in consumer spend due to the global squeeze on disposable income, even as the apps in general remained resilient. This decline in disposable income is also having a noticeable effect on the number of games with in-app purchases exceeding a billion dollars, with only six games achieving this milestone in 2022, compared to nine in 2021 and seven in 2020.

Multiple genres of mobile game saw decreases in revenue in 2022, even as downloads rose. The racing game genre saw the steepest fall, at 28 percent, with Need For Speed experiencing a decline of 44 percent. This indicates that, despite an eight percent increase in downloads, the revenue per install wasn’t sufficient to offset the decline.

In contrast, action games saw the highest increase in downloads, at 11 percent, coupled with the smallest fall in revenue across highlighted genres at 18 percent.

Fighting games saw a particularly sharp fall in revenue, losing around 20 percent in Western markets. Mortal Kombat being particularly hard hit, with a significant fall of 51 percent. Brawlers also saw a fall throughout the year, with Brawl Stars losing almost half of its revenue.

Meanwhile hypercasual bucked the trend according to gathered data, with a 30 percent year-on-year increase in IAP revenue.

What can game makers do to ensure a successful 2023?

After the only middling performance of 2022 Data.ai went on to isolate several methods game makers can use to help their games to succeed throughout the year. Their suggestion being gleaned by analysing the titles which have bucked the trend and continued to increase their revenue despite the down market.

Developers and publishers may be able to succeed by getting creative with their strategies, putting a larger emphasis on player traits as opposed to demographics and diversifying their marketing moves. As consumers worldwide have become increasingly concerned with how their data is used, game makers can do well by gaining a deeper understanding of the audience through constant marketability testing, helping game makers correctly analyse what works and what doesn’t. The goal for 2023 is high IPM (installs per thousand impressions).

Meanwhile well known IPs are proving increasingly popular and game makers can leverage these to increase their market share and revenue. Creating a game based on an established property can help widen the acquisition funnel. While previously the benefits of utilising an existing work in the development of a mobile game was offset by effective UA strategies, the increasing difficulty of user acquisition in the new landscape has helped to shrink the gap. As a result, the potential return from investing in existing IPs with an established fanbase has increased.

The only caveat to this would be that the IP is a good fit for the game. However, Uglietta stressed that “proper market research and meticulous business case modelling are necessary to succeed by implementing IP. You can’t just slap a famous name on an IP. A Gordon Ramsay shooter isn’t going to work…"

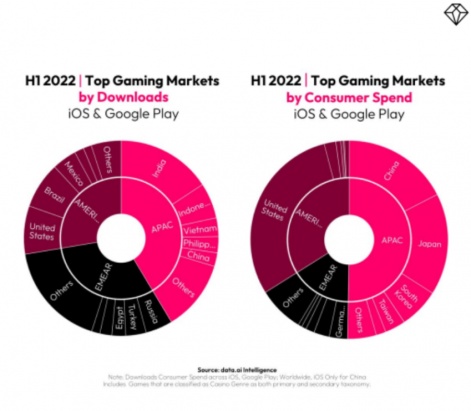

Finally, and perhaps most crucially, Uglietta advised game makers to “look beyond the United States and iOS.”

Although English-speaking markets are often the most valuable in terms of player LTV, this is coupled with a high cost. While the United States represented a significant portion of downloads in H1 2022, as well as the single largest market in terms of consumer spend, this is dwarfed by the collective downloads and spending in the APAC region. As such, a narrow focus on the American market can result in developers and publishers struggling to compete in an increasingly crowded global market.

“Companies that are successful outside the U.S. and iOS don’t think of international markets as the “rest of the world,” Uglietta suggested. “They focus on growth pockets, making sure to localise and even “culturalise” their approach.”

A report published by Data.ai in December identified 11 games poised to exceed $2 billion in revenue in 2023, including the fastest game ever to achieve this milestone.