Mobile gaming is set to generate $108 billion in consumer spending, more than double either console spending ($43 billion) or PC/Mac ($40 billion), and a massive $105 billion more than handheld consoles ($3 billion), according to Data.ai and IRC’s latest report.

Despite $108 billion being a massive figure, it represents a slight 2% decline from 2022. This is attributed to changes to ATT regulations and a crackdown on fingerprinting, making it more difficult for developers to effectively target high-value customers. Additionally, China’s increasing limitations on gaming among the country’s youth is expected to significantly impact the industry.

South Korea led the way in terms of growth in the Asia Pacific region, while Brazil, Turkey, and Mexico led the way in the rest of the world.

Simulation games led the way in terms of download growth in H1 2023, with driving games increasing by 0.3% and sports games increasing by 0.2%, with driving games maintaining their position as the fastest growing genre.

Breakout hits

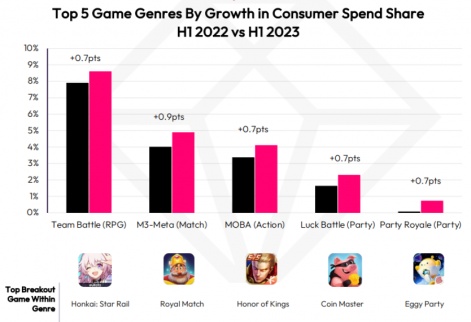

Match3 games saw a 0.9% increase in consumer spending, accounting for just under 5% of total spending. Team battle RPG’s maintained their place as the top performer in terms of spending at around 8.5% of the total, despite a smaller increase of 0.7%. This year’s smash hit release Honkai: Star Rail is identified as the genre’s breakout hit, with almost 62 million downloads and over $457 million in consumer spending to date, with consumer spending led by the United States, Japan, and China.

Interestingly, one in every seven in-app purchases in Honkai: Star Rail was for “6480 Oneiric Shard IAP Item,” a bundle of in-game currency costing $99, reflecting the game’s ability to attract high-value players.

Tencent’s Honour of Kings is identified as the top grossing mobile title of H1 2023, followed by Candy Crush Saga and Roblox. Despite it being identified as a strong performer, Honkai Star Rail’s release relatively late in the period - April 26 - means that it failed to chart among the top ten.

Dream Games’ Royal Match is also identified as a strong performer, reaching number two in the match category by consumer spend in H1 - up from number three in 2022 and number 8 in 2021. The game has generated $1.7 billion in revenue to date, and been downloaded almost 149 million times.

Match, casino, and tabletop games led the way in terms of paid installs, which accounted for a respective 66.7%, 66.3% and 61.2% of all installs in their categories. Meanwhile, action led the way in terms of playable ad impressions at a massive 79%. Tabletop came in second place, with 16%.

Advertising update

Banner ads are seemingly losing their popularity among consumers. While around 12% of consumers in the US said they liked banner ads, approximately 36% stated the opposite. While banner ads remain prevalent, with around 81% of respondents stating that they saw banner or display ads in Q3 2022.

In-game video ads remain prevalent with 85% of American users reporting they saw them in Q3 2022. However, the ad format also had the highest negative sentiment of all those examined, with around 10% liking them compared to around 42% responding that they dislike them.

Rewarded video ads remain the most popular ad format among American gamers, with around 20% of respondents stating they liked them, while approximately 37% disliking them. Despite this, the report notes that oversaturation can be a problem, and that gamers were more likely to view any form of ad negatively should they encounter it more often. As such, the report suggests that game makers relying on in-game ads for monetisation utilise a variety of formats to avoid oversaturation, while still maintaining profitability.

Conclusions

Despite a volatile market in 2022, the report notes that mobile remains the primary driver of growth in the games industry. The platform has allowed for greater democratisation of gaming, offering more opportunities to onboard new gamers and allowing every type of consumer to find the games that appeal to them.

A Data.ai report earlier this month found that mobile consumer spend in Japan is set to exceed $12.6 billion in 2023.