Consumer spending on mobile platforms returned to a positive direction in H1 2023, following a decline in 2022, according to a new report by Data.ai.

In-app spending hit an all-time record of $67.5 billion, representing an increase of 5.3% year-on-year. This marks a return to growth following the market contraction of 2022, when H1 saw the market generate $64.1 billion in revenue, a 2.7% decrease from $65.9 billion in H1 2021.

The first half of 2023's growth was largely due to the strong performance of apps, which drew $26.6 billion in the period, representing a 16% increase from $22.9 billion in H1 2022. However, in-app spending on mobile games continued to decline: H1 2023 saw gaming revenue hit $40.9 billion, representing a 0.7% decrease from $41.2 billion in H1 2022.

However, H1 2022’s figure itself represented a 7.4% decrease from $44.5 billion during the same period of 2021. As such, while in-app spending on games is still declining, the decline is slowing down significantly, perhaps indicating that a return to growth is on the cards.

Highlighting this possibility, the report notes that “while mobile game spending remaining flat might not seem like a positive signal at first glance, recent trends present a strong sign that growth for this largest of all categories is likely just around the corner. Positive YoY growth returned in both March and May 2023 after hitting its low at -13% in May 2022. In fact, growth rates in H1 2023 don’t look all that dissimilar from the start of 2020. Expect more signs of normal growth to emerge after the turbulent past few years.”

Battle of the Platforms

iOS continued to dominate in terms of consumer spending in H1 2023, indicating that iPhone users outspend Android users by a significant margin. In-app spending on Apple devices climbed 6% from $40.89 billion in H1 2022 to $43.5 billion in H1 2023. In comparison, in-app spending on Android phones rose 4% to $23.04 billion to $24 billion over the same period. In total, iOS users accounted for 65% of combined app store spend. Taking only non-gaming apps into account this figure is even higher at 71%.

Downloads continued their upward trajectory, climbing 3.2% year-on-year, with 76.8 billion in H1 2023 compared to 74.4 billion in the same period of 2022. As for in-app spending, non-gaming apps saw larger growth (46.4 billion, representing a 4.5% increase from 44.4 billion in H1 2022) while gaming apps also saw some improvement, climbing 1.3% from 30 billion in H1 2022 to 30.4 billion in H1 2023.

While iOS platforms dominated in terms of in-app spending, Android saw a significantly higher number of downloads, with 58.7 billion in H1 2023 compared to 18.1 billion for iOS, representing a majority of 76.8%. However, iOS downloads are increasing at a faster rate, climbing 10% from H1 2022 to H1 2023, versus 1.4% on Android over the same period.

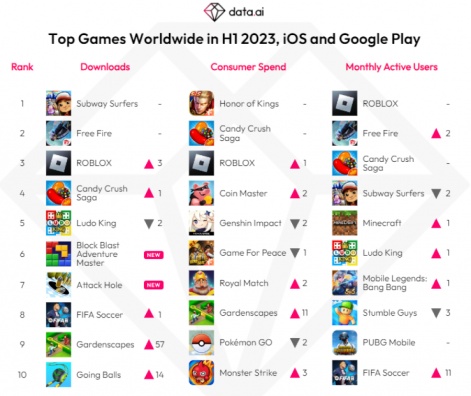

The gaming market saw several noteworthy successes, with some significant movement in the charts.

Subway Surfers, the most downloaded title of H2 2022, maintained its place in H1 2023, followed by Garena Free Fire. However, Roblox climbed three spaces to third place, while Candy Crush Saga climbed one spot to number four. H2 2022’s third placing game, Ludo King, fell two spots to round out the top five. The download charts saw two entirely new entries: Block Blast Adventure Master and Attack Hole, in the number six and seven slots respectively.

Honor of Kings continued to dominate in terms of consumer spend, with Candy Crush taking the number two spot. This was followed by Roblox, climbing one space, and Coin Master, climbing two spaces. Genshin Impact fell two spots to number five.

Roblox came in first place in terms of monthly active users, making it the only game to appear in the top three across all categories, highlighting its continued success. This was followed by Garena Free Fire, climbing two spots compared to H2 2022, and Candy Crush Saga maintaining its spot at third place. Subway Surfers fell two spots to number four, while Minecraft rose one spot to number five.

There’s one notable omission in these charts: Honkai: Star Rail, which released on April 26. While the game’s presence is felt in the decline of Genshin Impact it appears that, despite its record-breaking release, Honkai: Star Rail was unable to secure a spot in the H1 charts, it’s likely that it will make a big splash as Data.ai analyses H2, especially with the game making more money than Candy Crush this June.

We listed Honkai: Star Rail developer miHoYo as one of the top 50 mobile game makers of 2022. We'll be revealing our list for 2023 in the coming months.