Ikkjin Ahn is the CEO of leading mobile adtech company Moloco.

Unless you've been meditating in the desert for the past two weeks, you've been inundated by nonstop news of COVID-19, informally referred to as the coronavirus.

In early March 2020, the World Health Organization (WHO) officially declared the COVID-19 outbreak a pandemic.

We dug into data from the programmatic advertising landscape to see how a worldwide emergency like COVID-19 affects mobile advertising, and the mobile industry at large.

As we've discovered, there have been some material changes.

What the data says

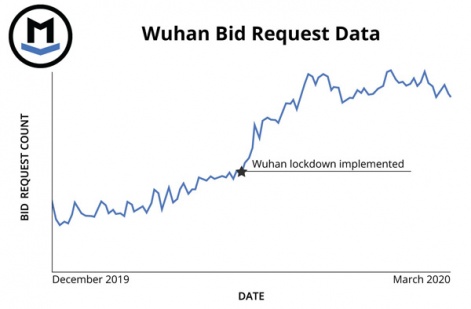

The first telling patterns emerged from our data in Wuhan, China.

Starting January 21 - the day after Wuhan implemented its lockdown - bid requests began to rise, resulting in a clear peak over the next few days. In fact, between 1/20 and 2/1, bid volume nearly doubled.

Overall, Wuhan saw a 72% increase in bid requests from December 2019 to January 2020 and a 173% increase from December to February.

We're seeing similar numbers in Daegu, the epicenter of the coronavirus outbreak in South Korea. While bid requests in the region didn't increase quite as sharply as those in Wuhan, there was still a gradual increase between December 1, 2019, and March 16 of this year.

Wuhan saw a 173% increase in advertising bid requests from December 2019 to February 2020.

Between 12/1/19 and 3/16/20, bid request volume increased by about 56%.

Italy and Japan, both hit hard by COVID-19, also saw jumps in bid requests from December 2019 to March 2020, though Japan didn't show an increase year-over-year for the same period.

In Italy, requests increased by more than 16%, while in Japan bids increased by 30% in the same timeframe. While these jumps may not seem as dramatic as the 77% increase we observed in China, it's clear that a pattern is emerging.

It seems that more people have eyes on mobile ads as a result of global quarantine measures.

But beyond bid requests, how is mobile behavior changing? And how can we make these insights actionable for marketers? We dug deeper to find out.

Game on

Video games have always provided a much-needed escape from reality, and social distancers are turning to games in incredible numbers across every available platform.

PC marketplace Steam hit a multiple new records for concurrent players during March. And that doesn't even account for the millions playing on other platforms, like consoles, handhelds, and — of course — mobile.

According to Mobile Dev Memo, in some cases, mobile gaming is surging as the pandemic continues.

Mobile publisher Zynga, known for its social games like FarmVille and Words With Friends, saw dramatic increases in downloads for two of its current Top 500 hits in early-to-mid March.

Words With Friends 2 had a massive spike at the start of the month that it's continued to hold onto, while Game of Thrones Casino shot up into the top 100 before dipping back down a week or so later.

Interestingly, these results aren’t consistent across all mobile game publishers; Candy Crush maker King's top titles all saw declines in downloads during the same period. (To be fair, Candy Crush Saga has an install base of 500 million; it's possible that it's already saturated the market and didn't have as much room to grow.)

Meanwhile, other mobile pubs are adapting to corona conditions in their own ways. Pokémon GO maker Niantic is accommodating the rise in engagement by adding more pocket monsters to players’ immediate surroundings and decreasing the number of steps needed to hatch eggs.

With bid requests up, and CPIs down, it's an ideal moment for mobile marketers to share their app with the world.

Pokemon GO was originally designed to get players walking around outside and gathering together; with that not an option, Niantic is keeping players engaged while encouraging them to practice social distancing.

What does it mean?

So far, we've noticed a measurable uptick in bid requests that can be largely attributed to increased mobile usage, particularly games and social media.

Of course, non-gaming apps also account for a large increase in mobile traffic; cloud meeting apps like Zoom and food delivery services such as Instacart are seeing the bulk of increased non-gaming app engagement.

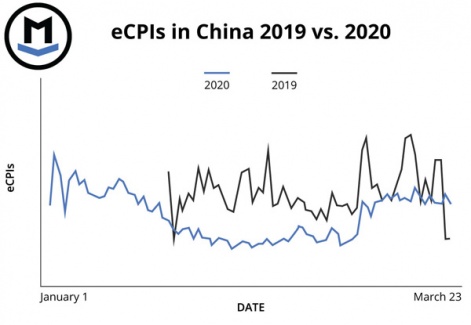

Combined, the data suggests that quarantine is a good time to attract new app users as most players are welcoming the distraction. In fact, in affected regions, we’ve found that mobile game marketers are seeing stronger cost-per-install figures, on average.

In China, for example, eCPIs (average effective cost per installation) steadily declined from January to mid-March. At the time of writing, eCPIs have just begun to reach parity with 2019 figures.

Below is a graph that compares 2020 data to 2019 historical performance:

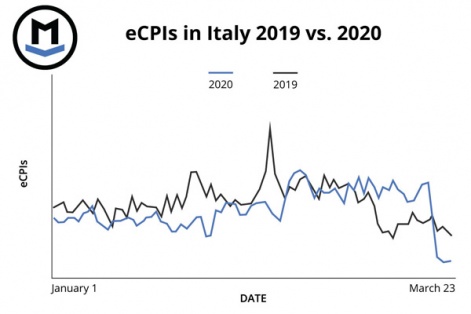

In other countries, eCPIs have remained relatively consistent with the previous year. However, growth in Italy seems to have tapered off as March comes to a close.

As the second-oldest population on the planet, Italy was hit especially hard by the coronavirus outbreak.

The steep drop in eCPIs on March 20 may reflect a country in crisis.

Here are several other noteworthy aberrations:

- In Japan, eCPIs have continued a slow growth trajectory, which aligns with projections that the mobile gaming category is declining in the region.

- Korea shows a similar pattern. This is in direct contrast to China, where mobile game revenue is expected to grow astronomically. It follows that CPIs may be lower in countries where mobile games growth is stronger.

- In the UK, eCPIs have flattened, hovering roughly 35% below 2019 figures. The two annual trend lines diverged in mid-February, following confirmation that the virus had spread to Italy.

- Given the interconnectedness of the European continent, it's not surprising that Europe, as a whole, is seeing 50% lower eCPIs in the first quarter of 2020, compared to Q1 2019.

- In the United States, eCPIs have remained relatively stable, though with a slight downward trend. Interestingly, eCPIs briefly spiked on March 1, one day after the country’s first coronavirus death.

While we're still collecting and analyzing data, some patterns are clear. In times of panic, anxiety, and quarantine, people turn to their mobile phones for information and entertainment.

As shelter-in-place orders hold in regions across the world, people will continue to have a strong appetite for mobile apps, and games in particular.

With bid requests up, and CPIs down, it's an ideal moment for mobile marketers to share their app with the world. Hopefully you can make someone's day by providing a source of entertainment, content, or connection while you’re at it.

However you choose to stay active during this pandemic, whether that's playing games or analyzing data (it can't just be us, right?), we hope you're staying safe and healthy.

For more tips on negating the spread and basic protective measures, check out this useful information from the World Health Organization.