Data.ai have given a highlights presentation in advance of the release of their State of Mobile 2023 report. The presentation, hosted by Lexi Sydow, head of insights at Data.ai, examined macro trends, took a deeper dive into gaming before assessing the broader picture of activity on mobile.

Time spent on mobile

Let's start at the top. Just how much in love with our mobiles are we?

Well, Data.ai's data shows that the average hours spent on mobile per UK user per day was 4.2 hours per day for 2022. When taken alongside the top ten mobile markets (such as China, Germany, France and more) that's an increase of 5% year on year. And when compared to a pre-Covid world of 2020 that’s a 14% increase.

Time spent on mobile grew 9% worldwide in 2022. The UK ranked 24th and saw a 6% year on year increase in total time spent.

“Time spent is an important metric for mobile ad spend and the potential to convert people with advertising,” observes Sydow. “If there’s a drop in spend through the App Stores there may be an increased opportunity to still monetise that base through in-app ads.”

“Engagement is up. Phenomenal growth in France +10%. Ukraine +45%. Pakistani +20%. And while the increases are uniform across the countries featured, each showing an increase, it's interesting that some – such as Saudi Arabia – saw more pronounced increases."

In short the evidence is that our lives are relying more on mobile than ever and the habits that were established in 2020 and 2021 have continued. However Data.ai’s experts predict this to level out as we continue into 2023. “This means that if you’re sleeping eight hours a day you’re spending between 25% and 33% – that’s a third – of your waking hours engaged with your mobile phone,” Sydow observes.

The story in downloads

Getting into the meat of the figures it’s the number of downloads that perhaps reveals the real state of play. Downloads grew in 2022 by 11% year on year worldwide. But in some more established markets this figure actually declined. Data.ai found that the UK number of downloads showed a marginal decline of 1% year on year.

Meanwhile China, India and the US however showed the most growth with Turkey and Pakistan also showing marked increase in downloads.

Interestingly these figures are all new app installs and do not include reinstalls. “So if you downloaded Facebook back in 2010 then that download would have counted at that point,” reminds Sydow.

“This is a great indicator that the market is still going strong. Even if we are seeing a little bit of softening in the market for downloads in the UK, France and Germany we’re still seeing over two billion apps downloaded every year. And we’re seeing a lot of growth from emerging markets, specifically Latin America, South East Asia and MENA."

Consumer spending habits

Moving onto consumer spend, China remains the number one overall market including third party stores (as Google Play is not in China). The US ranks number two followed by Japan at number three with the UK at number five.

“Despite downloads being a little bit lower, all of these markets are punching above their weight in terms of consumer spend. However, on the whole App Store spend did decrease 3% year on year to $167bn.” says Sydow.

Globally consumer spend dropped by 2% year on year in 2022. The UK saw a decline in consumer spend of -8%.

“People are affected by rising inflation and rising costs of living and that is having an effect on the wallet,” says Sydow. “It’s mostly games that have seen that hit, while non games – spends through subscriptions or in-app purchases – largely grew. Globally gaming consumer spend fell 5% but non-gaming consumer spend grew 6%. Games still represent 66% of all App Store spend, however.”

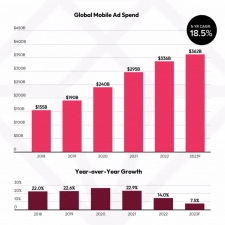

Global ad spend

Global mobile ad spend is set to hit $326b in 2023 and an increase of 7.5% is forcast for 2023, representing a very strong story for mobile. Cooling in growth… but still seeing an increase in performance.

“The impact on the wallet that is being felt by consumers is not universal. Spending in games declines while apps remain resilient amidst consumer disposable income squeeze,” says Sydow. “Gaming spend has fallen as disposable income decreased. But spending on apps has remained healthy and shown an uptick.”

“So ‘need to have’ services – traditionally like a cable package – have fared well. I.e. You’ll keep a service but may reign in ad-hoc transactions. Disney+, HBO Max had great years. Likewise there were plenty of pockets of growth. Non gaming apps saw strong growth despite economic headwinds – indicating resiliency in the sector. Pent up demand drove a desire for travel apps. While economic worries saw a drive for coupon and shopping apps.”

1419 apps and games generated over $10 million annually in 2022. 224 surpassed $100 million and 10 surpassed $1billion annually.

Worldwide consumer spend in mobile gaming dropped -5% in 2022 to $110 billion yet downloads surged to nearly 90 billion. In the UK decline was 15% - in Germany 12% but every market behaved slightly differently.

“Match games proved to be the number one spend with hypercasual and simulation [idle games/driving games/pet simulators] seeing nearly 50% of downloads. While generally there was decline in downloads with only party games showing an uptick,” observes Sydow.

Conclusions

All in all, while a slightly tempered market prevailed through 2022 (compared to 2021) the signs are for continued growth and the emergence of new markets (and new potential) through 2023 should more than make up for the declines of 2022.

For Data.ai's full State of Mobile 2023 report head here.